What Are Transaction Fees? A Guide for Your Business

Transaction fees are the small charges you pay for the service of moving money from a customer to your business. Think of them as a service toll on the financial highway—a necessary cost for the convenience and security of electronic payments.

Understanding Transaction Fees From the Start

Ever look at a sales report and wonder where those few cents or dollars from each sale actually go? You’re not alone. Every time a customer taps their card or clicks "buy now," a surprisingly complex series of events kicks off behind the scenes.

What seems like an instant process actually involves multiple financial institutions all working in concert to approve, verify, and settle the payment securely.

Transaction fees are the engine that powers this entire system. They aren't just a single charge, but a bundle of smaller costs collected by the different players who make that seamless payment possible. Getting a handle on these components is the first step toward managing them.

The Three Main Components of a Transaction Fee

At its core, almost every credit card transaction fee is made up of three distinct parts. Each one goes to a different entity and serves a specific purpose, ensuring the system runs smoothly and securely for everyone.

To make this simple, here’s a quick breakdown of who gets paid and why.

Quick Breakdown of Typical Transaction Fees

| Fee Component | Who It Goes To | Purpose |

|---|---|---|

| Interchange Fee | The customer's card-issuing bank (e.g., Chase, Capital One) | To cover the risk of fraud and fund customer rewards programs |

| Assessment Fee | The card network (e.g., Visa, Mastercard) | To maintain and operate their global payment networks |

| Processor Markup | The payment processor (e.g., Square, Stripe) | To cover their service costs and generate profit |

As you can see, each piece of the fee has a clear job to do.

These types of fees aren't just for card payments, either. You'll find similar charges in other financial sectors. For a great parallel, you can check out a complete guide to forex trading fees, which shows how service-based fees are structured elsewhere.

By breaking them down, we can see that transaction fees aren't just arbitrary deductions. They are the real operational costs of a massive, interconnected financial network that makes modern commerce possible.

The Anatomy of a Transaction Fee

To really get what a transaction fee is, it helps to break it down. Think of it like a pizza, where different companies get a slice for their part in making a sale happen. Every time you process a credit card payment, this "pizza" gets divided up. Understanding who gets which slice shows you exactly where your money is going.

This simple breakdown cuts right through the jargon and reveals the different costs bundled into that single charge you see.

The Largest Slice: Interchange Fees

The biggest piece of the pie, almost always, is the interchange fee. This slice is collected by the bank that issued the credit card to your customer—think of the big names like Chase, Capital One, or Bank of America.

So, why do they get the largest share? It boils down to two main things:

- Risk: They are the ones taking on the financial risk of the transaction. If a payment turns out to be fraudulent, the issuing bank is usually the one left holding the bag.

- Rewards: This fee also funds all those popular rewards programs that get people to use their cards. We're talking cashback offers, airline miles, and point systems.

That’s why when a customer pays with a premium rewards card, the interchange fee is often higher—it has to cover the cost of those great perks. This part of the fee is non-negotiable and is set by the card networks themselves.

The Smallest Slice: Assessment Fees

Next up is the assessment fee, which is a much smaller slice of our pizza. This little piece goes directly to the card networks, like Visa, Mastercard, or American Express.

This is what they charge for letting you use their incredibly secure and reliable payment systems. The assessment fee covers the massive costs of operating and maintaining their global networks, which process trillions of dollars in transactions every year. It’s a tiny percentage, but it adds up quickly and keeps the entire system stable for everyone.

For those in specific fields, understanding all related costs is vital; you can explore a breakdown of typical estate sale fees to see how these fit into a broader business model.

