A Complete Guide to Estate Sale Insurance

Let's be blunt: your standard homeowner's insurance policy was never designed to cover an estate sale. In a nutshell, estate sale insurance is a special, short-term policy that shields you from the unique financial headaches that can pop up when you open a private home to the public for a sale.

It's a temporary but absolutely critical safeguard for a high-traffic event, covering the exact gaps your homeowner's policy leaves wide open.

What Is Estate Sale Insurance and Why It Matters

Think of it like this: your homeowner's policy is for everyday living. An estate sale is not an everyday event. For a few days, your private home essentially becomes a pop-up retail shop. You're inviting strangers—sometimes dozens or even hundreds of them—onto the property to browse, handle items, and make purchases.

This simple act of inviting the public in for a commercial purpose is where things get tricky with standard insurance. The risk level skyrockets, and your policy, which is built for private residential use, just isn't equipped to handle it. This creates some serious liability and property protection gaps you need to be aware of.

The Gaps in Standard Home Insurance

Most homeowner's policies have something called a "business exclusion" clause buried in the fine print. This clause gives the insurance company the right to deny any claim related to a commercial activity happening on the property. And you can bet that a well-advertised estate sale looks a lot like a commercial activity to them.

Without a dedicated estate sale policy, you could be left holding the bag for some expensive problems:

- Visitor Injuries: A shopper trips on a rug and breaks their wrist. Suddenly, you're on the hook for their medical bills and potentially a lawsuit.

- Property Damage: A buyer accidentally knocks over and shatters a priceless vase that wasn't even for sale.

- Damage to the Home: A customer's movers scrape a huge gouge in the hardwood floor or punch a hole in the drywall while carrying out a heavy dresser.

An estate sale transforms a private residence into a public marketplace. This fundamental shift in how the property is used is precisely why specialized insurance becomes a necessity, not a luxury.

Homeowner's Insurance vs Estate Sale Insurance Coverage

To see where your homeowner's policy is likely to fall short, just look at the comparison below. It clearly shows the risks you face and how a dedicated policy is designed to step in and protect you.

| Risk Type | Standard Homeowner's Insurance Coverage | Estate Sale Insurance Coverage |

|---|---|---|

| Guest Injuries | Coverage may be limited or denied due to the "business exclusion" clause. | Provides general liability specifically for injuries to shoppers during the sale. |

| Damage to Sale Items | Unlikely to cover damage to personal property being sold as part of a commercial event. | Offers property damage coverage for the items being sold (often called "care, custody, and control"). |

| Damage to the House | Might not cover damage caused by customers or their movers during the sale. | Includes protection for the physical structure and property not included in the sale. |

| Theft of Sale Items | Coverage is often limited and may not apply during a publicly advertised event. | Can offer specific protection against theft of inventoried items during sale hours. |

As you can see, relying on your standard home insurance is a gamble. A specialized estate sale policy isn't just an extra expense; it's a core part of running a safe and financially sound event, protecting the estate's assets from unpredictable accidents.

Understanding Your Core Coverage Options

When you get an estate sale insurance policy, you aren't just buying one big safety net. It’s more like a toolkit, where each tool is designed for a very specific job. Let’s pop the lid on this toolkit and look at the two absolute must-haves you'll find inside.

First up is General Liability. This is your front-line defense for anything that happens to people at your sale. Picture this: a shopper trips over an extension cord you ran for extra light and needs to go to the doctor. General Liability is what steps in to handle their medical bills and any legal fees if things escalate. It's all about protecting you from the financial fallout when a person gets hurt on the property.

The second essential piece is Property Damage coverage. In the insurance world, you'll often hear this called Care, Custody, and Control (CCC). This part is incredibly important because it protects the very things you're there to sell.

Breaking Down Property Damage Protection

During the controlled chaos of an estate sale, a lot can happen to the property. This is why CCC coverage is typically divided into two distinct parts, each handling a different kind of risk. Knowing the difference is key to making sure you're truly covered.

