8 Best Estate Liquidation Options for 2025: A Complete Guide

Settling an estate is a complex journey, often filled with emotional and logistical challenges. One of the most significant tasks is deciding how to handle personal property, a process known as estate liquidation. The choices can feel overwhelming, ranging from hiring a full-service company to managing the entire process yourself. The right path depends entirely on your unique circumstances, including the size and location of the estate, the value and type of items involved, your available time, and your ultimate financial goals.

This guide is designed to demystify the process by providing a comprehensive, in-depth look at the top eight estate liquidation options. We will move beyond surface-level descriptions to offer a transparent, practical comparison of each method. You will gain actionable insights into critical factors such as:

- Potential Timelines: How long does each process typically take from start to finish?

- Associated Costs & Commissions: What fees can you expect to pay, and how do they impact your net proceeds?

- Pros and Cons: A balanced look at the advantages and disadvantages of every option.

- Best-Fit Scenarios: Understanding which method aligns best with specific types of estates and personal goals.

Our goal is to equip you with the detailed knowledge necessary to make an informed, confident decision. By understanding the distinct differences between hiring an estate sale company, consigning with an auction house, selling directly to a dealer, or managing a DIY sale, you can choose a strategy that honors your loved one's legacy while maximizing the estate's value and minimizing your personal stress. Let's explore the paths available to you.

1. Estate Sale Company

Hiring an estate sale company is one of the most comprehensive and hands-off estate liquidation options available. This full-service approach involves a professional team managing the entire process of selling an estate's contents directly from the home. It's an ideal choice for executors, families, or individuals who lack the time, expertise, or emotional capacity to handle the daunting task of liquidating a household's worth of possessions.

How It Works

An estate sale company takes charge from start to finish. Their services typically include sorting and organizing every item, from furniture and fine art to everyday kitchenware. They then research, appraise, and price each piece to maximize its market value. The company handles all marketing, including professional photography, online listings on platforms like EstateSales.net, and local advertising to attract a large number of potential buyers. Over a 2-3 day period, they staff and conduct the public sale on-site, managing all transactions and crowd control.

Pros and Cons

The primary advantage is convenience. Professionals handle the labor-intensive and emotionally taxing work for you. Their expertise in pricing and marketing often leads to higher overall returns than a DIY sale might achieve.

However, the main drawback is the cost. These companies work on commission, typically taking a percentage of the gross sales. It's crucial to understand their fee structure, as some may also charge for additional services like clean-out or trash hauling for unsold items.