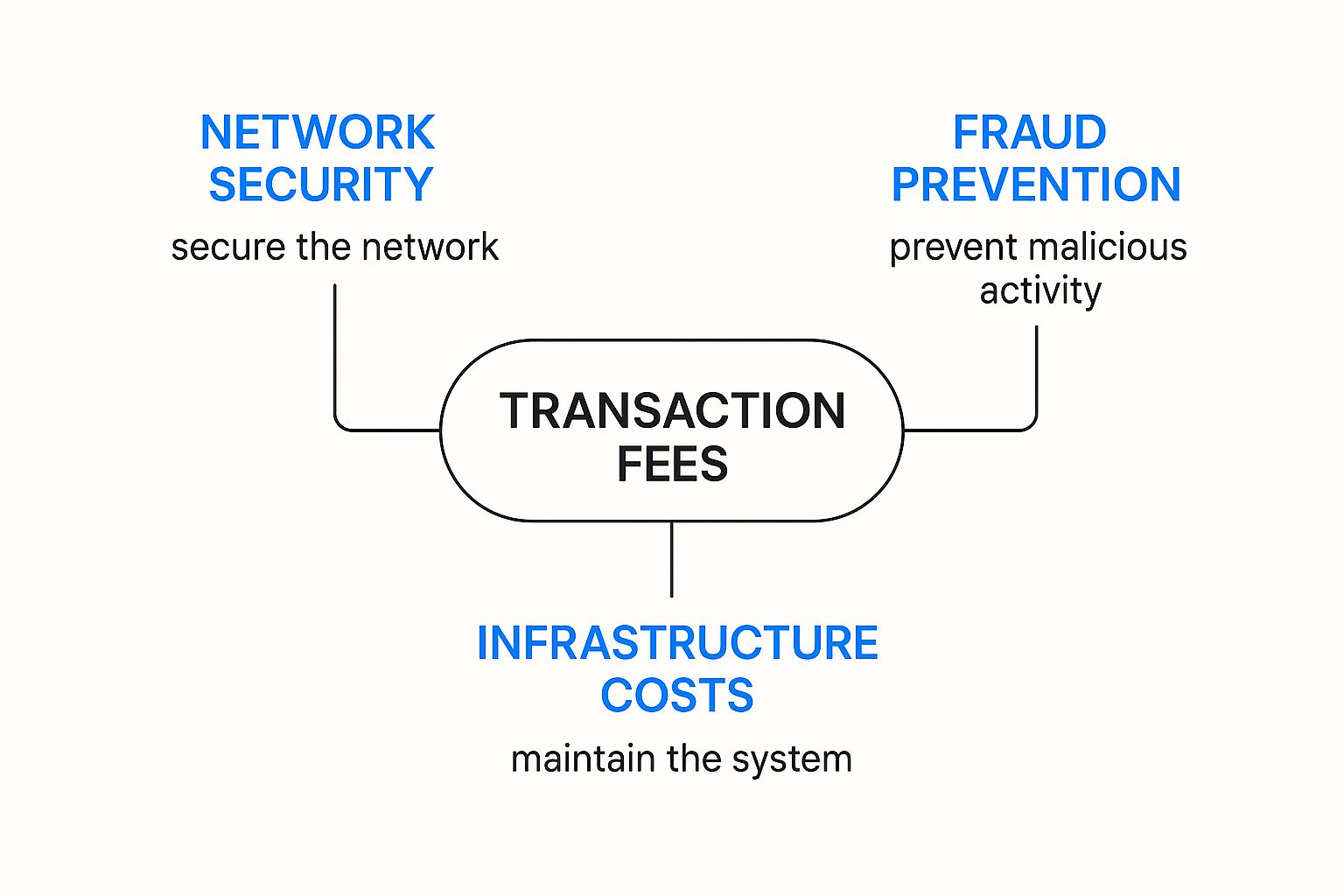

This concept map shows how these fees are essential to the core functions of the payment world, including network security, infrastructure costs, and fraud prevention.

As you can see, each component is a necessary expense to make sure our digital payments are fast, reliable, and safe from any threats.

The Final Slice: Processor Markups

The last slice belongs to your payment processor—the company that actually handles the transaction for you, like Square or Stripe. This is known as the processor markup. It's their charge for giving you the technology and service that connects you to the card networks and banks.