- Damage to the Sale Inventory: This protects the actual items being sold. Let's say a buyer fumbles a valuable porcelain figurine and it shatters on the floor. This coverage helps reimburse the estate for that financial loss. It's for the merchandise you've been entrusted to sell.

- Damage to the Premises: This protects the house itself. Imagine a buyer's movers scrape a huge gouge in the hardwood staircase while hauling out a heavy antique desk. This is the part of the policy that would cover the cost of that repair.

Care, Custody, and Control is more than just a name—it’s a critical concept. It acknowledges that for the duration of the sale, you are the temporary guardian of both the items for sale and the home they sit in. That makes their safety your responsibility.

This is an important distinction. Damage to an item for sale hurts the estate's bottom line, while damage to the home itself impacts the property owner. A solid estate sale insurance policy has your back on both fronts. Of course, knowing what things are worth is a huge piece of this puzzle. Our comprehensive estate sale pricing guide can help you get a handle on item values before your sale even starts.

Thankfully, the specialized insurance needed for estate sales is built on a strong foundation. The broader U.S. property and casualty insurance market has been performing well, which helps ensure policies like these remain available and stable. This financial health gives insurers the confidence to offer these specific protections for the unique liability and property risks that come with running an estate sale.

How Your Insurance Costs Are Determined

Figuring out the price of your estate sale insurance policy isn’t some big mystery. It's actually a pretty straightforward calculation based on one simple thing: risk.

Figuring out the price of your estate sale insurance policy isn’t some big mystery. It's actually a pretty straightforward calculation based on one simple thing: risk.

Insurers look at the specifics of your sale and essentially ask, "What's our potential for a financial loss here?" The answer comes from a few key variables that paint a clear picture of what you’re planning. Think of it like catering an event—the price changes based on how many guests you invite and how long the party lasts. Your insurance premium works the same way, tying directly to the unique details of your sale so the price you pay matches the protection you get.

The Core Factors That Drive Your Premium

When an insurer puts together your quote, they’re really weighing a few primary elements. Each one helps them understand the liability they might be taking on, which is what ultimately sets your final cost.

- Total Value of Items for Sale: This one’s a biggie. A sale packed with fine art and antique jewelry is a much higher financial risk than one with everyday household goods. The higher the total value of your inventory, the more an insurer stands to lose from damage or theft, which will bump up the premium.

- Duration of the Sale: A quick, one-day event has a much smaller window for accidents than a big three-day weekend sale. The longer your doors are open to the public, the higher the odds of an incident, leading to a slightly higher cost.

- Expected Number of Shoppers: Are you marketing to a niche group of 50 collectors or advertising to the general public and expecting hundreds of people? More foot traffic naturally increases the chances of someone tripping, falling, or accidentally breaking something.

The insurer's goal is to match the premium to the risk. It’s only logical: a small, short sale with modest items will cost less to insure than a massive, multi-day event filled with high-value assets.

How You Host the Sale Also Matters

One of the most important variables is who is running the sale. If you've hired a professional estate sale company, they almost always carry their own comprehensive liability insurance. That's great, but you should still ask for a copy of their insurance certificate. You need to make sure you, the homeowner, are listed as an "additional insured" party for total peace of mind.

But if you’re running the sale yourself—the DIY approach—then getting your own dedicated estate sale policy isn't just a good idea; it's non-negotiable. This is where your personal risk is highest, and that standalone policy becomes your most important shield.

This all fits into a huge, well-established industry. In the United States alone, the insurance sector brought in about $1.7 trillion in premiums. Property and casualty insurers, the category that includes estate sale policies, accounted for around 53% of that market. It just goes to show how significant and solid the industry segment covering property-related risks really is. You can explore more about the U.S. insurance market size to see the full scope.

A Step-by-Step Guide to Getting Your Policy

Getting the right insurance for your estate sale might feel like a big, complicated job, but it’s really just a few straightforward steps. Think of it less as a hurdle and more as a simple to-do list that gets you from worried to protected.

