The Ultimate Auction Fee Calculator to Maximize Your Profits

An auction fee calculator is one of the most important tools you can use. It cuts through the noise and shows you your true net profit by subtracting commission rates, buyer's premiums, and any other costs from the final sale price. Using one means you know exactly how much you'll take home before you ever agree to a platform.

How Auction Fees Actually Impact Your Payout

Have you ever been surprised how two auctions with the exact same winning bid can leave sellers with wildly different payouts? The culprit, almost every time, is the fee structure.

Traditional auction models have a way of quietly chipping away at your earnings. They lean on high, percentage-based commissions that feel unpredictable and can take a massive bite out of your final profit. The core numbers are always simple: the hammer price, the commission rate, and any extra charges. But understanding how they interact is what helps you make a smarter financial choice.

Traditional vs. Transparent Fee Models

A high commission rate can be a silent killer of your profits. In the estate liquidation industry, which is valued at around $230.3 million, it's common for companies to charge anywhere from 30-50% in commissions.

Think about that for a second. On a completely average $5,000 estate sale, that means the seller is losing between $1,500 and $2,500 just in fees.

This is where a modern, transparent model makes all the difference. Platforms like DIYAuctions use a capped-fee structure that is designed to protect your earnings, especially as the value of your sale goes up.

On that same $5,000 estate, a platform with a 10% capped commission lets the seller keep around $4,000. That’s a huge increase in their net profit, and it all comes down to choosing a fair and clear fee structure from the very beginning.

To show this in black and white, here's a quick comparison.

Fee Impact on a $5,000 Estate Sale

This table shows exactly how different commission structures affect your take-home profit from a typical estate sale.

| Fee Model | Commission Rate | Fees Paid | Your Net Profit |

|---|---|---|---|

| Traditional Auction | 40% | $2,000 | $3,000 |

| Capped Fee (DIYAuctions) | 10% | $500 | $4,500 |

The numbers don't lie. A fair fee structure can mean thousands of dollars back in your pocket.

Watching Out for Hidden Costs

Beyond that main commission, you have to keep an eye out for other costs that can sneak in and reduce your payout. I’ve seen them all over the years.

They often hide in the fine print and can include things like:

- Marketing Fees: Extra charges for promoting your auction.

- Photography Costs: Paying someone to take professional photos of your items.

- No-Sale Penalties: A frustrating fee you get charged even if an item doesn't sell.

- Buyer's Premiums: This is a percentage paid by the buyer, but it can indirectly push the final hammer price down as savvy bidders adjust their offers to account for it.

These extras are precisely why a simple percentage rate never tells the whole story. Even platforms that advertise themselves as "free" can hit your payout hard with these kinds of charges. If you want to get better at identifying hidden fees in 'free' software, it’s a good skill to have.

For a complete rundown of these charges, check out our guide on what transaction fees cover.

The Math Behind Your Auction Earnings

To really see what you'll make, you have to look past the final bid and understand the simple math that goes into any good auction fee calculation. Once you get a handle on these core formulas, you can accurately forecast what you'll pocket and compare different auction platforms with confidence.

The most basic calculation figures out your net profit from a simple commission percentage. It’s the starting point for everything.

Formula for Simple Commission:

Net Proceeds = Hammer Price - (Hammer Price * Commission Rate)

Let's say your antique clock sells for $1,000 and the auction house takes a 20% commission. The math is easy. You’d pay $200 in fees ($1,000 * 0.20), leaving you with $800. This formula is the backbone of most fee estimates.

Factoring in Tiered Commissions

Things can get a little more complex. Some auction houses use a tiered or sliding scale commission, where the percentage drops as the sale price goes up. This model is often better for higher-value items.

Imagine an auction with a tiered structure like this:

- 25% on the first $500

- 15% on the amount from $501 to $5,000

- 10% on any amount over $5,000

If your collection sells for $7,500, you don't just pay one flat rate. The fee is actually built in pieces:

- First Tier: $500 * 0.25 = $125

- Second Tier: ($5,000 - $500) * 0.15 = $4,500 * 0.15 = $675

- Third Tier: ($7,500 - $5,000) * 0.10 = $2,500 * 0.10 = $250

Your total fee comes out to $1,050 ($125 + $675 + $250). It’s not just a single percentage of the total sale, which is exactly why a reliable auction fee calculator is so important.

A critical part of forecasting is ensuring your financial data is accurate from the start. For complex sales with numerous transactions, using a reliable bank statement converter software can help organize your figures, ensuring precise inputs for any calculation.

How the Buyer's Premium Affects You

The buyer's premium is a fee the winning bidder pays, not you. So why does it matter? Because it can indirectly impact your final earnings. An experienced bidder always factors this extra cost into how high they're willing to go.