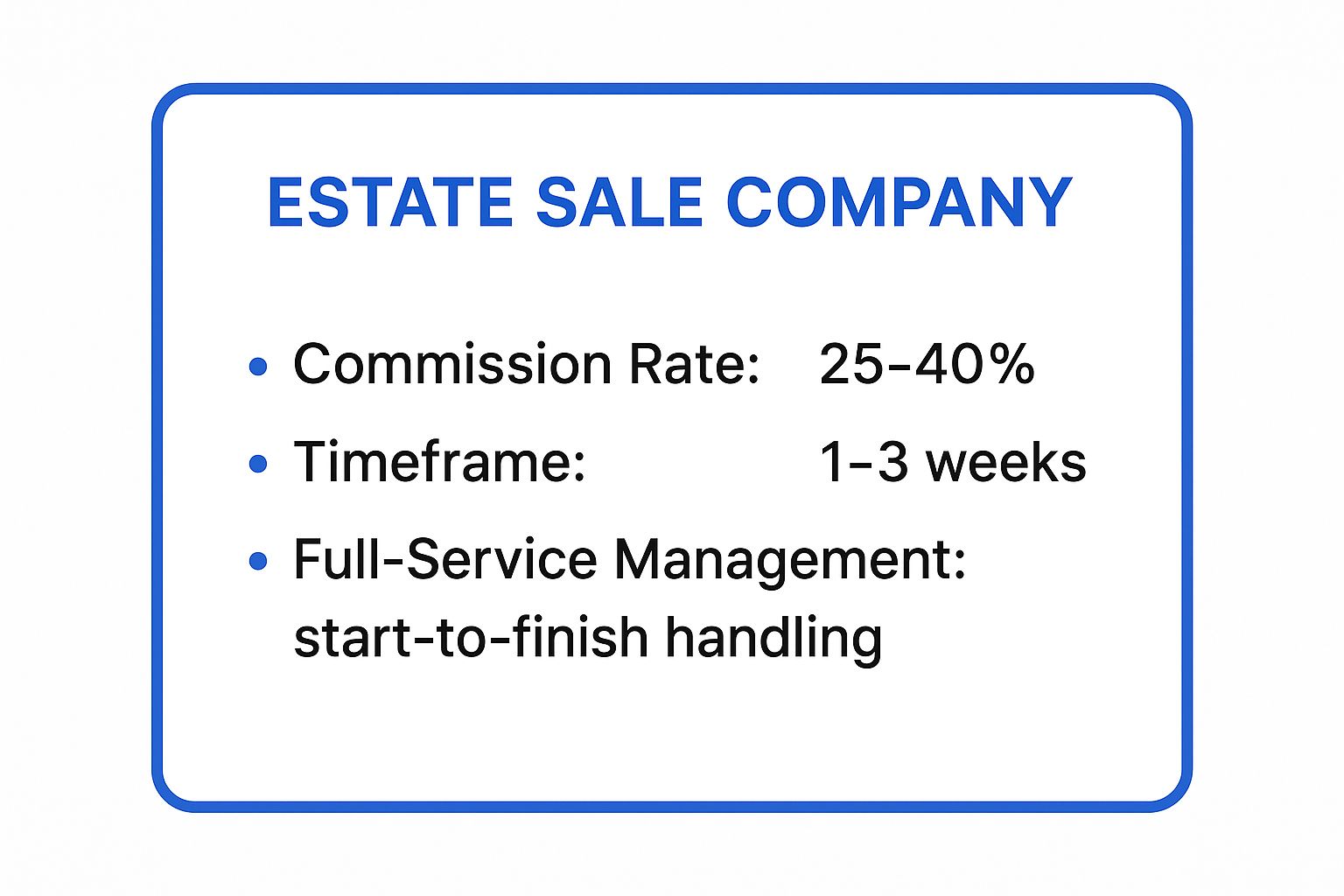

To help you quickly assess this option, the following summary box highlights the key data points for a typical estate sale company engagement.

This quick reference shows that while you trade a commission fee for convenience, the process is relatively fast and completely managed by professionals.

Actionable Tips for Success

- Vet Thoroughly: Interview at least three different companies. Ask for references, proof of insurance, and examples of past sales. To find reputable services in your area, you can learn more about the best estate sale companies on diyauctions.com.

- Clarify the Contract: Ensure your contract clearly outlines the commission rate, any flat fees, payment schedule, and what happens to items that don't sell.

- Secure Valuables: Before the company begins sorting, remove any personal items you intend to keep, including important documents, family heirlooms, and photos.

2. Auction House Consignment

For estates containing high-value items like fine art, rare antiques, jewelry, or significant collections, partnering with an auction house is a premier estate liquidation option. This method involves consigning specific assets to a professional auction firm, which then sells them to a global network of collectors and buyers through competitive bidding. It is the best choice for maximizing returns on individual, high-demand pieces rather than liquidating an entire household's contents.

How It Works

The process begins with an appraisal from the auction house to determine if your items meet their value and category requirements. Prestigious houses like Sotheby's focus on fine art, while others like Heritage Auctions specialize in collectibles. Once accepted, you sign a consignment agreement outlining fees and terms. The auction house then professionally photographs, catalogs, and markets your items to its established client base. The items are sold during a live or online auction event, where competitive bidding drives the final price.

Pros and Cons

The greatest advantage is access to a targeted, high-end market. Auction houses attract serious collectors willing to pay top dollar, often resulting in prices that far exceed estate sale estimates. Their expertise in authentication and marketing adds significant value and credibility.

The primary drawback is selectivity and higher costs. Auction houses are discerning and will not accept everyday household goods. Their commission rates, known as the "seller's premium," can be substantial, and they may also charge for insurance, photography, and cataloging. The process can also be much slower than an estate sale, depending on the auction schedule.

Actionable Tips for Success

- Research Specializations: Match your items to the right auction house. A firm specializing in 20th-century modern art will be a better fit for a Warhol print than one known for antique furniture.

- Understand All Fees: Carefully review the consignment contract. Clarify the commission structure, any "buy-in" fees if an item doesn't sell, and costs for insurance or shipping. For high-value consignments, these rates are often negotiable.

- Document Everything: Before handing over your items, take detailed photos and keep copies of all appraisal and consignment paperwork for your records. This is crucial for both insurance and accounting purposes.

