Steps to Close Down a Business The Complete Guide

Thinking about closing your business? It’s a bigger decision than just flipping the "closed" sign and walking away. The very first moves you make are legal, not operational. They're all about creating a formal, documented paper trail to protect yourself down the road.

Getting this part wrong can haunt you for years. Let's walk through how to do it right.

Making it Official: The Dissolution Vote

Before you tell your customers or cancel a single subscription, you need to make the decision to close official. How you do this depends entirely on how your business is structured. This isn't just about internal record-keeping; it's a critical step that legally shields the owners from future liabilities.

For a corporation, this means calling a formal meeting with the board of directors and shareholders. The goal is to get a recorded resolution to dissolve the company, which needs to be documented meticulously in the official meeting minutes. That paper trail is your proof that the closure was handled by the book, according to your own company bylaws.

If you're running a Limited Liability Company (LLC), your operating agreement is your guide. It will spell out exactly how to handle a dissolution, which usually involves a vote among the members. Once that vote passes, have all members sign a formal dissolution agreement to make it legally binding.

Things are a bit simpler for partnerships and sole proprietorships, but no less important. Partners should draft and sign a dissolution agreement that outlines how the business will be wound down. For a sole proprietor, the decision is yours alone, but you should still put it in writing and date it, noting the exact day your business operations will end.

Filing the Paperwork with the State

Once you have your internal decision documented, you have to tell the state. This is done by filing a formal document, often called "Articles of Dissolution" or a "Certificate of Termination." This filing officially lets the state know your company is ceasing to exist as a legal entity.

This is a step you absolutely cannot skip. In major economies like the U.S. and the European Union, these procedures are governed by strict regulations to ensure every legal loose end is tied up. You can read more about the global economic factors influencing business closures to understand the bigger picture.

Real-World Scenario: I once worked with a small graphic design agency, an S-Corp, whose founders were ready to move on. They did everything they thought was right—they told their clients, paid off their vendors, and closed their bank account. But they never filed the Articles of Dissolution with the Secretary of State. Two years later, the primary owner was hit with a notice for $1,600 in unpaid franchise taxes and penalties. Why? Because the business was never legally dissolved, the state kept assessing its annual minimum franchise tax. A simple oversight turned into a costly, prolonged headache.

Dissolution Actions by Business Structure

Knowing what’s required for your specific business structure right from the start is the key to avoiding these kinds of expensive mistakes. The initial steps can vary quite a bit.

This table breaks down the typical first legal steps you'll need to take based on your entity type.

| Business Structure | Key Decision-Making Body | Primary Dissolution Document to File |

|---|---|---|

| Corporation | Board of Directors & Shareholders | Articles of Dissolution |

| LLC | Members (as per Operating Agreement) | Certificate of Dissolution / Termination |

| Partnership | All Partners | Statement of Dissolution |

| Sole Proprietorship | The Owner | Cancellation of DBA/Fictitious Name |

As you can see, the process isn't one-size-fits-all. Taking the correct action for your business type is the first step toward a clean break.

