Your 2025 Estate Settlement Checklist: 8 Key Steps

Stepping into the role of an executor or administrator for an estate is a significant responsibility, often undertaken during a difficult time. The process can feel overwhelming, with a maze of legal requirements, financial obligations, and emotional complexities. A structured approach is not just helpful; it's essential for ensuring the deceased's wishes are honored, legal pitfalls are avoided, and assets are distributed fairly and efficiently. This guide serves as your comprehensive estate settlement checklist, breaking down the entire journey into eight manageable, chronological steps.

From locating the first crucial document to filing the final accounting, we provide actionable insights, practical examples, and expert tips to empower you. This detailed roadmap is designed for anyone tasked with managing an estate, whether you are a family member, a professional trustee, or a business owner handling liquidation.

We will cover every critical stage, including determining if probate is necessary, notifying all relevant parties, and conducting a thorough inventory of assets. We'll also touch on modern solutions for simplifying the liquidation of personal property, a common and often challenging task within the settlement process. By following this step-by-step checklist, you can navigate your duties with confidence, minimize stress, and bring the estate to a successful and timely close. This article delivers a clear, actionable framework, ensuring you have the knowledge needed to handle the process with precision and care from start to finish.

1. Locate and Secure the Will and Important Documents

The very first action in any estate settlement checklist is locating the foundational legal documents, chief among them being the last will and testament. This document is the legal cornerstone of the entire process; it names the executor, identifies beneficiaries, and dictates how assets should be distributed. Without it, the estate may be declared "intestate," meaning the state's laws will determine asset distribution, a process that is often lengthy, costly, and may not align with the deceased’s wishes.

Beyond the will, you must gather other critical paperwork. This includes death certificates, birth and marriage certificates, Social Security information, bank and investment statements, property deeds, vehicle titles, and insurance policies. These documents are essential for verifying identity, transferring ownership, and closing accounts.

