Payment Processing for Small Business Explained

If you're a small business owner, the world of payment processing can feel like a tangled mess of jargon and hidden fees. At its core, though, it’s just the system that lets you get paid by your customers, whether they're buying something online or standing in your store.

Think of it as the secure digital handshake between your customer's bank account and yours. It’s what makes sure the money from a sale travels safely and ends up where it belongs—with you. Getting this right is absolutely fundamental to managing your cash flow and growing your business.

Your Guide to Getting Paid

Staring at all the different payment options can be overwhelming. This guide is here to cut through the noise and give you a clear, straightforward path. We'll walk through everything you need to know, from how transactions work behind the scenes to picking the right partner for your business.

Let’s imagine you own a local coffee shop. Your customers want to pay in all sorts of ways—tapping a credit card, using Apple Pay on their phone, or maybe even ordering a big batch of coffee beans from your website.

To handle all of those, you need a system that securely connects all the dots. That system is payment processing.

Why This Matters for Your Business

Having the right payment processing for small business setup isn't just a small detail; it directly hits your bottom line, keeps customers happy, and makes your daily operations smoother.

If there are delays in getting your money, you can run into serious cash flow problems. If the transaction fees are too high, they'll slowly chip away at your hard-earned profits. A clunky or unreliable payment experience can frustrate customers and make them think twice about coming back. With over 90% of consumers now using digital payments, you just can't afford to get this wrong.

This guide will give you the confidence to make smart financial decisions, no finance degree required. We’re going to break down the key pieces so you're fully prepared:

- How Payments Work: We’ll follow the money, tracing the path of a single transaction from the moment a card is swiped to when the funds actually land in your bank account.

- Deciphering Fees: You’ll learn how to read between the lines of different pricing models and spot those sneaky hidden costs, making sure you get a fair deal.

- Choosing a Partner: We’ll lay out the different types of payment processors to help you find the one that’s a perfect match for your business and budget.

Our goal is simple: to take a complicated topic and turn it into a practical plan for your business. By the time you're done reading, you'll know exactly how to choose and manage a payment solution that helps you succeed.

How a Simple Card Swipe Actually Works

Ever wonder what really happens in those few seconds between a customer tapping their card and the money showing up in your account? It feels like magic, but it's actually a high-speed, secure relay race involving a whole team of financial players.

Think of it as a super-fast, armored delivery service for your money. Understanding this journey is the key to seeing why payment processing for small business has certain fees and why security is something you can never compromise on.

The Key Players in Every Transaction

Behind every single sale, there's a team of institutions working in perfect sync. Getting to know who's who demystifies the whole thing. Each one has a very specific job to do to get the funds from your customer's wallet to your business bank account.

Here are the main players in this financial relay:

- The Merchant: That’s you! The business owner selling the goods or services.

- The Customer: The person buying from you with their credit or debit card.

- The Payment Gateway: This is the digital bouncer. For online sales, it's the software that securely grabs the customer's card info and passes it along. For in-person sales, it's built into your card reader.

- The Payment Processor: This is the middleman, the messenger shuttling transaction data between you, the banks, and the card networks.

- The Card Networks: You know these names: Visa, Mastercard, American Express. They’re the ones who set the rules of the road for card payments.

- The Issuing Bank: This is your customer’s bank—the one that gave them their card.

- The Acquiring Bank (or Merchant Bank): This is your bank. It receives the money from the customer's bank and puts it into your account.

