A Guide to Estate Sale Fees and Costs

When you bring in a traditional estate sale company, you're paying for their time, labor, and know-how. This almost always comes in the form of a commission, where they take a cut of the total sales. Generally, you can expect these estate sale fees to range anywhere from 25% to as high as 50% of the gross revenue.

The exact percentage isn't random—it depends on the value of what you’re selling, how much work is involved, and even your local market.

Understanding Traditional Estate Sale Fees

The commission model is the industry standard for a reason. It means the company gets paid a percentage of whatever they sell. If you have a home packed with high-value antiques and desirable collectibles, you’re in a better position to negotiate. You might land a rate closer to 25-35% because the company sees a clear path to a larger payout for their efforts.

On the other hand, if an estate is smaller or requires a ton of sorting, cleaning, and organizing, the company will ask for a higher cut—often between 40% and 50%. This higher fee ensures they’re compensated for the heavy lifting involved.

What the Commission Typically Covers

That percentage isn't just for a couple of days of selling. It covers the full-service, labor-intensive process that happens long before the first customer walks through the door.

This "all-in" fee usually bundles together services like:

- Sorting and Organizing: Methodically going through every single item in the home.

- Research and Pricing: Figuring out what your items are worth in today's market. This takes expertise.

- Staging and Merchandising: Setting up the home like a temporary retail store to make items look their best.

- Marketing and Advertising: Getting the word out through online listings, email newsletters, and signs to attract serious buyers.

- Staffing the Sale: Having enough people on-site to manage the sale, answer questions, and handle payments.

Key Takeaway: The commission pays for a company to completely manage the liquidation from start to finish. You’re handing over the keys, and they’re handing you back a check, with minimal effort on your part.

Potential Hidden or Additional Costs

While the commission is supposed to be all-inclusive, you have to read the fine print. Some companies bill extra for services they consider outside their standard agreement. Always get a contract and ask direct questions about what isn't covered.

Keep an eye out for these potential add-on fees:

- Excessive Trash Haul-Away: Charges for removing large quantities of garbage or items that couldn’t be sold.

- Deep Cleaning Services: The cost to have the home professionally cleaned before or after the sale.

- Credit Card Processing: Some companies will pass the 2-3% transaction fee from credit card sales directly on to you.

- Specialist Appraisals: If you have fine art, jewelry, or rare coins, you may have to pay for an outside expert to get an accurate valuation.

This model is a lot like other commission-based services. Think about real estate agents, who earned an average commission of around 5.44% in 2025 for their comprehensive work. Understanding these parallels helps put the fees into perspective. For a deeper dive into how these commissions work, check out our guide on understanding estate sale commissions.

The Rise of DIY Online Auction Platforms

For decades, the full-service estate sale company was the only game in town. But that's changing. A modern alternative has emerged for families who want more control over the process and a much better handle on their estate sale fees: the Do-It-Yourself (DIY) online auction platform.

These platforms let you run your own professional-style sale right from your home. You’re essentially swapping the high commission rates of a traditional company for a small, transparent fee. Instead of handing over the keys and hoping for the best, you’re in charge.

The whole experience is built to be simple, even if you’ve never sold anything online before. You can catalog every item just by snapping photos with your smartphone, writing a quick description, and setting your own starting bids. This hands-on method gives you complete authority over your family's assets and a clear view of the entire process.

How DIY Platforms Change the Game

DIY online auctions completely flip the old script on who does the work and who keeps the profit. You put in your own time and effort to prepare the sale, and in exchange, you keep a much, much larger slice of the final proceeds. The platform gives you the tools—the online storefront, the marketing to local buyers, and the secure payment system—while you manage the items on-site.

This model is a game-changer for a few key reasons:

- Financial Control: With fees often as low as 10% (or sometimes a simple flat rate), the financial upside is massive.

- Total Transparency: You see every bid as it comes in and every sale as it happens. No more mysterious fees or line items you don't understand.

- Flexibility: You set the schedule. From how long the auction runs to when buyers pick up their items, the entire sale works around your life, not the other way around.

This approach is perfect for the seller who wants to maximize their net profit and isn’t afraid of a little hands-on work. It gives you the professional tools to run a successful event without the professional price tag.

By moving the sale online, platforms like DIYAuctions create a straightforward path to liquidating an estate. We handle the heavy lifting of marketing your sale to interested local buyers and managing all the credit card payments securely. That leaves you with the totally manageable tasks of cataloging your items and hosting one scheduled pickup day. You're in the driver's seat.

Comparing Fee Structures and Services

When you're figuring out how to handle an estate liquidation, your choice comes down to a simple trade-off: money versus time. The two main paths—hiring a traditional company or running a DIY online auction—offer completely different answers to that question. It’s all about weighing hands-on control against hands-off service.