Where to Start Your Search

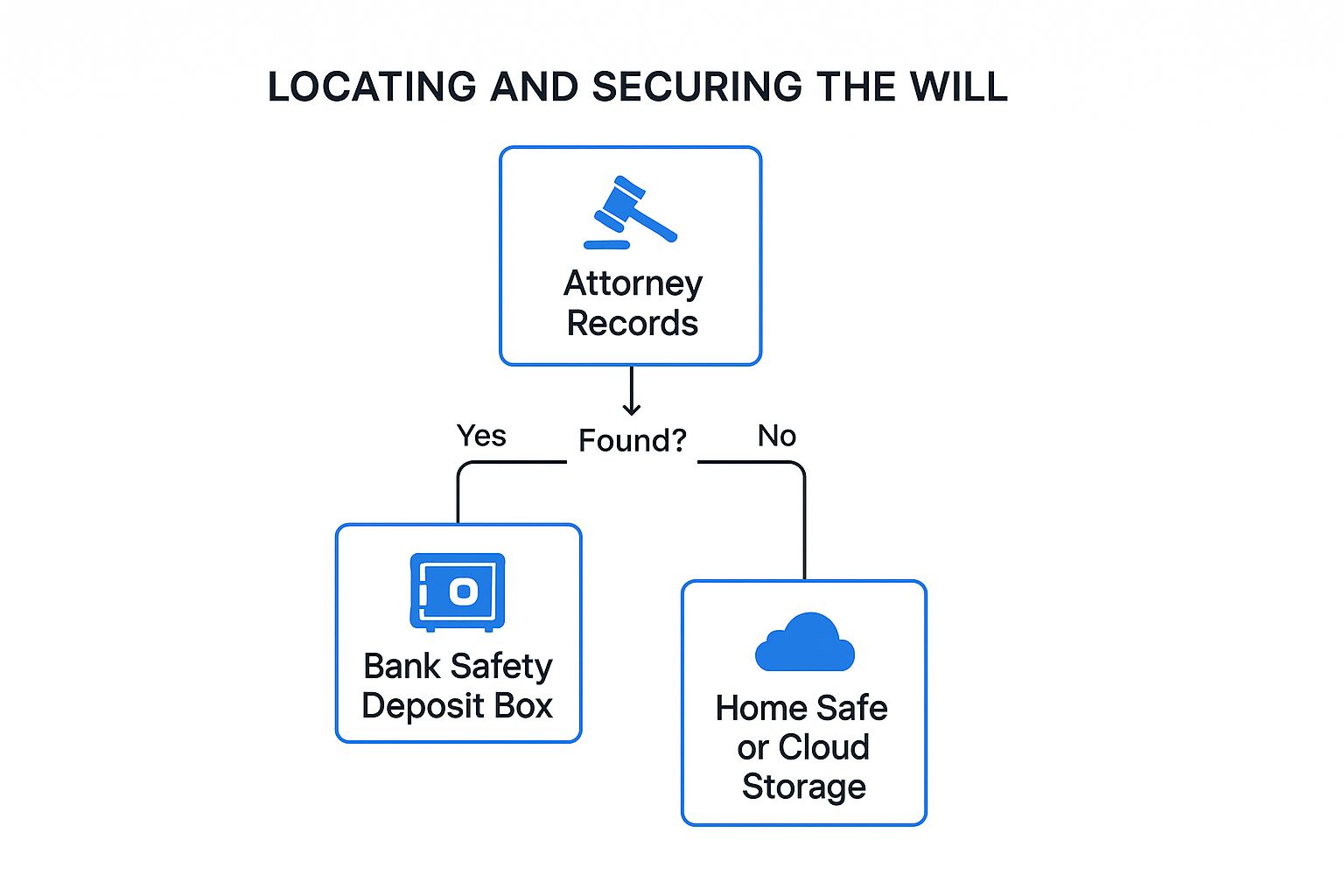

Finding these documents can feel like a scavenger hunt, but there are several common storage locations. The deceased’s attorney is often the first and best point of contact, as they may hold the original will or a copy. Other likely places include a bank safety deposit box, a home safe, or a designated file cabinet. In today's digital world, don't overlook cloud storage accounts or encrypted digital vaults, which may hold scanned copies or digital-only documents.

To streamline your search, follow a logical progression from the most likely to the least common locations. This infographic illustrates a clear decision tree for locating a will.

This systematic approach prevents wasted time and ensures you methodically check the most probable locations before expanding your search.

Actionable Tips for Securing Documents

Once you locate these items, your job is to secure and organize them. Here are a few practical steps:

- Order Multiple Death Certificates: Immediately order 10 to 15 certified copies of the death certificate from the funeral home or vital records office. Financial institutions, government agencies, and insurance companies will each require an official copy.

- Create a Master File: Make photocopies and digital scans of every document. Store the originals in a secure, fireproof location and use the copies for day-to-day work to prevent loss or damage.

- Notify Key Professionals: Contact the deceased’s financial advisor, accountant, and insurance agent. They can often provide statements and policy documents you may not find at home.

2. Determine if Probate is Required

A common misconception is that all estates must go through the formal, court-supervised process known as probate. This critical step in your estate settlement checklist involves determining if probate is legally necessary. This decision hinges on the total value of the estate, the types of assets involved, and specific state laws. Making the right determination can save the estate significant time and money.

When an estate can bypass or use a simplified version of probate, beneficiaries receive their inheritance faster and with fewer legal fees. For example, a modest $150,000 estate in Texas could avoid formal probate by using a small estate affidavit, saving the family around $8,000 in legal fees. Similarly, a $2 million estate held within a revocable living trust can avoid probate entirely, ensuring a private and efficient transfer of assets.

How to Evaluate the Need for Probate

The first step is to categorize the deceased’s assets into two groups: probate and non-probate assets. Non-probate assets transfer directly to a designated person upon death, outside of the will's control and the court's purview. These commonly include life insurance policies with named beneficiaries, retirement accounts (like 401(k)s and IRAs) with beneficiaries, and assets held in a living trust. Property owned as "joint tenants with right of survivorship" also passes directly to the surviving owner.

Once you have isolated the probate assets, you must calculate their total value. Each state has a specific "small estate" threshold. If the total value of probate assets falls below this limit, you can likely use a simplified procedure, such as a small estate affidavit, which is quicker and less expensive than formal probate.