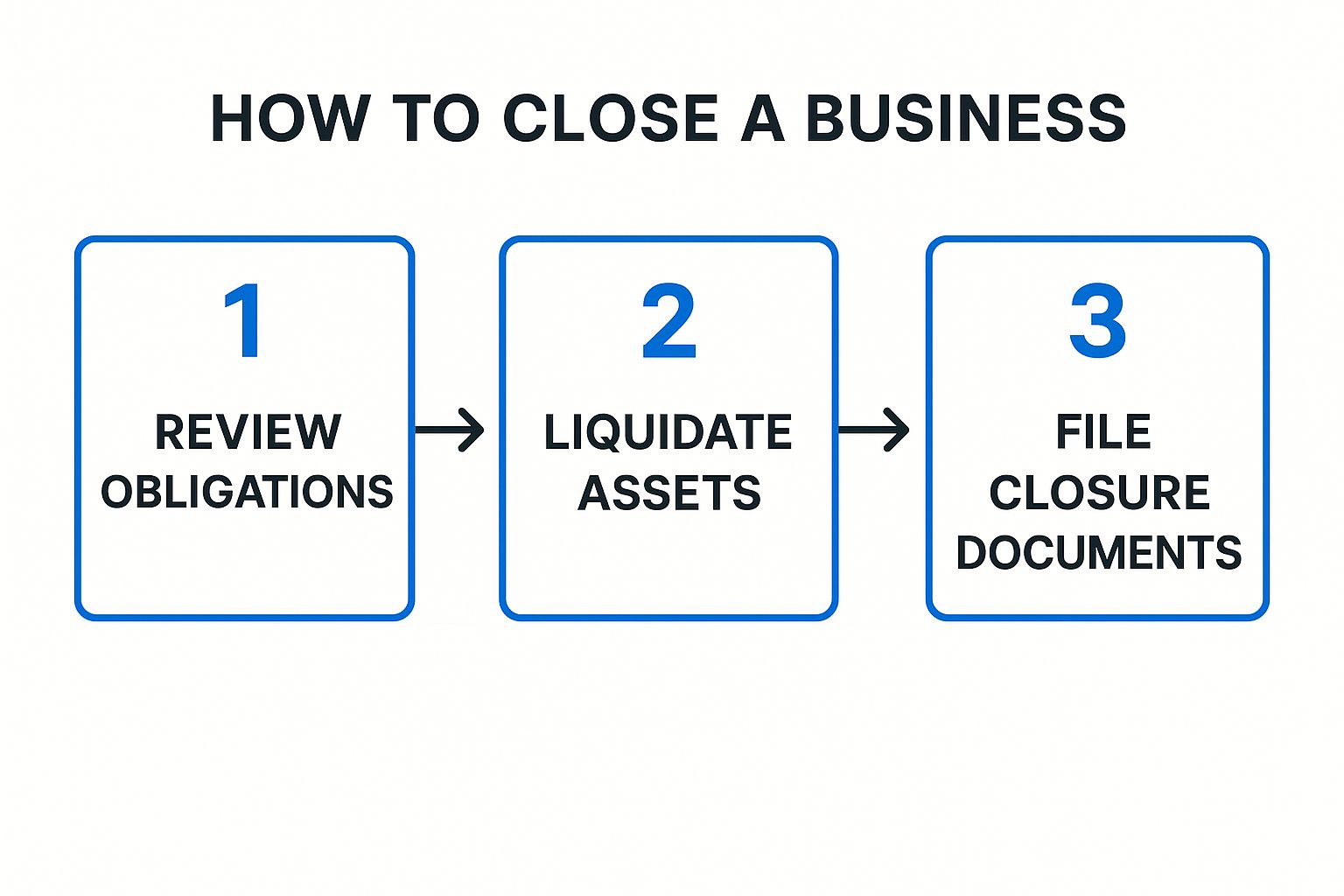

This simple flow shows that filing your closure documents is the final bookend to the process. It all starts with reviewing your obligations and ends with making it official. Getting these first legal steps right lays the foundation for a responsible and stress-free shutdown.

Taming Your Finances and Settling Debts

Let's be honest: untangling your business finances is usually the toughest, most draining part of shutting down. It demands extreme organization and a lot of proactive communication. This is where you need a clear, documented plan to make sure you leave a clean slate and, most importantly, protect yourself from personal liability.

Your first move is to build a complete inventory of every single financial obligation you have. I'm talking about a detailed list of what you owe and who you owe it to. Go way beyond the obvious bank loans and credit card balances. Dig into everything.

- Supplier Invoices: Pull together every outstanding bill from vendors.

- Service Contracts: Look at your agreements for software, utilities, and other recurring services. What are the cancellation terms?

- Lease Agreements: Document exactly what you owe on your property and any equipment leases.

- Employee Payouts: Calculate final payroll, any accrued vacation pay, and potential severance.

This master list is your roadmap for the financial wind-down. It's the only way to get a true picture of where things stand and figure out if your assets can actually cover your debts.

How to Prioritize and Talk to Creditors

With your full list of debts ready, it’s time to prioritize. Not all debts are created equal. You have to separate your secured debts from your unsecured debts.

A secured debt is tied to a specific asset—think of a loan on a company vehicle where the van itself is the collateral. An unsecured debt, like a credit card balance or a supplier invoice, isn't backed by a specific asset. You absolutely must prioritize paying secured creditors first to stop them from seizing those assets.

This is also when you need to start talking. Don't sit back and wait for the calls to start coming in. Be the one to reach out to your bank, lenders, and key suppliers to let them know you’ve decided to close.

Expert Tip: When you talk to creditors, be straight with them. They are often far more willing to work with you if you're transparent about the situation. You might even be able to negotiate a settlement for less than the full amount owed, especially with unsecured creditors. Whatever you do, document every single conversation—the date, the person's name, and what you agreed to.

Turning Assets into Cash

For a lot of businesses, the cash you have on hand won't be enough to cover all the bills. This is where asset liquidation comes in. It’s simply the process of selling your business's physical assets—inventory, equipment, furniture, you name it—to generate cash to pay off your creditors.