A traditional estate sale company is a full-service operation. They come in and do everything for you, from sorting through dusty attics to pricing every last teacup, staffing the sale, and managing the final clean-out. This comprehensive, “white glove” service is a huge relief, but it comes at a significant cost—typically a commission between 30% and 50% of the gross sales. That fee directly reflects the immense amount of labor involved.

On the other hand, a DIY online auction platform puts you in the driver's seat. You handle the on-site work like cataloging your items and organizing them for pickup. The platform gives you the professional-grade tools to pull it off, including marketing to a built-in buyer base and secure payment processing. This approach requires more of your time, but it slashes the cost down to a much lower commission, usually around 10%, or sometimes a small flat fee.

Breaking Down Costs and Value

So, where does the money really go? With a traditional service, you’re paying a premium for convenience and their professional experience. It's the perfect fit if you're out of state, short on time, or simply overwhelmed by the task.

With a DIY platform, you’re paying for powerful technology and massive reach while pocketing the difference. You retain full control and a much, much larger share of the profits.

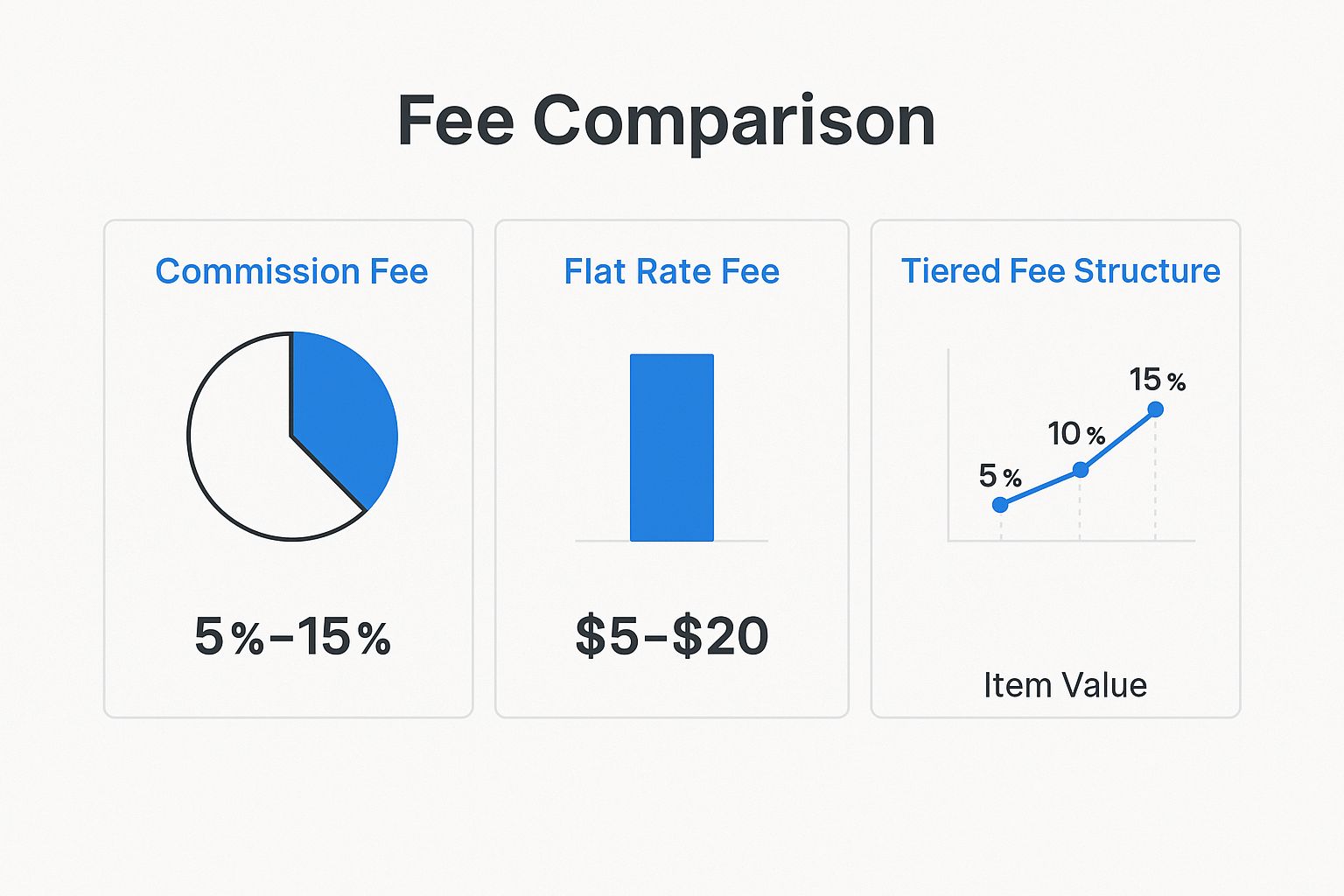

This chart breaks down the common fee structures you’ll see in the industry.