Actionable Tips for Bypassing Probate

Here are practical steps to determine the most efficient path forward for the estate:

- Research State-Specific Thresholds: Investigate your state's laws regarding small estate limits and simplified probate procedures. This information is often available on state court or legislative websites.

- Identify All Beneficiary Designations: Meticulously review all financial accounts, retirement plans, and insurance policies to confirm that beneficiaries are properly named. These assets can be transferred directly without court involvement.

- Consult an Attorney for Complex Cases: If the estate’s value is close to the probate threshold or includes complex assets like a business, seek advice from a probate attorney. A brief consultation can clarify the best course of action and prevent costly mistakes.

3. Apply for Letters Testamentary or Letters of Administration

Once you have the will and other essential documents, the next critical step in the estate settlement checklist is to obtain legal authority to act on behalf of the estate. This authority comes in the form of a court-issued document. If the deceased left a valid will naming an executor, you will apply for Letters Testamentary. If there is no will (an intestate estate), you will petition the court for Letters of Administration, which appoints an administrator.

These documents are not mere formalities; they are the legal keys that unlock your ability to manage the estate’s affairs. Without them, banks, financial institutions, and government agencies will not grant you access to accounts, allow you to sell property, or even discuss the deceased's financial details. This step formally empowers you to perform your duties, transforming you from a named individual in a will to a legally recognized fiduciary.

How This Legal Authority Works

Obtaining these letters involves filing a petition with the local probate court in the county where the deceased resided. This process, often called "opening probate," formally initiates the court-supervised settlement of the estate. The court verifies the will's validity (or confirms the absence of one), officially appoints the executor or administrator, and then issues the certified letters.

This legal recognition is non-negotiable for most third-party transactions. For instance, an executor in Illinois needed Letters Testamentary to access the deceased's business accounts and prevent operations from halting. Similarly, a bank will rightfully refuse to release account information until it receives certified Letters of Administration. These documents provide proof that you are the sole person authorized to conduct business for the estate.

Actionable Tips for a Smooth Application

The court process can be slow, so efficiency is key. Filing correctly the first time prevents significant delays.

- Apply Promptly: This is often the longest lead-time item in the entire process. Start the application with the probate court as soon as you have the will and death certificate.

- Gather All Required Paperwork: Before filing, ensure you have the original will, a certified death certificate, and a list of all heirs and beneficiaries. Incomplete applications are a common source of delay.

- Check Bond Requirements: Some wills include a clause that waives the requirement for the executor to post a bond (a type of insurance policy). Highlighting this to the court can save the estate significant expense.

- Order Multiple Certified Copies: Just like with death certificates, you will need multiple certified copies of your Letters. Each financial institution, real estate agent, and government body will likely require its own original certified copy to keep on file. Ordering 10 to 15 copies upfront is a wise investment of time and money.

4. Notify Beneficiaries, Heirs, and Creditors

Once you've secured the will and initiated the probate process, your next critical responsibility in the estate settlement checklist is formal communication. This involves legally notifying all interested parties, including beneficiaries named in the will, legal heirs who may have a claim, and known or potential creditors. This step is a legal requirement designed to protect the rights of everyone involved and establishes firm deadlines for any claims against the estate.

Proper notification is not just a formality; it is a defensive measure. It provides a legal shield against future challenges, disputes, and late claims that could otherwise derail the settlement process. By formally and transparently communicating, you ensure the estate can be closed with finality, giving all parties a fair opportunity to state their interest.

Why Formal Notification is Non-Negotiable

Failing to properly notify interested parties can have severe consequences, including personal liability for the executor. For instance, if an heir is not notified and the estate is distributed, they could later sue the executor for their rightful share. Similarly, failing to notify a known creditor could result in the executor being held personally responsible for the debt. This structured process provides legal closure and is an indispensable part of a thorough estate settlement checklist.

Consider a real-world scenario where proper creditor notice in Michigan protected an executor. When a creditor attempted to file a claim after the legally mandated deadline had expired, the court dismissed it because the executor had followed the correct notification procedures. This simple act of compliance saved the estate from a significant financial loss.