3. Online Marketplace Sales

Selling items individually through online marketplaces is a powerful estate liquidation option for those willing to invest the time and effort. This DIY approach involves listing items on platforms like eBay, Facebook Marketplace, and others to reach a vast audience of potential buyers. It's best suited for executors or family members who are tech-savvy, have the time to manage listings and shipping, and want to maximize the sale price of individual items.

How It Works

This method requires you to act as the seller for each item. You will be responsible for taking high-quality photos, researching comparable sales to set competitive prices, and writing detailed, honest descriptions. Each item is then listed on the most appropriate platform; for instance, eBay is excellent for collectibles and shippable goods, while Facebook Marketplace is ideal for larger furniture and local pickup items.

Once an item sells, you must manage payment processing and coordinate either local pickup or the complex tasks of packing and shipping. This process is repeated for every item you wish to sell from the estate, turning the liquidation into a series of individual transactions rather than a single event.

Pros and Cons

The greatest advantage is profit potential. By selling directly to the end buyer, you cut out the middleman and can often achieve higher prices for desirable items, especially niche collectibles or antiques. You also maintain complete control over the pricing and sales process.

The significant drawback is the immense time and labor commitment. Photographing, listing, and shipping dozens or hundreds of items is a massive undertaking. There are also platform fees, payment processing costs, and shipping expenses to consider, which can eat into your profits. Managing communications with multiple buyers can also be overwhelming.

Actionable Tips for Success

- Match Item to Platform: List items where they are most likely to sell. Use eBay for collectibles with a global audience, Facebook Marketplace for local furniture sales, and specialized sites like Ruby Lane for high-end antiques.

- Master Photography and Descriptions: Invest in good lighting to take clear, appealing photos from multiple angles. Write detailed, transparent descriptions that mention any flaws or damage to build trust and avoid disputes.

- Research "Sold" Listings: Don't just look at what items are listed for; research the "sold" or "completed" listings on platforms like eBay to see what buyers are actually paying. This is the most accurate way to price competitively.

- Batch Your Workflow: To make the process more efficient, group similar tasks together. Dedicate specific days to photography, others to writing listings, and set aside time blocks for packing and shipping.

4. Antique Dealer Direct Sales

Selling directly to an antique dealer or specialty collector is one of the fastest estate liquidation options for specific, high-demand items. This method involves identifying experts who purchase items outright for their own inventory or collections. It is an excellent choice for estates with notable collections, such as rare books, vintage jewelry, coins, or period furniture, where a targeted sale can yield immediate payment.

How It Works

This process begins by identifying and grouping similar valuable items from the estate. You would then research and contact dealers who specialize in those categories, such as numismatists for coin collections or horologists for antique clocks. After you initiate contact, the dealer will typically schedule an appointment to inspect the items in person. They will assess authenticity, condition, and rarity before making a cash offer based on wholesale value, which is the price they are willing to pay to resell the items at a profit. If you accept the offer, payment is usually immediate, and the dealer arranges for the items' removal.

Pros and Cons

The most significant advantage is speed and simplicity. You can liquidate valuable assets quickly, receive immediate payment, and avoid the complexities of a public sale. Dealing with an expert also means you are selling to someone who truly understands the item's worth and history.

The primary trade-off is the price. Dealers buy at wholesale, not retail, so their offers will be lower than what you might get from an end-user at an auction or estate sale. This method is also only suitable for specific categories of items and isn't a solution for liquidating an entire household of general goods.

Actionable Tips for Success

- Get Multiple Quotes: Never accept the first offer. Contact at least two or three different dealers specializing in your items to compare their valuations and ensure you receive a fair market price.

- Research First: Before meeting with a dealer, do some preliminary research on your items. Knowing a bit about their potential value gives you a stronger negotiating position. You can explore online marketplaces to see what similar items are selling for.

- Negotiate Terms: Beyond price, clarify payment terms and who is responsible for packing and transporting the items. Ensure these details are agreed upon before finalizing the sale. For more insights on finding the right buyers, you can learn about where to sell antiques online on diyauctions.com.

5. Charitable Donation with Tax Benefits

Opting for charitable donation is an estate liquidation option that offers both a philanthropic and financial benefit. This approach involves giving an estate's contents to qualified non-profit organizations. It's an excellent choice for estates where items have modest resale value, when the timeline is short, or when the family wishes to support a cause they care about while potentially receiving a valuable tax deduction.