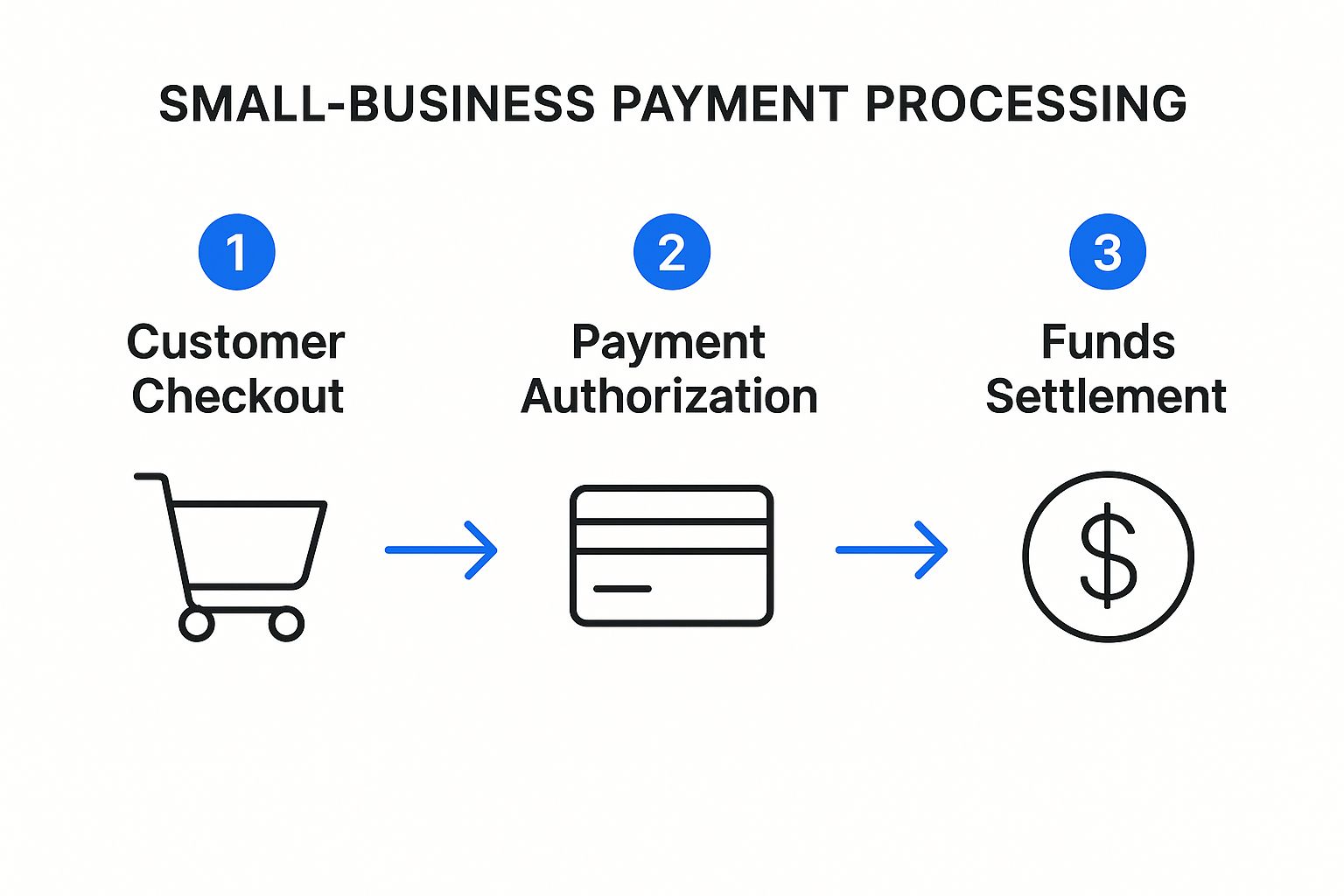

This graphic breaks down how a typical transaction flows, from the moment of purchase to the final deposit.

It’s a great visual for seeing how a seemingly simple tap is actually a series of secure handoffs between all these different parties.

The Three Stages of a Payment

The entire journey unfolds in three main stages: authorization, clearing, and settlement. Each step is crucial for making sure the payment is legit, the books are balanced, and the cash lands safely in your account.

Key Insight: This three-stage process is what makes card payments both instant and secure. Authorization gives you a quick "yes" or "no" so you can make the sale, while clearing and settlement handle the actual (and more complicated) movement of money behind the scenes.

First up is authorization. When your customer pays, the request zips through the gateway to the processor. The processor then asks the card network (like Visa), which pings the customer's issuing bank: "Hey, does this person have the funds or credit for this purchase?"

The bank checks the account and shoots back an "approved" or "declined" message. This whole round trip takes just a couple of seconds.

From "Approved" to Your Bank Account

Once your business day is done, all of those approved transactions are bundled up and sent to your processor. This kicks off the clearing stage, where the banks get down to the business of formally exchanging transaction details.

Finally, we get to settlement. This is when the money actually moves. The customer's bank sends the funds over to your acquiring bank, which then deposits the money into your business account. This is why you don't see the money hit your account instantly—it usually takes one to three business days for the settlement process to complete.

The global digital payment market was valued at around $122.32 billion in 2024, showing just how vital these systems are. Processors like Square, which offers straightforward rates like 2.6% + $0.10 for in-person sales, have made it incredibly easy for even the smallest businesses to get in on the action. You can learn more about the top payment processors for small businesses on sltcreative.com.

Choosing the Right Payment Processor

Picking a payment processor is one of the biggest financial decisions you'll make for your small business. With so many options out there, it can feel like digging through a massive, disorganized toolbox for one specific wrench.