A processor's markup is the only part of the transaction fee that is negotiable. It represents their profit margin and covers the services they provide, including customer support, payment gateways, and reporting tools.

When you put these three slices together, you get the final fee you pay. All-in, transaction fees typically range from 1.5% to 3.5% of the sale amount. To give you a real-world example, Visa's interchange fees can range from 1.15% + $0.05 to 2.40% + $0.10, while network assessment fees are around 0.14%—and that’s all before the processor adds their own markup.

How Processors Calculate Your Fees

Now that we've broken down a transaction fee into its three parts, the next big question is how your processor actually bills you. They don't just pass along the raw costs from the banks and card brands. Instead, they use a specific pricing model to bundle everything together.

This is a really important detail. The model your processor uses can dramatically change what you pay for the exact same sale.

Imagine you and another seller both sell an identical item for $100. You could easily end up paying completely different fee amounts, simply because your processors calculate the final bill differently. Getting a handle on these models is the key to finding a fair deal and making sure you're not overpaying for payment processing for small business operations.

There are three main ways processors do this: Interchange-Plus, Tiered, and Flat-Rate pricing. Each one has its own logic, along with its own set of pros and cons.

Interchange-Plus Pricing

Often called the most transparent model, Interchange-Plus (or Cost-Plus) keeps the wholesale costs separate from the processor's markup. Your processor passes the true interchange and assessment fees directly to you, then adds their own fixed fee on top. It’s clean and simple.

The beauty of this structure is that you can see exactly what you're paying for. You know what portion goes to the banks and card networks and what the processor is keeping for themselves.

- Example: On a $100 sale with a 1.8% interchange rate and a $0.10 assessment fee, an Interchange-Plus model with a 0.3% + $0.15 markup would look like this:

- Wholesale Cost: (1.8% of $100) + $0.10 = $1.90

- Processor Markup: (0.3% of $100) + $0.15 = $0.45

- Total Fee: $1.90 + $0.45 = $2.35

Tiered Pricing

With Tiered pricing, the processor takes the hundreds of different interchange rates and groups them into a few simple "tiers." These are usually labeled something like Qualified, Mid-Qualified, and Non-Qualified, each with its own set rate.

A standard debit card transaction might fall into the cheapest "Qualified" tier, while an online payment made with a premium rewards card often lands in the most expensive "Non-Qualified" tier.

The biggest issue here is the lack of transparency. The processor decides which transactions fall into which tier, and they often push more of them into the higher-cost categories. This can inflate your costs without you ever knowing why.

A Tiered model looks simple on your statement, but it often hides the true cost of a transaction. This makes it tough for sellers to know if they're actually getting a competitive rate.

- Example: For that same $100 sale, if the processor puts it in a Mid-Qualified tier with a 2.6% + $0.20 rate, the total fee suddenly jumps to $2.80.

Flat-Rate Pricing

Flat-Rate pricing is the simplest model of all. Processors like Stripe and Square made this famous by charging one single, predictable percentage and a per-transaction fee for every single sale, no matter what kind of card is used.

You always know exactly what you're going to pay, which is fantastic for budgeting. The trade-off is that this simplicity often comes at a higher overall cost, especially if you process a lot of low-cost debit card transactions. For a better sense of how different platforms stack up, it helps to check out a detailed payment gateway fees comparison.

- Example: If a flat-rate processor charges 2.9% + $0.30, that $100 sale will always cost you $3.20, period.

Choosing the right payment processor often comes down to understanding which of these pricing models best fits your business. Here's a quick breakdown to help you compare them at a glance.

Comparing Payment Processing Pricing Models

This table analyzes the three main pricing models to help merchants understand their options.

| Pricing Model | Best For | Pros | Cons |

|---|---|---|---|

| Interchange-Plus | Businesses with high volume or those seeking full transparency. | Most transparent; often the lowest cost for established businesses. | Can have complex statements; requires more analysis to understand. |

| Tiered | Businesses that prefer simplified statements over cost savings. | Easy-to-read statements with just a few rates. | Lacks transparency; often leads to higher, unpredictable costs. |

| Flat-Rate | New or small businesses, or those with low average transaction values. | Extremely predictable and simple; great for budgeting. | Can be the most expensive option, especially for larger businesses. |

As you can see, the "best" model really depends on your sales volume, average ticket size, and how much complexity you're willing to manage. For many growing businesses, the transparency of Interchange-Plus provides the most value, while new sellers often appreciate the straightforward nature of Flat-Rate pricing.