For instance, if a buyer is willing to spend a total of $1,000 and knows there's a 15% buyer's premium, they’ll probably stop their bid around $870. The premium ($130.50) pushes their total cost just over their $1,000 limit. If that premium wasn't there, they might have been willing to bid closer to the full $1,000, which would have meant a higher hammer price for you.

Understanding these calculations is the first step toward true financial clarity. For a deeper look into the specifics of your revenue, our guide on how to calculate profit margins offers more advanced insights.

Putting the Auction Fee Calculator to Work

Knowing the formulas is one thing, but seeing them in action is where the lightbulb really goes on. An auction fee calculator isn’t just some abstract tool—it's your best friend for predicting exactly how much cash you'll walk away with.

Let's run a few common scenarios to see how a traditional, high-commission auction house stacks up against a modern, capped-fee model.

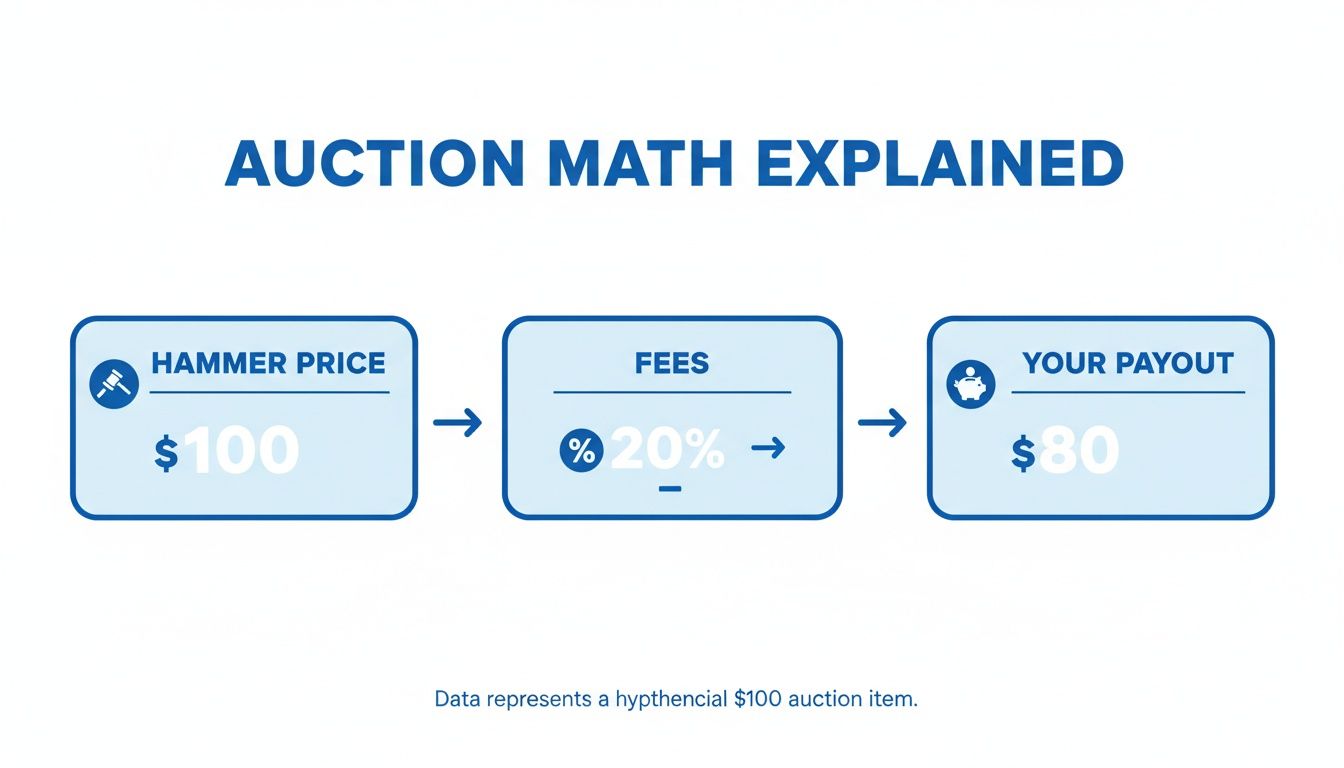

The math itself is simple. The auction's final sale price, often called the hammer price, gets hit by the commission percentage, and what's left is your payout.

It’s that fee in the middle that can make or break your bottom line.

Scenario One: Downsizing a Family Home

Imagine you're helping your parents clear out their lifelong home. After adding up all the furniture, tools, and household goods, you estimate the total value at $15,000. It's a common, respectable amount for a full house.

A local estate sale company comes in and quotes you their standard 40% commission.

- Total Fees: $15,000 x 0.40 = $6,000

- Your Net Payout: $15,000 - $6,000 = $9,000

Now, let's plug those same numbers into a modern platform like DIYAuctions, which uses a 10% fee capped at $1,000.