How It Works

The process begins by identifying qualified 501(c)(3) organizations that align with the estate's values or the types of items available. For general household goods, organizations like Goodwill Industries or The Salvation Army are common choices. For more specific items, you might contact a Habitat for Humanity ReStore for furniture and building materials, a local library for a book collection, or even a museum for items of historical significance. You then arrange for the items to be picked up or dropped off, ensuring you receive an official donation receipt from the charity. This receipt is the key document for claiming a tax deduction.

Pros and Cons

The main advantage is the dual benefit of supporting a good cause and gaining a tax advantage. This method can also be one of the fastest ways to clear out a home, especially if a charity offers a bulk pickup service. It simplifies the liquidation process significantly.

The primary drawback is that you receive no direct cash payment for the items. The financial benefit is indirect, realized only when you file taxes, and its value depends on your tax bracket. Furthermore, the IRS has strict rules for documentation and valuation, especially for non-cash donations exceeding $500 in value.

Actionable Tips for Success

- Verify Charity Status: Before donating, confirm the organization is a qualified 501(c)(3) entity using the IRS's Tax Exempt Organization Search tool. Only donations to qualified charities are tax-deductible.

- Document Everything: For donations over $500, you must file IRS Form 8283. For items or groups of similar items valued over $5,000, a formal written appraisal from a qualified appraiser is typically required. Keep detailed records and photos of what you donated.

- Get a Proper Receipt: Do not leave without a receipt. Ensure it is dated and includes the charity's name and address. For items of value, the charity is not allowed to assign a value; that is your responsibility as the donor.

6. Family Distribution and Negotiation

Distributing items among family members is one of the most personal and emotionally significant estate liquidation options. This method prioritizes keeping heirlooms and sentimental possessions within the family, bypassing sales commissions and public processes. It focuses on equitable, rather than purely financial, value and can be a meaningful way to honor a loved one's legacy. However, it requires careful planning and communication to prevent disputes.

How It Works

The core of this approach is a structured process for dividing assets. Families first create a comprehensive inventory of the estate's contents, often with photos and descriptions. From there, they agree on a fair method for selection. Common strategies include a "draft" or rotating selection process, where heirs take turns choosing items. Another approach involves using an appraiser to assign monetary values, allowing heirs to select items up to an equal total value. For geographically dispersed families, a digital catalog can facilitate remote participation.

Pros and Cons

The greatest advantage is legacy preservation. This method ensures that cherished items with sentimental value stay with the people who appreciate them most. It also completely avoids the costs associated with commissions or fees from sale companies.

The significant drawback is the high potential for family conflict. Disagreements over who gets what can strain relationships if not handled delicately. The process can also be time-consuming and emotionally draining, especially when family members have different attachments to items.

Actionable Tips for Success

- Establish Ground Rules First: Before anyone claims an item, agree on the process. Decide if you will use a rotating draft, an appraisal-based system, or another method. Put the rules in writing.

- Create a Visual Inventory: Use a shared photo album or a simple spreadsheet with pictures of every significant item. This creates a transparent, accessible catalog that everyone can review before the distribution process begins.

- Consider a Neutral Facilitator: For large estates or families with complex dynamics, hiring a professional mediator or an impartial third party can help enforce the rules and navigate difficult conversations, ensuring the process remains fair.

- Document Everything: Once the distribution is complete, create a signed document listing who received which major items. This record is crucial for transparency and can be important for legal and tax purposes later on.

7. Professional Appraisal and Selective Sales

A professional appraisal combined with selective sales is a strategic, hybrid approach to estate liquidation. Instead of selling everything through one channel, this method involves first identifying the most valuable items through expert evaluation. These high-value pieces are then sold through specialized channels, while lower-value items are liquidated using more general methods. This is an excellent choice for estates that may contain hidden gems like fine art, antiques, or rare collectibles.

How It Works

The process begins by hiring a certified appraiser with expertise relevant to the estate's contents, such as a numismatist for coins or a gemologist for jewelry. The appraiser assesses items and provides a formal valuation report, which identifies pieces that warrant a more targeted sales approach. Based on this information, you can direct specific items to the most profitable venues. For example, a rare first-edition book might be sold through a specialized literary auction house, while antique furniture could be placed with a high-end consignment shop. The remaining household goods can then be sold through an estate sale, online marketplace, or donated.

Pros and Cons

The primary advantage is value maximization. By matching valuable items with the right market, you can achieve significantly higher prices than a general estate sale would yield. This targeted strategy ensures you don't unknowingly sell a precious asset for a fraction of its worth.