This choice directly impacts your day-to-day operations, your profit margins, and the checkout experience you give your customers. A solution that’s perfect for a high-volume coffee shop probably won't be the right fit for an online-only boutique.

The key is to match the processor's strengths to your business's real-world needs. Let's break down the main players to help you find the right one.

Comparing Your Main Options

Most payment solutions fall into one of three buckets: traditional merchant accounts from banks, modern all-in-one processors, or specialized payment gateways. Each serves a different purpose and comes with its own approach to fees, features, and support.

Here’s a quick look at the major types of payment processing solutions and who they’re best for. This table should help clarify the fundamental differences and steer you toward the category that best fits your business model.

Comparing Payment Processor Types for Small Businesses

| Feature | Merchant Account Providers (Banks) | All-in-One Processors (e.g., Square, Stripe) | Payment Gateways (e.g., Authorize.net) |

|---|---|---|---|

| Best For | High-volume, established businesses that can negotiate rates. | Startups, SMBs, online stores, and anyone needing a fast start. | E-commerce businesses with a developer and custom needs. |

| Pricing Model | Complex (Interchange-Plus pricing is common and hard to predict). | Simple and predictable (usually a flat rate per transaction). | Per-transaction fee plus a required monthly fee. |

| Setup Speed | Slow. The application and approval process can take weeks. | Incredibly fast. You can often be up and running in hours or a day. | Varies. It requires a separate merchant account and integration work. |

| Support | Can be hit-or-miss, depending on the bank. | Generally strong, with 24/7 support available through multiple channels. | Highly technical and often geared toward developers. |

| Integrations | Usually limited to major enterprise software. | Extensive app marketplaces that connect to hundreds of tools. | API-driven, offering maximum flexibility for custom integrations. |

As you can see, for most new and small businesses, the all-in-one processors like Square or Stripe are the clear winners. They bundle the merchant account and payment gateway into a single, easy-to-use package with predictable pricing and no surprise monthly fees. They just work.

Key Questions to Ask Before You Commit

Before you sign on any dotted line, you have to ask the right questions. This isn't just about finding the lowest rate—it's about finding a true partner for your business. A good provider will be transparent and won't shy away from your questions.

Your goal is to uncover the total cost of ownership, not just the flashy percentage they advertise on their homepage. Trust me, that initial rate is rarely the full story.

Critical Takeaway: Never assume the advertised rate is all you'll pay. Always demand a complete fee schedule. You need to see the monthly fees, chargeback costs, PCI compliance charges, and any other hidden expenses before making a decision.

Here are the essential questions you need to ask:

- What is your complete fee structure? Ask for a full breakdown of every single fee. That means transaction rates, monthly service charges, chargeback penalties, and PCI compliance costs.

- Are there any long-term contracts or early termination fees? Most modern processors are month-to-month, but some old-school providers will try to lock you into a multi-year deal with a hefty exit fee. Avoid them.

- How does this solution scale as my business grows? Will your rates go down as your sales volume goes up? Can the hardware and software handle more traffic or another location down the road?

- What does your customer support actually look like? Is it 24/7? Can you get a real person on the phone, or are you stuck with a chatbot? When you have a payment problem, you need help now, not tomorrow.

- How do your services integrate with the tools I already use? Make sure it plays nice with your accounting software (like QuickBooks), your e-commerce platform (like Shopify), and your POS system.

Getting straight answers to these questions will empower you to make a smart choice. For businesses that manage unique inventories, like those we cover in our guide on how to start an estate sale business, making sure your processor can handle varied and high-value items is another critical piece of the puzzle.

By being thorough now, you'll find a payment processing for small business solution that actually supports your goals and grows right alongside you.

Understanding Processing Fees and Costs

Let’s be honest—fees are the most confusing part of payment processing. But they don't have to be a black box. Taking a few minutes to demystify your monthly statement is the first real step toward controlling your costs and boosting your profitability.

Think of it like this: your statement is a receipt that shows exactly where your money is going. Once you can tell the difference between a non-negotiable cost and a processor's markup, you gain the power to negotiate and pick a partner who offers real value, not just a flashy low rate.

Decoding the Pricing Models

Not all pricing structures are created equal. Payment processors generally use one of three models, and the one you land on can have a huge impact on your bottom line. Getting this decision right is crucial.

Let's break down the most common models you'll see:

-

Flat-Rate Pricing: This is the simplest model out there, made popular by companies like Square and Stripe. You pay one predictable percentage plus a small fixed fee for every single transaction (e.g., 2.9% + $0.30). It’s perfect for new businesses that need predictability, but it can get pricey for businesses with higher sales volumes.