Actionable Tips for Effective Notification

To manage this responsibility effectively and create a clear record of your actions, follow these practical steps:

- Use Certified Mail: Send all formal notices to beneficiaries and known creditors via certified mail with a return receipt requested. This provides undeniable proof of delivery and the date it was received, which is crucial for legal documentation.

- Keep Meticulous Records: Create a communication log detailing who was notified, the date of notification, the method used (e.g., certified mail, publication), and any responses received. This log will be invaluable if any disputes arise.

- Publish Notice to Creditors: Most states require you to publish a "Notice to Creditors" in a local newspaper. While this may seem like an outdated expense, it is a vital legal step. For example, a published notice in a major city newspaper might cost a few hundred dollars but could prevent a large, unknown credit card claim filed after the deadline.

- Consult an Attorney for Complex Cases: If the family dynamics are contentious, there are unknown heirs, or the estate has significant debts, it is wise to have an attorney handle all official notifications. Their expertise ensures full legal compliance and can de-escalate potential conflicts.

5. Inventory and Appraise All Estate Assets

Once the foundational documents are secure, the next critical step in any estate settlement checklist is to create a comprehensive inventory of all estate assets and determine their value. This process is essential for proper administration, calculating potential estate taxes, and ensuring beneficiaries receive their fair share as stipulated in the will. It involves systematically identifying, locating, and professionally appraising everything the deceased owned, from real estate and bank accounts to less obvious assets like digital currencies or valuable collectibles.

A thorough inventory prevents assets from being overlooked, which can have significant financial consequences. For example, a forgotten storage unit containing valuable antiques could add tens of thousands of dollars to an estate's value, while a professional real estate appraisal might reveal a property is worth significantly more than its tax assessment suggests. Failing to uncover all assets means they cannot be distributed correctly, undermining the entire settlement process.

This meticulous accounting forms the basis for all subsequent financial decisions, from paying off debts to making final distributions.

How to Compile a Comprehensive Asset List

Your goal is to create a detailed spreadsheet or document listing every asset, its location, and its estimated value. Start with the most apparent categories and then dig deeper for hidden or non-traditional assets. Reviewing the deceased's recent tax returns can provide valuable clues, pointing to sources of income from investments, rental properties, or businesses you may not have known about.

This systematic search ensures no stone is left unturned. A digital asset search, for instance, could uncover thousands of dollars in cryptocurrency wallets, while a business valuation might be required to assess a 50% ownership stake in a family restaurant. The more thorough your inventory, the smoother the rest of the settlement will be. For guidance on handling the personal property discovered, you can learn more about downsizing and preparing for an estate sale.

Actionable Tips for Inventory and Appraisal

Accurate valuation is just as important as a complete inventory. Here are practical steps to ensure both are handled correctly:

- Hire Certified Appraisers: For high-value items like real estate, fine art, jewelry, or antiques, hire certified professionals. Their official appraisal reports are necessary for probate court and tax filings.

- Don't Overlook Digital Assets: Actively search for digital property, including cryptocurrency, domain names, online business revenue, and even valuable social media accounts or loyalty program points.

- Check for Hidden Locations: Systematically search for safe deposit boxes, secondary properties, and off-site storage units. Check bank statements for recurring payments to storage facilities.

- Document Everything: Photograph or videotape the contents of the home and other properties. This creates a visual record that can help resolve disputes and assist with appraisals.

- Consider Appraisal Timing: For assets like real estate, seasonal timing can impact value. An appraisal in the spring market may yield a higher valuation than one conducted in the winter.

6. Pay Outstanding Debts and Taxes

A critical and non-negotiable step in any estate settlement checklist is the satisfaction of all legitimate debts and taxes before any assets are distributed to beneficiaries. As the executor, you are legally obligated to use estate funds to pay off these obligations. This includes the deceased’s final income taxes, any applicable estate or inheritance taxes, ongoing property expenses, and valid claims from creditors.