As you can see, the fee models are built for different needs, from broad percentage-based commissions to more detailed, value-based tiers.

To really see how this plays out in the real world, let's put the two models side-by-side. The table below cuts through the noise and shows you what you get for your money.

Cost and Service Breakdown: Traditional vs. DIY Online Auction

This table offers a direct comparison of what to expect when hiring a full-service company versus managing the sale yourself with an online platform. It highlights not just the fees, but how each model impacts your final net profit.

| Comparison Point | Traditional Estate Sale Company | DIY Online Auction Platform |

|---|---|---|

| Primary Fee | 30% - 50% commission on gross sales. | ~10% commission or a low flat fee. |

| Upfront Costs | Generally none, but some may ask for a deposit. | Minimal to none. You just pay the platform fee. |

| Included Labor | All on-site sorting, pricing, staging, and sale staffing. | You manage on-site cataloging and pickup day. |

| Marketing | Local newspaper ads, email lists, and yard signs. | Targeted digital marketing to a local buyer base. |

| Cleanup | Often included, but a "deep clean" may be extra. | You are responsible for handling unsold items. |

| Hidden Fees | Potential charges for trash removal, credit card processing, or special appraisals. | Generally transparent. What you see is what you pay. |

The key takeaway is that neither model is inherently "better"—they just serve different goals. One maximizes convenience, while the other maximizes your profit.

The most crucial factor is understanding where your money is going. A 40% commission might seem steep, but it covers dozens of hours of professional labor. A 10% DIY fee is low because you provide the labor, letting you keep the savings for yourself.

For those interested in the tools that make a DIY sale not just possible but profitable, you can learn more about the specifics of estate sale software and see how it simplifies the entire process. Ultimately, the right choice always comes back to your personal priorities and what you value most.

Crunching the Numbers: How Estate Sale Fees Impact Your Bottom Line

It’s one thing to talk about percentages, but it’s another to see how they actually play out with real money. The gap between a high-commission service and a low-fee platform can easily mean thousands of dollars staying right where they belong—in your pocket.

Let's walk through two common scenarios to see how your choice directly impacts your final payout. We’ll compare a typical 40% commission for a traditional company against the 10% fee for a DIY online auction with a platform like DIYAuctions.

Scenario 1: The Moderate Family Estate

Picture an average estate filled with a mix of good-quality furniture, everyday household items, and some nice china. You do a quick walk-through and estimate the total value of the contents at around $30,000.

Here’s how the math breaks down.

With a Traditional Estate Sale Company:

- Gross Sale Revenue: $30,000

- Commission (40%): $12,000

- Potential Extra Fees (Trash Haul-Away, Credit Card Processing): ~$500

- Your Estimated Net Profit: $17,500

Sure, the professional company handles everything. They sort, price, staff the sale, and manage the cleanup. You're paying for that convenience, but it comes at a steep price.

With a DIY Online Auction Platform:

- Gross Sale Revenue: $30,000

- Platform Fee (10%): $3,000

- Potential Extra Fees: $0

- Your Estimated Net Profit: $27,000

By taking on the hands-on tasks yourself, like cataloging the items and managing the pickup day, you keep an extra $9,500. For most families, that kind of difference makes the effort more than worth it.

Scenario 2: The Niche Collectibles Estate

Now, let's look at a smaller, more specialized estate. This one is full of collectibles—think vintage toys, a great vinyl record collection, and signed memorabilia—with a total estimated value of $15,000. These sales are perfect for drawing in dedicated buyers, whether online or in person.

For smaller or more specialized estates, high commission rates can devour a huge chunk of the total value. This is exactly where the lower, fixed-percentage fee of a DIY model really shines, making sure you keep the lion's share of the profits.

Let's run the numbers again.

With a Traditional Estate Sale Company:

- Gross Sale Revenue: $15,000

- Commission (40%): $6,000

- Your Estimated Net Profit: $9,000

With a DIY Online Auction Platform:

- Gross Sale Revenue: $15,000

- Platform Fee (10%): $1,500

- Your Estimated Net Profit: $13,500

In this case, the DIY approach puts an additional $4,500 back in your hands. The numbers don't lie. As an estate’s total value gets smaller, that 40% commission hits even harder. It can feel downright punishing, while a 10% fee ensures the sale is still financially rewarding for you.