Why Some Transactions Cost More Than Others

Ever look at your sales report and notice the transaction fees aren't always the same, even for sales of the exact same amount? It’s not a mistake. The simple truth is that payment processors see every transaction differently, and it almost always boils down to one thing: risk.

Think of it like this: the higher the chance of something going wrong with a payment, the higher the fee to cover that potential headache. The system automatically prices in the level of security it has for each transaction, which is why your costs can fluctuate.

Card Present vs. Card Not Present

One of the biggest factors is whether a customer’s physical credit card is in the room when the sale happens. This splits transactions into two main buckets, and the difference directly hits your bottom line.

-

Card-Present Transactions: This is what happens at a typical retail store when a customer taps, swipes, or inserts their card into a terminal. Because the card and the customer are physically there, the risk of fraud plummets. That security means you get a lower transaction fee.

-

Card-Not-Present (CNP) Transactions: This is the world of online sales. It includes every online estate sale purchase, phone order, or any time you have to manually key in a card number. Since the physical card isn't there to verify, the risk of a fraudulent purchase skyrockets. Processors charge you a higher fee to offset that danger.

This is exactly why an online estate sale purchase will almost always have a higher transaction fee than an in-person one. If you want to dive deeper, understanding the different levels of what is fraud protection can shed more light on why these costs vary so much.

The core principle is simple: The less secure the transaction method, the more it will cost to process. This fee acts as a form of insurance for the bank that issues the card.

Debit Cards vs. Premium Credit Cards

The type of card a customer pulls out of their wallet also plays a huge role. A standard debit card is just about the cheapest to process. It’s a low-risk event because the money is pulled directly from a person’s bank account.

On the other hand, you have premium rewards cards, business cards, and corporate cards. These all come with much higher interchange fees. The banks that issue these cards have to pay for all the fancy perks they offer—cashback, travel points, airport lounge access—and they pass that cost right on to you, the seller, as a higher processing fee.

Merchant Category and Business Type

Finally, your specific type of business can influence your rates. Different industries carry different risk profiles and have different average sale amounts, which all leads to unique fee schedules.

Grocery stores, for example, often get lower interchange rates because their profit margins are so thin and their sales volume is massive. The mix of credit vs. debit cards used in any given industry also plays a big part in the effective costs for sellers. You can see just how much these fees vary across different industries and even countries on kansascityfed.org.

By getting a handle on these key variables—risk, card type, and your industry—you can start to get a much clearer picture of your costs and make smarter decisions for your sales.

A Global View of Transaction Costs

It’s easy to think of transaction fees as just a local issue, but they're a fundamental piece of the massive global financial system. The moment a payment has to cross a border, things get a lot more complicated—and usually, a lot more expensive.

Think of it this way: a domestic payment is like a direct flight. But an international payment is a multi-leg journey with several layovers. Your money has to pass through a correspondent banking network, where a chain of intermediary banks each takes a small cut for helping it along its way. Each "layover" adds time and cost to the final amount.

The Hidden Costs of International Payments

On top of those intermediary bank fees, there are a couple of other major costs that drive up the price of sending money abroad. Getting a handle on these is key to seeing the whole picture.

- Currency Conversion Markups: When you convert dollars to euros, for example, banks and payment processors almost never give you the real exchange rate. They add a markup, which is basically a hidden fee baked right into the rate they offer you.

- Remittance Fees: These are the specific charges for sending money to people in other countries, often to support family. These fees can be surprisingly high and take a significant bite out of the money people are sending home to loved ones.