Properly managing and paying these liabilities protects you, the executor, from personal liability and ensures that beneficiaries receive their inheritance free and clear of any future claims. Failure to do so can result in legal action against the estate and potentially the executor themselves.

How to Prioritize and Manage Payments

The process of paying debts is not random; there is a legal hierarchy. Generally, secured debts like mortgages or car loans are paid first, followed by administrative costs of the estate, then funeral expenses, taxes, and finally, unsecured debts like credit cards or personal loans. You must carefully validate each claim to ensure its legitimacy before making a payment.

For example, if an estate owes significant final income taxes due to large IRA distributions, the executor might need to sell stock investments to cover the liability. Conversely, if an estate's assets are insufficient to cover all debts, such as $30,000 in credit card balances after secured debts are paid, the executor can notify the credit card companies, which may be forced to write off the remaining balance.

Actionable Tips for Paying Debts and Taxes

Navigating financial obligations requires diligence and careful record-keeping. Here are some practical steps to follow:

- File Final Tax Returns Promptly: File the deceased’s final federal and state income tax returns (Form 1040 and the estate's income tax return, Form 1041) as soon as possible. This starts the clock on the statute of limitations, limiting the time the IRS has to challenge the filings.

- Negotiate with Creditors: If the estate is insolvent (debts exceed assets), you can and should negotiate with unsecured creditors. They may be willing to accept a smaller amount rather than receive nothing.

- Seek Professional Tax Help: For estates with assets over $100,000 or complex financial situations, hiring a CPA or tax attorney is a wise investment. For example, professional tax preparation costing $3,500 might identify $12,000 in overlooked deductions, saving the estate money.

- Keep Meticulous Records: Document every single payment made from the estate, including the date, amount, recipient, and purpose. This information is vital for the final accounting you must provide to the beneficiaries and the court. If you held an estate sale to generate funds, be sure to account for any associated costs. You can learn more about estate sale fees on diyauctions.com.

7. Distribute Assets to Beneficiaries

The final major step in the estate settlement checklist is the distribution of assets to the rightful beneficiaries. This is the culmination of the entire process, where the deceased’s wishes are fulfilled. Distribution can only occur after all estate debts, taxes, and administrative expenses have been paid and any required court approvals have been secured. This crucial phase involves legally transferring ownership of everything from real estate and financial accounts to personal belongings.

Properly managing this stage ensures the estate is closed correctly and minimizes the risk of future legal challenges from beneficiaries. The process requires meticulous documentation, careful coordination with financial institutions, and adherence to the terms outlined in the will or, in its absence, state intestacy laws.

How to Approach Asset Distribution

Distributing assets is not as simple as handing over checks or keys. For example, transferring a family home to three siblings might require a new deed listing them as joint tenants or tenants-in-common, which must then be recorded with the county. Similarly, investment accounts could be distributed "in-kind," meaning the beneficiaries receive the actual stocks or bonds rather than their cash value. This strategy can be beneficial for avoiding capital gains taxes that would be triggered by selling appreciated assets.

For personal property like furniture, art, and jewelry, a common and fair method is to create a detailed inventory. Beneficiaries can then take turns selecting items based on a predetermined order. This approach can be supported by an organized system, much like preparing for an estate sale. For more information on this, you can learn more about estate sale organization on diyauctions.com. It is also important to remember that some assets, like life insurance proceeds or retirement accounts with named beneficiaries, pass outside of the probate estate and are distributed directly by the financial institution.

Actionable Tips for a Smooth Distribution

To ensure the final step is completed without issue, follow these practical tips:

- Obtain Signed Receipts: Before distributing any asset, require each beneficiary to sign a receipt or release form. This document confirms they have received their inheritance and releases you, the executor, from further liability regarding that asset.

- Document Everything: Keep a detailed ledger of what was distributed, to whom, its value, and the date of transfer. This meticulous record-keeping is your best defense against potential disputes or a formal court accounting.

- Consider Tax Implications: Discuss distribution strategies with a financial advisor or CPA. The way assets are distributed can have significant tax consequences for beneficiaries. For instance, distributing appreciated property in-kind may be more tax-efficient than liquidating it first.