Settling all your financial obligations is one of the most critical parts of closing a business. In fact, roughly 50% of new businesses fail within their first five years, and it's often poor financial handling during the final stretch that causes major problems. You can learn more about the challenges small businesses face by reviewing these key small business statistics from Bizplanr.ai.

A Real-World Example of Liquidation

Imagine a small catering company that needed to close its doors. The owner had a commercial van (with a loan on it), a kitchen packed with professional ovens and refrigerators, and a lot of high-end cookware.

Here’s how she handled it:

- First, she tackled the secured debt. She called the lender for the van, arranged to sell it, and used that money to pay off the remaining loan balance in full. One major liability was gone.

- Next, she liquidated the other assets. Using a platform like DIYAuctions, she efficiently sold all her kitchen equipment and cookware to other local restaurants and aspiring chefs.

- Finally, she used the proceeds to pay everyone else. The cash she made from the sale went to her unsecured creditors. She paid her food suppliers, then the landlord for the final month's rent, and finally cleared the balance on her business credit card.

By following this logical order, she made sure every creditor was paid, left a clean financial record, and avoided any personal hit for the business debts. She was meticulous, documenting every sale and payment, which gave her a clear paper trail proving she acted responsibly.

Communicating The Closure To Employees And Stakeholders

The checklists and legal filings for closing a business are just procedures. The real test of your leadership—and what defines your professional legacy—is how you handle the human side of the shutdown.

This is, without a doubt, the most sensitive part of the entire process. It demands a careful balance of compassion, absolute clarity, and legal diligence. If you get this wrong, you're not just closing a business; you're burning bridges, inviting legal trouble, and leaving a stain on your reputation.

Your employees must be your first priority. They deserve to hear the news directly from you, face-to-face, not from whispers in the hallway. Schedule a mandatory meeting and be ready to deliver the difficult news with honesty and empathy. Make sure you acknowledge their hard work and the gravity of the situation.

How you handle this first conversation sets the tone for everything that follows. Being transparent about why the business is closing (without getting into every confidential financial detail) can go a long way in building goodwill when it's needed most.

Crafting The Employee Transition Plan

Once you've delivered the news, your team’s minds will immediately jump to very practical questions about their jobs, their pay, and their future. Your next task is to provide them with a clear, documented transition plan. This isn't just about being a good boss; it's a legal and practical necessity.

Your plan needs to spell out the essentials:

- Final Paychecks: Be specific about when they will receive their final pay, which must include all wages they've earned right up to their last day.

- Accrued Time Off: State laws differ on paying out unused vacation or sick time. You absolutely need to check with your state’s labor department to make sure you're compliant.

- Severance Packages: While not always legally required, offering severance is a powerful gesture of goodwill. It often involves having the employee sign a release of claims, which gives you legal protection from future lawsuits.

- Benefits Information: Give them crystal-clear details on when their health insurance and other benefits will end. You also need to provide all the necessary information on COBRA continuation coverage.

A critical legal trap for larger businesses is the Worker Adjustment and Retraining Notification (WARN) Act. This federal law is not something to take lightly. It mandates that any business with 100 or more full-time employees must give a 60-day advance notice of a mass layoff or closure. Failing to do this can trigger severe financial penalties, including back pay and benefits for every affected employee.

Notifying Your Customers And Suppliers

After you’ve addressed your team, it’s time to communicate with your external partners. Your approach here needs to be tailored to each group, with the goal of maintaining professional relationships and tying up loose ends.

For customers who have outstanding orders or ongoing projects, proactive communication is non-negotiable. Don't wait for them to call you. Reach out individually, explain the situation, and give them a clear plan for how you'll either complete their order or issue a swift refund. Leaving customers guessing is the quickest way to destroy your reputation.

Next, get in touch with your suppliers and vendors. Pull out your contracts and review any termination clauses or penalties. Your goal is to end these relationships on good terms—you never know when your paths might cross again in the business world. You could even offer to help them sell off your remaining inventory, a process where you can learn a lot from seeing how to run an estate sale effectively.

Informing Investors And Lenders

Finally, you have to formally notify your investors and lenders. These are the people with a direct financial stake in your company, and your operating agreements almost certainly outline exactly how and when this conversation needs to happen.

You'll need to provide them with a summary of your dissolution plan, outlining how assets will be liquidated and debts will be settled. Brace yourself for tough questions about the company's finances and what kind of return, if any, they can expect. In these final, critical conversations, complete honesty and transparency are your best tools for maintaining trust and fulfilling your fiduciary duties.