The main drawback is the upfront cost and complexity. Professional appraisals are not free, and their fees must be factored into the budget. The process is also more hands-on, requiring you to coordinate with multiple experts and sales channels, which adds time and organizational effort to the liquidation.

Actionable Tips for Success

- Hire Certified Experts: Always choose appraisers certified by reputable organizations like the American Society of Appraisers (ASA) or the International Society of Appraisers (ISA). Verify their specific area of expertise aligns with your items.

- Understand Appraisal Types: Clarify whether you need a Fair Market Value appraisal (for sales), a replacement value appraisal (for insurance), or a different type. The purpose dictates the valuation approach.

- Leverage the Appraisal Report: Use the detailed information in the appraisal not just for pricing, but also to write compelling descriptions when selling items through auction houses or private dealers.

- Get Multiple Opinions: For items suspected to be extremely valuable, consider getting a second or even third appraisal. A small investment here could lead to a substantial difference in the final sale price.

8. DIY Estate Sale

Organizing a Do-It-Yourself (DIY) estate sale is a hands-on approach where the family or executor manages the entire liquidation process without hiring a professional company. This method offers complete control and is a popular choice for smaller estates, or for those who have the time, energy, and organizational skills to handle the significant workload involved. It's essentially an expanded, more structured version of a garage sale, encompassing the entire contents of a home.

How It Works

A DIY estate sale requires you to personally handle every task. This includes sorting through all possessions, cleaning them for presentation, and researching comparable items online or in antique stores to set appropriate prices. You are responsible for staging the home by organizing items into categories and creating an intuitive shopping flow for buyers.

You will also manage all marketing efforts, such as placing ads on Craigslist, Facebook Marketplace, and in local newspapers. During the sale, which typically runs for a weekend, you'll need to handle customer inquiries, negotiate prices, process payments (cash and digital), and ensure the property is secure.

Pros and Cons

The most significant advantage is financial. By cutting out the middleman, you keep 100% of the sales proceeds, avoiding the 30-50% commission charged by professional firms. This can make a substantial difference in the net return. You also maintain complete control over pricing and which items are sold.

However, the primary disadvantage is the immense time and labor required. The process can be physically exhausting and emotionally draining, especially when dealing with a loved one's possessions. There's also a risk of underpricing valuable items without expert knowledge, potentially leaving money on the table.

Actionable Tips for Success

- Price Everything: Research comparable sales on eBay, Etsy, and Facebook Marketplace to price items accurately. Attach a clear price tag to every single item to avoid constant interruptions and facilitate smooth transactions.

- Organize and Stage: Group similar items together, like all kitchenware in the kitchen and all tools in the garage. Display items neatly on tables and shelves to create an appealing, store-like environment.

- Advertise Strategically: Start advertising at least a week in advance. Use clear photos of your best items in online posts and place directional signs throughout the neighborhood on sale days.

- Plan Sale Logistics: Recruit family and friends to help manage different rooms, watch for theft, and handle payments. Have a cash box with plenty of small bills and coins for change, and consider using a service like Venmo or PayPal for digital payments.

- Have a Post-Sale Plan: Decide beforehand what you will do with unsold items. Arrange for a charity to pick them up, or have a junk removal service scheduled for the day after the sale concludes.

Estate Liquidation Methods Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Estate Sale Company | Medium - Professional handling, multi-day on-site | High - Requires expert staff, marketing, security | High revenue potential, quick liquidation (1-3 weeks) | Large estates, families wanting full-service management | Expert pricing, minimal executor effort, full logistics |

| Auction House Consignment | High - Professional appraisal, cataloging, event coordination | Medium to High - Appraisals, marketing, auction fees | Potentially highest prices via competitive bidding | High-value antiques, art, collectibles with strong demand | Access to serious collectors, professional marketing |

| Online Marketplace Sales | High - Time-intensive listing, communication, shipping | Low to Medium - Photography, packaging, online skills | Variable; can achieve high prices but slow (3-12 months) | Unique items, collectibles, families with time to invest | Full pricing control, broad reach, no commissions on some platforms |

| Antique Dealer Direct Sales | Low - Direct negotiation and sale | Low - Dealer evaluations and negotiations | Quick sale but usually at wholesale prices | Quick liquidation, dealer-specialty items | Immediate payment, no staging/marketing, easy logistics |

| Charitable Donation with Tax Benefits | Low - Item donation and paperwork | Low - Documentation and possible appraisal | No cash return, tax deduction varies | Items with modest value, quick disposal, charitable intent | Tax savings, supports charity, minimal effort |