First things first, you need to create a detailed inventory of everything you plan to sell. Don't just make a quick list; take the time to document the condition and estimate the value of each item. If you have high-value pieces like fine art or antiques, getting a professional appraisal is a smart move. This gives the insurance company a clear, credible picture of exactly what they're being asked to cover.

Next, it's time to put on your safety inspector hat and assess the property for any potential hazards. Walk through the home and the yard looking for anything that could cause an accident.

- Are there any loose rugs people could trip over?

- Are the stairs well-lit and completely clear of clutter?

- Is there any wobbly or rickety furniture that could give way?

Finding these risks now lets you fix them before the sale starts, which can often help you get a better rate on your insurance.

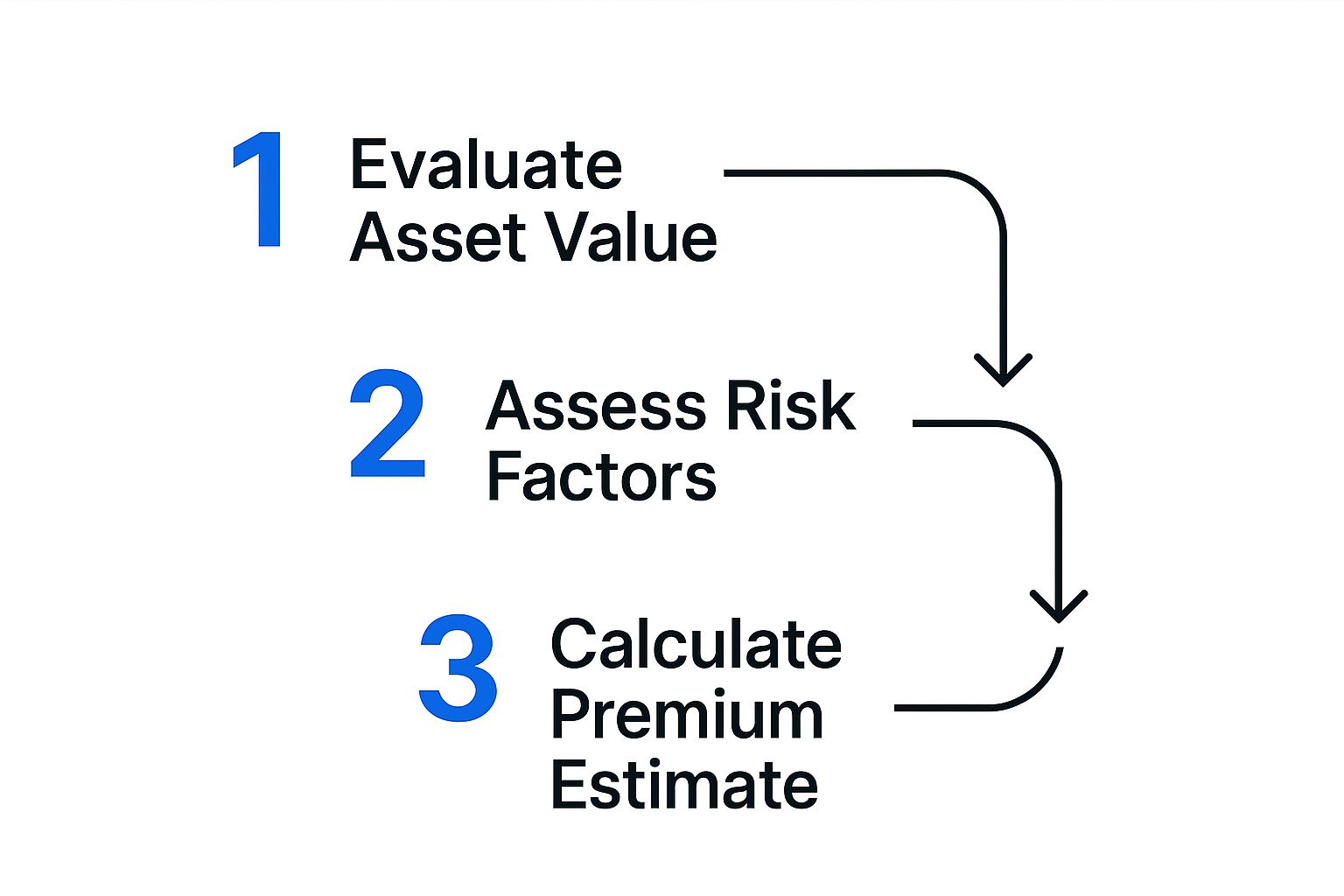

This is basically how insurers figure out what your policy will cost.