All these extra layers mean that a simple international business deal or a family remittance ends up costing far more than a sale you make down the street.

Globally, cross-border business-to-business (B2B) transaction fees often range from 1% to 3% for large corporations but can shoot past 5% for small businesses. Remittance costs are also steep, with the global average fee to send $200 standing at 6.2% in 2023—more than double the United Nations' target of 3%. You can find more insights on these global remittance prices on worldbank.org.

Looking Ahead to a Flatter World

So why does this matter to you? Understanding this bigger picture helps connect your local experience with transaction fees to a much larger international system.

The high costs of moving money across borders have actually sparked a ton of innovation in financial technology. New companies are building systems to bypass the old correspondent banks, aiming to make international payments faster, cheaper, and more transparent. By seeing what drives global transaction fees today, you're better equipped to understand the changes that will shape how we all do business tomorrow.

Actionable Ways to Cut Down Your Transaction Fees

Alright, so you know what transaction fees are. That's step one. The next—and more important—step is actually taking control of them. While you can't just wish these costs away when you accept electronic payments, you absolutely can manage and reduce them.

A few smart moves can go a long way in protecting your profit margins and making sure you aren't leaving money on the table.

The most direct route? Negotiate with your processor. This works especially well if you’re on an Interchange-Plus pricing model where the processor’s markup is crystal clear. If your sales have been growing, you have real leverage.

Get on the phone with your provider, have your recent processing statements in hand, and ask for a rate review. More often than not, they’d rather trim their markup than watch you walk over to a competitor.

Nudge Customers Toward Lower-Cost Payment Methods

Another powerful strategy is to gently guide your customers toward the payment options that are cheaper for you to accept. The cost difference between payment types can be surprisingly large, and small shifts in customer behavior can add up to big savings over time.

- Promote Debit Cards Over Credit Cards: Debit card transactions almost always have lower interchange fees because they’re seen as less risky. A simple question like "Debit or credit?" at checkout can be enough to encourage the better choice for your bottom line.

- Offer ACH Transfers: If you handle larger B2B sales or recurring invoices, Automated Clearing House (ACH) transfers are a game-changer. These are direct bank-to-bank payments that come with tiny fixed fees. Compare that to a percentage-based credit card fee on a huge sale, and the savings become obvious.

- Consider Surcharging (Where It’s Allowed): Some businesses pass a small fee to customers who opt to pay with a credit card. This is called surcharging, but be careful—it’s regulated by state laws and the card networks themselves. It can definitely offset your costs, but you have to be sure you're fully compliant and that it won't sour the experience for your customers.

The Bottom Line: The single most impactful thing you can do is get in the habit of reviewing your monthly processing statements. Hunt for hidden fees, calculate your real effective rate, and never be afraid to shop your business around to get a better deal from another processor.

Common Questions About Transaction Fees

Even after you get the hang of the basics, a few specific questions about transaction fees always seem to pop up. Let's tackle some of the most common ones head-on so you can handle your payment processing with confidence.

Are Transaction Fees Tax Deductible?

Yes, for the most part. Since these fees are a direct cost of running your business and accepting payments, they are generally tax-deductible as an operating expense.

Of course, every financial situation is unique. It's always a smart move to chat with your tax professional to see exactly how this applies to your business.

Is It Possible to Avoid Fees Completely?

The short answer is no, not if you want to accept credit or debit cards. But you can absolutely minimize them.

You can steer customers toward lower-cost payment methods like direct ACH bank transfers or even cash. These options can significantly reduce the total amount you pay in fees.

The convenience of accepting electronic payments often boosts sales enough to easily outweigh the associated fees. For most businesses, it's a worthwhile trade-off.

Why Do American Express Fees Cost More?

It all comes down to their business model. American Express runs on what's known as a "closed-loop" network.

This just means they wear all the hats—they're the card issuer, the payment network, and the acquiring bank all rolled into one. This total control allows them to set their own rates, which are often a bit higher to support their brand and access a customer base known for higher spending.