When to Choose Each Estate Sale Method

Deciding between a traditional estate sale company and a DIY online auction isn't as simple as picking the lowest commission. Honestly, the cheapest option isn't always the right one. The best choice really boils down to your specific situation—how much time you have, how hands-on you want to be, and what’s actually in the estate.

This isn't just a local decision, either. The cost of selling personal property and real estate varies wildly across the globe. For example, real estate agent commissions in South Africa can hit a steep 7.5%, while in European countries like Spain and Switzerland, they stick closer to 3% to 5% plus a VAT. It’s a good reminder that local norms and taxes play a huge role in your final costs. You can learn more about these global commission differences to see the bigger picture.

When to Hire a Traditional Company

A full-service estate sale company is your go-to when convenience is everything. That high commission rate—often between 30-50%—is what you pay for a completely hands-off experience.

Hiring a traditional company makes the most sense if you are:

- Managing the estate from a distance. Living out of state makes having a local crew on the ground to manage every single detail an absolute lifesaver.

- Pressed for time or energy. Grieving is exhausting. Juggling a full-time job or other life responsibilities can make the idea of sorting through an entire house feel impossible.

- Dealing with a very large or high-value estate. Professionals know how to properly research and price antiques, fine art, and rare collectibles. Their expertise can bring in higher returns on specialty items than you might achieve on your own.

Think of a traditional company as a "done-for-you" service. You hand over the keys and, a few weeks later, a check arrives. For many, that peace of mind is well worth the steep fee.

When a DIY Online Auction Is Superior

On the other hand, a DIY online auction platform like DIYAuctions is built for people who want to keep the most money in their pocket and have full say over the process. This method really shines when the bottom line is what matters most.

A DIY auction is your best bet when:

- You want to maximize your net profit. With a low 10% fee, you keep the lion's share of the money your items earn.

- You have a smaller estate. Many traditional companies have high minimums and won't take on smaller sales. A DIY platform lets you sell everything profitably, no matter the size.

- You enjoy a hands-on approach. If you have the time and feel comfortable cataloging items and taking photos, you can save yourself thousands of dollars.

- You want complete control. You’re in the driver’s seat. You set the prices, the timeline, and you make all the final calls.

This model is a perfect fit for the organized, motivated person who is focused on getting the best possible financial outcome.

Common Questions About Estate Sale Fees

Even after you’ve run the numbers, a few questions always seem to pop up. The world of estate sales has its own language and rules, and getting comfortable with them is the key to a smooth and profitable experience.

Let's walk through some of the most common concerns we hear. Getting clear, practical answers will give you the confidence to move forward.

Are Proceeds from an Estate Sale Taxable?

This is a big one, and for good reason. The short answer is usually no, but there's an important catch.

For the most part, the money you make from selling personal property is not considered taxable income. This is because you’re typically selling items for less than what they were worth when the original owner passed away. In the eyes of the IRS, you're liquidating assets, not making a profit.

The exception? If an item sells for more than its appraised value, that gain could be subject to capital gains tax. This is most common with big-ticket assets like fine art, rare antiques, or valuable jewelry collections.

Important Note: Tax laws are complicated and can change based on your specific situation and the estate's value. We always recommend consulting with a qualified tax professional or an estate attorney to understand your personal obligations.

What Happens to Items That Do Not Sell?

It’s almost a guarantee that a few things will be left over after a sale. What you do next depends entirely on the path you chose.

-

Traditional Estate Sale Company: Many companies offer a “clean-out” service, either included in their fee or for an extra charge. They’ll handle donating usable goods, consigning valuable pieces, and disposing of the rest. Just make sure the terms are spelled out clearly in your contract.

-

DIY Online Auction: When you run your own sale, you're in the driver's seat. You get to decide what happens with any leftover items. This gives you total control to hold another small sale, donate to a cause you love, give things to family, or arrange for disposal yourself.

How Do I Spot Red Flags in a Contract?

Your contract is your single most important piece of protection when hiring a traditional estate sale company. A reputable firm will be upfront and transparent, but you should always read the fine print before signing anything.

Keep an eye out for these red flags:

-

Vague Commission Terms: The contract needs to state the exact commission percentage and what it covers. If it just says "a commission will be charged," that’s a major warning sign.

-

Unclear Additional Fees: A pro will disclose every potential extra charge from the start. Watch for fuzzy language like "miscellaneous costs" or "cleanup charges" that don't have specific price caps.

-

No Proof of Insurance: The company absolutely must carry liability insurance to protect against accidents or damage during the sale. Never, ever work with an uninsured company.

-

No Clear Payment Schedule: Your contract should detail exactly when and how you'll get paid. Most professional companies pay out within 7-14 days after the sale ends.

Getting a handle on these details is a huge part of the process. For more in-depth answers, check out our ultimate estate sale FAQ for even more guidance.