As you can see, the value of your items and the safety of your property are the two key pieces of information an insurer uses to calculate your premium.

As you can see, the value of your items and the safety of your property are the two key pieces of information an insurer uses to calculate your premium.

Finding and Finalizing Your Coverage

With your inventory and safety check done, it's time to find a specialized provider. Your average insurance agent might not be familiar with the specifics of an estate sale, so look for brokers who specialize in event insurance or specialty liability policies. It's always a good idea to get at least two to three quotes to compare what you’re getting for your money.

Once you’ve picked a provider, you’ll need to gather the required documents. This typically includes your detailed inventory, any appraisal documents, photos of the property, and your planned sale dates. Having all this organized and ready to go will make the application process a whole lot smoother.

Before you sign on the dotted line, review all the policy details with a fine-tooth comb. Make sure you fully understand the coverage limits, what your deductible is, and—most importantly—any exclusions. Don't ever hesitate to ask your agent to explain anything that isn't 100% clear.

Being properly prepared is the secret to a smooth event. If you're managing the sale on your own, you might also want to look at our guide on how to run an estate sale for more hands-on tips. The right insurance, combined with smart planning, is your recipe for a successful, stress-free sale.

Common Myths About Estate Sale Insurance

When it comes to estate sale insurance, there's a lot of bad advice floating around. Believing these myths can lead to some seriously expensive mistakes. Let's clear the air and tackle these misconceptions head-on so you can make decisions based on reality, not rumor.

The biggest—and most dangerous—myth is that a standard homeowner's policy is all you need. We've touched on this before, but it bears repeating: this is simply not true. Homeowner's policies are written for normal residential life, and they almost always include a "business exclusion." An estate sale is a commercial event, and that exclusion could give your insurer grounds to deny a claim, leaving you completely exposed.

Myth Versus Reality

Another common assumption is that the estate sale company's insurance has you covered. While any reputable company will carry its own liability insurance, that policy is designed to protect them, not you. The only way their policy helps you is if you are formally named as an "additional insured," which is something you must specifically request and confirm.

Believing these myths can leave you financially exposed. The reality is that dedicated estate sale insurance is the only surefire way to close critical coverage gaps and protect the estate’s assets.

Many people also think that getting a special policy is a huge hassle or only necessary for sales with priceless antiques. The truth is, the application process is usually quite straightforward. More importantly, the most common and costly risk—a visitor getting injured on the property—has nothing to do with how much your items are worth. A simple trip and fall can lead to a massive liability claim.

For those managing a sale on their own, our guide with estate sale help offers more practical tips for navigating these kinds of details.

Why Specialized Coverage Matters

Finally, some worry that these kinds of policies are from a niche, unstable market. That couldn't be further from the truth. Estate sale insurance is part of the huge property and casualty sector. In fact, this broader market saw $30 billion in total deal value across 209 transactions in the U.S. insurance space.

This kind of strong financial activity shows that the industry is stable and investors are confident. It ensures that brokers have reliable options to find you customized coverage for unique situations like an estate sale. This stability means you can count on the protection being there when you need it most.

Your Essential Estate Sale Protection Checklist

Alright, you’ve learned about the risks and the types of coverage available. Now it’s time to put that knowledge into practice. This isn't just theory anymore—this is your practical roadmap to ensure your estate sale is both profitable and safe.

Think of this as your pre-flight check before you open the doors. Running through these steps methodically is how you build a successful, stress-free event. It all comes down to solid planning and the right estate sale insurance.