| Family Distribution & Negotiation | Medium - Requires organization, communication | Low to Medium - Inventory and mediation efforts | Keeps meaningful items, risk of disputes | Families prioritizing heirlooms and sentimental items | No commissions, preserves heritage, promotes family bonding |

| Professional Appraisal & Selective Sales | Medium - Appraisal coordination plus sale planning | Medium - Fees for appraisals plus sales effort | Maximizes value, informs sale strategy | Estates with potentially valuable items | Identifies hidden value, professional documentation |

| DIY Estate Sale | High - Complete self-management including marketing | Medium - Time, marketing, security support | Full proceeds but may get lower prices (4-9 weeks) | Families with time and effort capacity, moderate-value estates | Keeps all profits, full control, personal buyer interaction |

Choosing Your Best-Fit Liquidation Strategy

Navigating the landscape of estate liquidation can feel like charting a course through unfamiliar territory. You began this journey likely facing a mountain of possessions and a sea of questions. After exploring the distinct pathways available, from the comprehensive service of an estate sale company to the targeted approach of a direct sale to an antique dealer, it's clear there is no single "correct" answer. The most effective solution is rarely a single choice but rather a carefully crafted, multi-pronged strategy tailored to the unique assets, timeline, and emotional needs of your specific situation.

The power lies not in selecting one option, but in understanding how to blend them. Your journey to a successful liquidation is an exercise in strategic decision-making, where a clear assessment of your goals dictates the path forward.

From Theory to Action: Building Your Hybrid Plan

The core takeaway from our deep dive into the various estate liquidation options is that a hybrid model often yields the best results. A successful liquidation is rarely about finding a single "magic bullet" solution. Instead, it’s about assembling a customized toolkit.

Consider this practical, blended approach:

- Step 1: High-Value Triage. Begin by identifying the "crown jewels" of the estate. Is there a signed first-edition book collection, a verified mid-century modern furniture set, or a portfolio of fine art? These items are prime candidates for Auction House Consignment or a Professional Appraisal followed by a Selective Sale, where their specific value can be maximized by connecting with the right buyers.

- Step 2: The Core Liquidation. For the vast majority of good-quality household items, furniture, and everyday goods, a professionally managed Estate Sale or a modern Online Marketplace Sale often provides the best balance of efficiency and return. This is the workhorse of your strategy, designed to clear the bulk of the home's contents in a structured, time-bound manner.

- Step 3: The Family Dialogue. Before anything is sold, engage in a structured Family Distribution process. This prevents future conflict and ensures sentimental items find their way to loved ones who will cherish them. Use a clear system, like a lottery or a round-robin draft, to keep the process fair and transparent.

- Step 4: The Final Sweep. After the primary sales and family distribution, you will inevitably have items left over. This is where Charitable Donation becomes an invaluable tool. Not only does it clear the remaining possessions responsibly, but it also provides a potential tax benefit, adding one final layer of financial value to the process.

Key Insight: The most successful liquidators act like project managers, not just sellers. They segment the estate's assets, assign the best-fit liquidation method to each segment, and execute the plan with precision. This transforms a potentially overwhelming task into a series of manageable, strategic steps.

Aligning Your Strategy with Your Primary Goal

Ultimately, your choice of estate liquidation options must align with your primary objective. It's crucial to define what "success" means to you before you begin.

- If Maximizing Profit is Paramount: Your strategy will lean heavily on options that connect you directly with end-buyers and specialized collectors. This means investing time in professional appraisals, considering high-end auction houses, and potentially managing direct-to-consumer sales for certain items to avoid high commission fees.

- If Speed and Simplicity are Your Priority: A full-service estate sale company is often the most direct route. They handle everything from sorting and pricing to marketing and cleanup, allowing you to be hands-off. While their commissions reduce the net profit, the value of their time-saving, stress-reducing service can be immeasurable, especially during a difficult period.

- If Emotional and Logistical Ease is the Goal: A combination of a generous family distribution plan followed by a comprehensive charitable donation can be the least stressful path. This approach prioritizes legacy and goodwill over financial gain and is a perfectly valid and honorable way to settle an estate.

By mastering these concepts, you transform from someone simply "getting rid of stuff" into a strategic executor of an estate plan. This informed approach not only ensures a better financial outcome but also provides a sense of control and confidence during what is often a challenging life transition. You are now equipped with the knowledge to assess your unique inventory, weigh your personal capacity, and select the partners and platforms that will lead you to a successful, respectful, and rewarding conclusion.