-

Interchange-Plus Pricing: This is hands-down the most transparent model. It clearly separates the non-negotiable interchange fees (which go to the card-issuing banks) from the processor's markup. You see exactly what you’re paying for their service, making it a fantastic choice for established businesses that want to keep pricing fair.

-

Tiered Pricing: This model is the trickiest. It bundles hundreds of different interchange rates into vague tiers like "qualified," "mid-qualified," and "non-qualified." It often obscures the processor's true markup and can lead to surprisingly high costs. Most experts will tell you to steer clear of this one because of its lack of transparency.

Common Fees to Watch Out For

Beyond that main transaction rate, your statement can be littered with other charges. These little fees can add up fast, so knowing what they are—and why you're being charged—is vital for avoiding a nasty surprise at the end of the month.

Here are a few of the usual suspects:

- Monthly Account Fees: A simple recurring charge just to keep your account open.

- PCI Compliance Fees: A fee to ensure your business meets mandatory data security standards.

- Chargeback Fees: A penalty you have to pay whenever a customer disputes a transaction and you lose the claim. Understanding what is a chargeback fee is key to protecting your revenue.

- Early Termination Fees (ETF): A hefty penalty for closing your account before your contract is up.

Pro Tip: Always ask a potential processor for a full, itemized fee schedule. If they hesitate or refuse, consider it a major red flag. Good partners are upfront about what they charge.

Negotiating Better Rates and Spotting Hidden Costs

Once you know how to read the menu, you're in a much better position to order what you want. Don't ever be afraid to negotiate. Processors want your business, and if you have a decent sales volume, they’re often willing to trim their markup to get you on board.

This has become even more important as payments have shifted online. After a quick dip in 2020, global payment transaction values exploded to a record $2.1 trillion, and electronic transactions jumped by 19% in 2021 alone. Small businesses had to adapt on the fly, making affordable processing an absolute must-have.

To protect your hard-earned money, always read the fine print. Look for monthly minimums, equipment rental costs, and sneaky clauses about automatic rate increases. Knowing https://www.diyauctions.com/learn/how-to-calculate-profit-margins will help you see exactly how every single fee eats into your success. Armed with this knowledge, you can confidently find a processor that offers fair, transparent pricing.

Ensuring Security and PCI Compliance

When a customer gives you their credit card, they're handing over more than just a piece of plastic—they're giving you their trust. Protecting that trust isn't just a nice-to-have; it's the absolute foundation of your business. Without solid security, you can't build the customer confidence you need to grow.

This is where a set of rules called the Payment Card Industry Data Security Standard (PCI DSS) comes into the picture. It’s easy to get bogged down in the acronyms, but think of PCI DSS as a security blueprint. It’s a framework designed to protect both you and your customers from the fallout of fraud and data breaches.

Why PCI Compliance Is Non-Negotiable

PCI compliance is about so much more than just checking boxes to avoid fines. It's about protecting the integrity of your business. It can take years to build a loyal customer base, but a single data breach can shatter that trust in an instant. These standards exist to create a secure environment for every single transaction, ensuring sensitive cardholder data is handled with care.

The best way for a small business to tackle this is by partnering with a payment processor that is already fully PCI-compliant. They do the heavy lifting by making sure their systems meet these strict security requirements from the get-go, which makes your life a whole lot easier. To get a handle on your own responsibilities, this ultimate PCI DSS compliance checklist is a great resource.

Key Security Features to Look For

When you're shopping for a payment processor, don't treat security as an afterthought. It should be at the very top of your list. Two of the most critical technologies you'll hear about are tokenization and encryption.

Here’s a quick breakdown of how they keep you safe:

- End-to-End Encryption: This technology essentially scrambles card data the moment it's swiped, dipped, or keyed in. The information becomes unreadable gibberish to anyone trying to intercept it while it travels from your business to the payment networks.

- Tokenization: This is a clever process that swaps out the actual card number for a unique, stand-in code called a "token." You can use this token for things like recurring billing without ever storing—or exposing—the real card details. It drastically reduces your risk if your system is ever compromised.

Key Takeaway: A processor offering both encryption and tokenization is actively working to keep sensitive data out of your systems. This lowers your PCI compliance burden and helps protect you from liability if a breach happens.

As you grow, you might start thinking about selling to customers in other countries. It’s a huge opportunity, with global cross-border payments expected to hit $222.1 billion by the end of 2025. But with it comes a new layer of complexity. In fact, 72% of small businesses now depend on their payment processor to help them navigate these challenges, which shows just how much we rely on these platforms.