Pre-Sale Safety and Security

-

Confirm Your Insurance is Active: First things first. Before you do anything else, double-check that your policy is officially in effect for all your sale dates. Have a copy of your insurance certificate handy, either on your phone or printed out.

-

Conduct a Final Safety Walk-Through: The day before the sale, walk through the property with a critical eye. Are there any loose rugs? Tape them down. Any stray extension cords? Secure them. Clear all walkways and make sure to lock the doors to any rooms that are off-limits.

-

Secure High-Value Items: Small, valuable items like jewelry, watches, or collectible coins are prime targets for theft. Don't leave them out in the open. Display them in a locked case or keep them safely behind your checkout counter. It’s a simple step that makes a huge difference.

Peace of mind comes from preparation. This checklist isn’t about being paranoid; it's about being professional and proactive, ensuring you’ve controlled every variable you can.

During the Sale Operations

-

Manage Crowd Flow: It’s tempting to let everyone rush in at once, but it’s a bad idea. Limit how many shoppers are in the home at any given time. This prevents overcrowding, which not only makes for a safer space but also creates a much more pleasant shopping experience for your buyers.

-

Establish Clear Payment Procedures: Set up a single, centralized checkout area to keep things organized. Decide on secure payment methods you'll accept and have a clear, firm policy for when and how buyers can remove large items. This simple system cuts down on chaos and protects both the items and the home itself from damage.

Still Have Questions? Let's Clear Things Up

Even after you've got the essentials down, a few specific questions always seem to pop up about estate sale insurance. It's totally normal. Getting these details straight is the final step to feeling completely confident in your coverage. Let's tackle some of the most common ones we hear.

What If One of My Staff or Volunteers Steals Something?

This is a really important question, and the honest answer is that your standard policy probably won't cover it. General liability is all about protecting you from accidents involving the public—slips, falls, or damage they might cause. It isn't designed to cover theft from within your own team.

The good news is, there's a specific fix for this. You can ask your provider to add an endorsement called Employee Dishonesty Coverage (or a fidelity bond). This add-on is built specifically to protect you if an employee or volunteer commits theft or fraud. If you're running a sale with anyone's help, you should absolutely ask your insurance agent about this. It's a small addition that can save you a huge headache.

How Long Is My Estate Sale Insurance Policy Good For?

Think of this insurance as a short-term, special event policy, not an annual contract like your car or home insurance. It's designed to cover only the exact window of time when you face the risks of an estate sale.

When you buy the policy, you'll define a specific coverage period that usually includes:

- A few setup days to get everything staged and priced.

- The official sale dates when shoppers are in the home.

- A day or two afterward for item pickup and cleanup.

This whole period is usually just a handful of days, maybe a week at most. You only pay for the protection you need, exactly when you need it.

Can I Get Insurance If I'm Just Renting The House?

Yes, absolutely! This is a very common situation. You don't have to be the property owner to get estate sale insurance. In fact, it's often executors or family members who don't own the home who need this coverage the most.

When you take out the policy, you become the "named insured." This means the policy protects you from liability claims and property damage that might happen during the event you are running. It’s your safety net when you’re responsible for a sale on someone else’s property.

Don't be surprised if the homeowner or landlord actually requires you to provide proof of insurance before they'll even let you hold the sale. It’s a standard request to make sure everyone is protected.

What's The Process If I Actually Need To File A Claim?

If an accident happens, your first priority is to make sure everyone is safe. Once the immediate situation is handled, your next job is to become a documentarian. Take pictures of any damage or the spot where an injury occurred. Get names and phone numbers from anyone who saw what happened. And while it's fresh in your mind, write down a detailed account of the incident.

Then, call your insurance provider as soon as you possibly can to report it. They'll open a claim and assign an adjuster to your case. This person will be your guide, walking you through the process of submitting your photos, notes, and any formal paperwork. Their job is to investigate what happened and figure out how your policy applies to the situation, getting you the help you're covered for.