- Total Fees: $15,000 x 0.10 comes out to $1,500. But since that's over the cap, your fee is just $1,000.

- Your Net Payout: $15,000 - $1,000 = $14,000

In this very typical situation, switching to a platform with a transparent, capped fee puts an extra $5,000 straight into your family’s pocket. That’s not a rounding error; it’s a game-changing amount of money.

Scenario Two: Liquidating a Specialized Collection

Next up, a more specialized sale: a curated collection of antique radios valued around $40,000. You've got rare items that will attract passionate, niche collectors, so you expect the bidding to be strong.

With a 40% traditional commission, the numbers are pretty jarring.

- Total Fees: $40,000 x 0.40 = $16,000

- Your Net Payout: $40,000 - $16,000 = $24,000

This is where the capped-fee model really pulls ahead. Even though the sale value is much higher, that fee protection kicks in instantly.

- Total Fees: Your fee stays locked in at the $1,000 cap.

- Your Net Payout: $40,000 - $1,000 = $39,000

The difference is a jaw-dropping $15,000. For anyone selling high-value assets, this shows just how badly old-school commission models can punish success. Choosing the right platform is everything; you can see what to look for in our guide on the best online auction software.

Scenario Three: Clearing Out Business Assets

Finally, let’s look at a business liquidation. A small graphic design firm is closing its doors and needs to sell everything—office furniture, high-end computers, and printing equipment. The estimated value comes to $25,000.

- Traditional 40% Fee: You'd pay $10,000 in fees, leaving you with $15,000.

- 10% Capped Fee: You'd pay the $1,000 maximum, leaving you with $24,000.

Scenario Comparison: Traditional vs. Modern Capped Fee

To really drive the point home, let's look at all three scenarios side-by-side. The difference in your net profit is impossible to ignore.

| Scenario | Estimated Sale Value | Net Profit (Traditional 40% Fee) | Net Profit (10% Capped Fee Model) |

|---|---|---|---|

| Downsizing | $15,000 | $9,000 | $14,000 |

| Specialty Collection | $40,000 | $24,000 | $39,000 |

| Business Liquidation | $25,000 | $15,000 | $24,000 |

As you can see, the higher the value of your assets, the more a capped-fee structure protects your earnings. It ensures you're rewarded for having valuable items, not penalized.

This matters more than ever as sales shift online. The global online auction market is on track to grow from $5.25 billion in 2023 to an incredible $11.3 billion by 2032. This explosion gives sellers access to a huge new pool of buyers, but it also makes choosing a platform with fair fees absolutely critical if you want to make the most of it. You can dig into the data on this market growth over at dataintelo.com.

Why Platform Marketing Drives Higher Bids

Low fees are a great starting point, but they're only half of the equation when it comes to your total payout. The real magic happens when your items get in front of the right buyers—and lots of them. An auction platform’s marketing engine is the secret weapon that truly drives up the final hammer price.

Think of it this way: a low commission is nice, but it means very little if your auction only attracts a handful of bidders. Competition is what creates value. A platform with a powerful marketing reach acts as a magnet, pulling in qualified, interested buyers who are ready to compete. This flurry of bidding activity is what pushes the final sale price far beyond its starting point.

The Power of Digital Reach

Don't assume a high commission automatically equals better marketing. Many old-school auction houses rely on outdated, expensive methods and simply pass those high costs on to you. Modern platforms, on the other hand, use targeted digital marketing to get superior results for a fraction of the cost.

This isn't just about posting a listing and hoping for the best. A smart digital approach includes:

- Targeted Social Media Ads: Finding potential buyers based on their interests, location, and even their past online behavior.

- Email Marketing: Alerting a large, curated list of buyers who have already shown interest in items just like yours.

- Search Engine Optimization (SEO): Making sure your items pop up the moment a potential buyer searches for them online.

This digital-first strategy gives your items the visibility they deserve without bloating your fees. It connects your sale directly with an active, engaged audience that's ready to buy.

The goal isn't just to find any buyer; it's to find the best buyers. A robust marketing engine builds a competitive environment where multiple bidders feel compelled to outdo one another, directly increasing your bottom line.

How Marketing Impacts Your Payout

The link between digital visibility and final sale price is undeniable. In markets like real estate and collectibles, a massive 96% of buyers start their search online. What’s more, listings that include videos get a staggering 403% more inquiries. You can see more stats on how digital marketing drives sales over at digitalagencynetwork.com.

This data proves that a platform’s ability to support modern marketing is crucial for maximizing sale prices. Platforms that help you create professional listings with strong visuals give you a huge advantage—one that impacts your final proceeds far more than the commission rate alone.

So, when you're using an auction fee calculator to compare your options, don't just fixate on the percentage. Ask yourself what that fee actually gets you. A slightly higher fee might seem worse on the surface, but if it comes with a marketing engine that doubles your bidder pool and drives the final price sky-high, your net payout could be significantly larger.