- Use Professionals for Complex Transfers: For assets like real estate, business interests, or valuable collectibles, engage attorneys or other professionals to handle the title transfers and legal paperwork to ensure everything is done correctly.

8. File Final Accounting and Close the Estate

The final major task in any comprehensive estate settlement checklist is to prepare and file a final accounting with the probate court and beneficiaries. This formal report details every financial transaction that occurred during the administration period, from the initial asset inventory to the final payments of debts and expenses. It serves as a transparent record, demonstrating that you have managed the estate's assets responsibly and are ready to distribute the remaining property to the rightful heirs.

Successfully closing the estate provides crucial legal protection for you as the executor. Once the court approves the accounting and the beneficiaries sign off, it formally releases you from your duties and shields you from future claims of mismanagement. For example, a properly filed final accounting protected an executor from a later lawsuit when a disgruntled beneficiary claimed financial misconduct, as the court had already approved all transactions.

How to Prepare the Final Accounting

The final accounting is a detailed summary of all financial activity. It must balance perfectly, showing what the estate started with, what came in, what went out, and what is left for distribution. It typically includes an inventory of assets, a record of all income received (like interest or dividends), a list of all expenses paid (such as funeral costs, professional fees, and debts), and a proposed schedule for distributing the remaining assets.

This step can be complex, and accuracy is paramount. An accounting for a $400,000 estate, for instance, might need to document $15,000 in executor fees and $8,000 in legal and professional costs, with every penny tracked. Any discrepancies can lead to objections from beneficiaries and significant delays. For example, a beneficiary's objection to an accounting in one case delayed the estate closing by six months until the court could resolve the dispute.

Actionable Tips for a Smooth Closing

To ensure the final stage of the estate settlement process goes smoothly, meticulous preparation is key. Here are several practical steps:

- Keep Meticulous Records: From day one, maintain detailed and organized records of every single transaction. This is the most critical step and will make creating the final report infinitely easier.

- Seek Waivers When Possible: In some cases, if all beneficiaries are agreeable and trust the executor, they can sign a waiver of accounting. This document allows you to bypass the formal accounting process, saving significant time and expense.

- Use Professional Help: For complex estates, consider using estate accounting software or hiring a CPA or probate attorney. Their expertise can prevent costly errors and ensure compliance with court requirements.

- File Tax Clearances First: Before petitioning the court to close the estate, ensure all final tax returns have been filed and you have received clearance letters from the relevant tax authorities (like the IRS and state tax departments).

- Retain All Records: After the court formally closes the estate, securely store all related documents, including receipts, statements, and tax returns, for at least seven years. This protects you in the unlikely event of a future audit or inquiry.

8-Step Estate Settlement Checklist Comparison

| Step / Task | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Locate and Secure the Will and Important Documents | Medium: locating and verifying documents | Moderate: access to multiple copies, legal help | Clear legal authority; faster settlement; reduces disputes | Beginning of estate process; when documents are disorganized | Establishes legal foundation; prevents unauthorized access |

| Determine if Probate is Required | Low to Medium: depends on estate complexity | Low to Moderate: research and legal consultation | Saves time, costs, and maintains privacy if probate avoided | Estates with small value or clear beneficiary designations | Avoids lengthy probate; reduces fees and court involvement |

| Apply for Letters Testamentary or Administration | Medium to High: formal court application | High: court fees, legal documents, possible bond | Legal authority to act for estate; access to assets | Estates with must-have court validation for management | Provides official executor powers; protects third parties |

| Notify Beneficiaries, Heirs, and Creditors | Medium: formal notices and publication | Moderate: mailings, newspaper publication | Legal deadlines established; protects from future claims | Estates with multiple heirs and potential creditors | Reduces liability; ensures all parties informed |

| Inventory and Appraise All Estate Assets | High: thorough asset identification and valuation | High: professional appraisals, detailed records | Accurate valuations; facilitates fair distribution and taxes | Estates with diverse assets including real estate/art | Prevents asset loss; supports tax compliance and fairness |