Powerful security isn't just for the big guys anymore. A great payment partner will provide these tools and, just as importantly, help you understand how to use them. Choosing a processor that takes security seriously is a direct investment in your business’s reputation and your own peace of mind. To dive deeper, check out our guide on what is fraud protection and how it can shield your business.

Your Next Steps to Smarter Payments

Picking a payment processor isn't just another item on your to-do list. It's a strategic move that has a real impact on your cash flow, your customers' trust, and your ability to grow. Now that you're armed with the right knowledge, you can find a partner that does more than just move money—it should help your business thrive.

This last step is all about putting that knowledge into action. Let's walk through a clear roadmap to help you make this decision confidently.

Create Your Action Plan

Your hunt for the perfect payment processing for small business solution has to start with a solid plan. Don't even think about comparing providers until you know exactly what you're looking for. A little bit of prep work now will save you from major headaches and costly mistakes down the road.

Follow these four steps, and you'll be in a great position to make the right choice:

- Evaluate Your Unique Business Needs: First things first, get a clear picture of your business. Look at your sales volume, where you sell (online, in-person, or a mix), and who your typical customer is. A busy retail shop has completely different needs than a consultant who sends out invoices.

- Compare at Least Three Providers: Never settle for the first option you find. Use what you’ve learned in this guide to put a few top contenders side-by-side. You'll want to focus on their pricing models, the features they offer, and what their customer support is really like.

- Scrutinize the Contract: This is huge. You have to read the fine print. Be on the lookout for hidden fees, long-term contracts, and any penalties for leaving early that could trap you in a bad deal.

- Plan for a Smooth Implementation: Ask potential partners what the setup process actually involves. A good provider will offer real support to make the transition painless, ensuring you don't miss a beat in your daily operations.

The right payment processor is like a silent partner in your success. By following a structured plan to evaluate your options, you'll find a solution that protects your bottom line and gives your customers a great experience—clearing the path for real, sustainable growth.

A Few Lingering Questions?

Even with the big picture clear, you probably have a few specific questions popping into your head. That's completely normal. Let's tackle some of the most common ones we hear from business owners who are right where you are now.

What's the Cheapest Way to Take Card Payments?

For most new or small businesses, the simplest and most budget-friendly route is usually a processor with flat-rate pricing. Think Square or PayPal. They charge one predictable percentage plus a small fixed fee on every single transaction. No monthly fees, no hidden costs.

This setup is perfect when your sales volume isn't massive or predictable. You know exactly what you'll pay every time someone taps their card. While a high-volume business might save a few tenths of a percent with a more complex pricing model, the sheer simplicity of a flat rate is a huge win for forecasting and avoiding nasty surprises. It’s also worth noting that in-person payments are almost always cheaper than online ones because there's less risk of fraud.

Do I Really Need Both a Merchant Account and a Payment Gateway?

That depends entirely on who you partner with. In the old days, you absolutely did. You’d have to go to a bank to get approved for a merchant account and then find a separate payment gateway company to actually build the "bridge" for your online transactions. It was a pain.

Thankfully, modern providers like Stripe or Square have changed the game. They're what we call payment service providers (PSPs), and they bundle everything into one package. When you sign up, you get the merchant account and the gateway functionality all rolled into one. For nearly every small business out there, this all-in-one approach is the way to go—it's just so much easier.

Think of it this way: An all-in-one processor is like a smartphone. It comes with the camera, the internet, and the phone all built-in. You don't have to buy each component separately and then figure out how to wire them together. It just works, right out of the box.

How Long Until I Actually Get My Money?

It’s not instant, and that’s a crucial thing to understand for your cash flow. The time it takes for money to travel from your customer's bank to yours is called settlement time. After a sale is approved, the banks have to do their behind-the-scenes work to formally move the funds.

You can typically expect to see the money in your bank account within one to three business days. Keep in mind that weekends and holidays will slow things down. Some processors, like Square, know that waiting is hard, so they offer instant or same-day deposits for a small extra fee. This can be a real lifesaver when you have bills to pay.

What Is a Chargeback, and How Do I Deal with It?

A chargeback is when a customer disputes a transaction with their credit card company, demanding their money back. It could be because of suspected fraud, an item that never arrived, or because they were unhappy with what they bought. When this happens, the money is immediately yanked from your account.

Your first move is to act fast. Your processor will send you an alert with a deadline. It's on you to provide compelling evidence that the charge was legitimate—think receipts, shipping confirmations, photos, or any emails you exchanged with the customer. This is why keeping meticulous records isn't just good practice; it's your absolute best defense in a chargeback dispute.