Strategies to Boost Your Final Sale Value

Now that you know how to calculate your fees, let’s talk about the fun part: increasing the final sale value. An auction fee calculator is a great tool, but your own actions can have a huge impact on how much you walk away with. After all, more bidders almost always means a higher hammer price.

This process starts long before the first bid is ever placed. Taking control of your sale with a few proven strategies can make a real difference in your final payout.

Master Your Item Presentation

First impressions are everything in an online auction. Bidders can’t pick up your items and inspect them, so your photos and descriptions are doing all the heavy lifting. This is one area where putting in a little extra effort pays off big time.

High-quality, well-lit photos are non-negotiable. Don’t just snap a quick picture with your phone in a dark room. Take a moment to clean your items and photograph them against a simple, neutral background. Make sure you get shots from multiple angles, and for valuable pieces, include close-ups of any signatures, maker's marks, or unique details.

Your description is just as important. Go beyond the basics and tell a story if you can. Mention the item's history, its exact condition, and any interesting quirks that make it unique. A well-written description builds trust and helps bidders feel confident, which often translates directly into higher bids.

Strategic Pricing and Item Grouping

How you price and group items can make or break bidder engagement. It might seem backward, but starting your bids low—often at just $1—can spark a bidding frenzy that pushes the final price far higher than a cautious, high starting bid ever could.

For lower-value items, bundling is your best friend. A single coffee mug might not get much attention, but a curated “Mid-Century Modern Breakfast Set” can be incredibly appealing.

Pro Tip: Group items by theme, color, or function. Creating a lot of vintage gardening tools or a collection of blue-and-white porcelain can attract specific collectors and command a much higher price than selling each piece on its own. It also saves you a ton of time on individual listings.

Do Your Homework with Research

Finally, take a few minutes to research comparable sales. See what similar items have sold for recently on different auction sites. This quick search helps you set realistic expectations and informs your entire pricing strategy.

Knowing the market value also helps you decide if a reserve price is needed. A reserve is simply a secret minimum price your item has to hit before it will sell. You shouldn't use them on everything, but they’re a smart way to protect your most valuable assets from selling for a song. This kind of prep work ensures you're not just a passive seller—you're an active participant in maximizing your auction's success.

Your Top Auction Fee Questions, Answered

Let’s be honest, auction fees can feel like a minefield. You’re focused on what your items are worth, but the commission structure, extra charges, and industry jargon can eat into your profits if you’re not careful.

Getting a handle on these terms is the key to a successful sale. A little bit of knowledge here goes a long way, ensuring the final payout is what you actually expected. We’ll break down the most common questions we hear so you can walk into your auction with confidence.

What’s a Buyer’s Premium? And How Does It Affect Me as a Seller?

A buyer’s premium is a percentage added on top of the winning bid that the buyer has to pay. So, while it’s not a fee you pay directly, it absolutely impacts your final sale price.

Here's how it plays out in the real world. Let’s say a bidder has a firm budget of $500 for a piece of furniture. If they know there’s a 20% buyer’s premium, they’ll do the math backward and stop bidding around $415. Why? Because the $83 premium gets them right up against their $500 ceiling.

Without that premium, the bidding could have easily climbed closer to their actual $500 budget, putting more money directly in your pocket.

When buyers don't have to account for extra fees, they tend to bid more freely. Platforms without a buyer's premium create a simpler, more transparent auction where the bid price is the real price—often leading to higher hammer prices for sellers.

Are There Hidden Fees I Should Watch Out For?

Absolutely. This is where many traditional auction services can get you. The initial commission might sound reasonable, but the final invoice is often bloated with charges you never saw coming. This is why having an auction fee calculator is essential for getting a true estimate.

Keep an eye out for sneaky fees buried in the fine print:

- Marketing & Advertising Surcharges: Extra costs for promoting your sale.

- Photography or Cataloging Fees: Paying for someone to prep your listings.

- "No-Sale" or "Pass" Fees: A penalty if an item doesn't sell. Yes, really.

- Item Removal or Disposal Costs: Charges to haul away unsold inventory.

This is exactly why we built DIYAuctions. Our model is different: one simple, upfront commission covers everything. No surprises, no gotchas.

How Does a Commission Cap Work?

A commission cap is one of the most seller-friendly features you can find. It puts a ceiling on the total fee you'll ever pay, no matter how much your auction brings in.

Imagine an auction with a 10% commission that’s capped at $1,000. If your sale totals $5,000, your fee is a straightforward $500 (10%).

But if your auction is a massive success and brings in $20,000, your fee doesn't jump to $2,000. It stays at the $1,000 cap. This structure is a game-changer for larger estates or high-value collections, protecting your profits and making sure you keep the lion’s share of the earnings.