| Pay Outstanding Debts and Taxes | Medium to High: financial and legal complexity | Moderate to High: tax professionals, funds to pay debts | Debt clearance; protects executor; clears title for heirs | All estates before distribution | Protects beneficiaries; prevents IRS liens and penalties |

| Distribute Assets to Beneficiaries | Medium: legal deeds and documentation | Moderate: legal and administrative coordination | Transfers ownership legally; provides closure | Final phase of estate settlement | Completes process; ensures rightful ownership |

| File Final Accounting and Close the Estate | High: detailed reporting and court filings | Moderate to High: accounting, legal fees | Legal discharge for executor; official estate closure | Last step after all distributions | Protects executor; prevents future disputes |

Bringing the Process to a Close with Confidence

Navigating the complexities of settling an estate is a significant responsibility, one that demands diligence, precision, and compassion. This comprehensive estate settlement checklist was designed to serve as your roadmap, guiding you through each critical phase with clarity and purpose. By systematically working through these steps, from the initial task of securing the will to the final act of distributing assets and closing the estate, you have constructed a framework for honoring the deceased's wishes and fulfilling your legal obligations. The journey is often long and intricate, but it is not one you have to walk without direction.

The process is a testament to the idea that the whole is greater than the sum of its parts. Each checklist item you complete builds momentum and clarity for the next. Locating essential documents lays the groundwork for the probate application. A thorough inventory and appraisal directly inform how you will pay debts and ultimately distribute the remaining assets to beneficiaries. This interconnectedness is the very essence of effective estate administration.

Key Takeaways for a Successful Estate Settlement

As you bring this process to a close, it's vital to internalize the core principles that ensure a smooth and successful settlement. Reflect on these fundamental takeaways that underpin the entire checklist:

- Documentation is Your Defense: Meticulous record-keeping is non-negotiable. Every decision made, every dollar spent, and every asset transferred must be documented. This creates an unassailable record of your actions and serves as your primary defense against potential disputes, ensuring you have fulfilled your fiduciary duty.

- Communication Prevents Complications: Proactive and transparent communication with beneficiaries, heirs, and creditors is paramount. Keeping all parties informed of progress, timelines, and key decisions can preempt misunderstandings, build trust, and minimize the likelihood of legal challenges down the line.

- Professional Guidance is an Investment, Not an Expense: While this guide provides a robust framework, it is not a substitute for professional legal or financial advice. Recognizing when to consult an attorney or an accountant for complex tax situations, will contests, or intricate asset valuations is a sign of a prudent executor. Their expertise can save the estate significant time and money in the long run.

Your Actionable Next Steps: From Checklist to Completion

With the major tasks behind you, your focus now shifts to finalization and future preparedness. Use these next steps to ensure a confident conclusion and apply these lessons moving forward.

- Conduct a Final Review: Before filing the final accounting, perform a comprehensive audit of your records. Cross-reference your initial inventory with the final distribution list. Ensure all creditor claims have been satisfied and that you have receipts for all paid expenses.

- Organize and Archive All Documents: Create a final, organized file containing all relevant documents: the will, court orders, asset appraisals, tax returns, creditor notices, and distribution receipts. Provide copies to the beneficiaries and retain a complete set for your own records for the period required by your jurisdiction.

- Explore Modern Liquidation Solutions: For the tangible personal property within the estate, reflect on the liquidation process. Consider how modern platforms could have streamlined the sale of assets. For future needs, whether for another estate or your own downsizing, exploring services like DIYAuctions can offer a more efficient, cost-effective way to maximize value from specialty items, collections, and household goods, putting more money directly back into the hands of the beneficiaries or owners.

Final Insight: The successful settlement of an estate is a profound act of service. It is the final chapter in a person's life story, and as the executor or administrator, you are its careful author.

By diligently following an estate settlement checklist, you not only navigate a complex legal and financial process but also provide a legacy of order, fairness, and closure for all involved. You have transformed a daunting list of tasks into a structured, manageable process that honors the deceased and supports the beneficiaries as they move forward. This experience, while challenging, equips you with invaluable knowledge, empowering you to handle future responsibilities with the same integrity and confidence you have demonstrated here.