Filing Final Tax Returns and Notifying Agencies

Once you've handled your employees and paid off your creditors, you have one final partner to settle up with: the government. This isn't a step you can rush or overlook. Properly settling your tax obligations is one of the most critical parts of closing a business cleanly, making sure you truly sever all ties and avoid any nasty financial surprises down the road.

This is about more than just paying what you owe. It’s about officially telling every single government agency that your business is no longer operating.

The cornerstone of this whole process is filing your final tax returns. It doesn't matter if it's your annual income tax return (like Form 1120 for corporations) or your final quarterly payroll return (Form 941). On each of these, you must find and check the box that marks it as the “final return.”

It sounds simple, but this one little checkmark is what flags your account for closure with the IRS and state tax authorities. Forgetting this is a surprisingly common—and expensive—mistake. If you don't check that box, their systems just assume you're still in business and simply failed to file. That can kick off a nightmare of automated notices, penalties, and interest charges that can follow you for years.

Notifying Federal and State Agencies

Beyond just filing, you have to be proactive about closing every account tied to your business's legal identity. This includes your federal Employer Identification Number (EIN). Now, you can't technically "cancel" an EIN, since it's a permanent identifier for your business.

What you do instead is close the business account connected to it. After you've filed all your final returns, you need to send a formal letter to the IRS. In it, you'll need to state clearly that you have closed the business, including its full legal name, your EIN, the business address, and why you're closing the account. This simple letter prevents anyone from ever using your EIN fraudulently in the future.

One of the biggest oversights I see is business owners forgetting to close their state-level accounts. We're talking sales tax, unemployment insurance, and workers' compensation. Each state has its own unique forms and shutdown procedures. One e-commerce owner learned this the hard way when he got a sales tax bill for $5,000 a full year after he thought he'd closed up shop—all because his account was still technically active.

Think of this part of the process like settling an estate. An executor has to follow a very precise sequence of steps to finalize everything. You need that same methodical approach, closing each government account one by one to wrap up the business's affairs for good. For a good parallel on the types of steps involved, our comprehensive estate settlement checklist shows just how important it is to follow a sequence so no detail gets missed.

Final Tax Compliance Checklist

Trying to navigate the web of government forms and agencies can feel overwhelming. The best approach is to create a simple checklist and work your way through it, documenting everything as you go. This is how you guarantee a clean break with no loose ends.

Here’s a summary table of the essential tax tasks you'll need to tackle when closing a business in the U.S.

| Task | Relevant Agency or Form | Key Consideration |

|---|---|---|

| Final Income Tax | Varies by entity (e.g., Form 1120, 1065, Schedule C) | CRITICAL: Check the "final return" box to initiate account closure. |

| Final Payroll Taxes | IRS Form 941 (Quarterly) & 940 (Annual Unemployment) | Must be filed for the final quarter you paid wages, even if it's for a partial period. |

| EIN Account Closure | Letter to the IRS | Send this letter after all final returns have been filed and processed. |

| State & Local Taxes | Varies by State (Sales Tax, Income Tax, etc.) | Contact your state's department of revenue for their specific "final return" forms. |

Don't forget, you are also responsible for making final federal tax deposits for any employment taxes and reporting all payments made to contractors using Form 1099-NEC. Meticulous record-keeping is your best friend here and your best defense against any future questions. If you treat this stage with the gravity it deserves, you can walk away with confidence, knowing every official loose end is tied up.

Wrapping Up Operations and Preserving Records

You’re in the final stretch, but this last mile of closing your business is all about diligence. This is where you methodically check off every last operational detail to prevent future headaches and financial leaks. It’s not glamorous, but it’s absolutely critical.

Think of it like decommissioning a ship. You wouldn’t just cut the engine and walk away; you’d systematically shut down every system, from navigation to the galley lights. Your business deserves that same careful, deliberate approach before you can truly move on.

Canceling Your Official Business Identity

First things first: you need to officially erase your business's public identity. This starts with canceling any local or state business licenses and permits you hold. Get in touch with each issuing agency to find out their exact cancellation procedures.

This also means taking care of any registered trade names or "Doing Business As" (DBA) filings. Canceling your DBA is a key step, as it formally severs the connection between your personal name and the business name, giving you another layer of legal closure.

Shutting Down Financial and Utility Accounts

Closing your business bank accounts and credit cards is all about timing. You absolutely cannot do this until every single check has cleared and all final payments to creditors have been processed. Jumping the gun here can cause payments to bounce, which creates a logistical nightmare and can burn bridges you thought were behind you.

Once your accounts hit a zero balance and all activity has stopped, call your bank to formally close them. Always, always get written confirmation of the closure for your records.

Don't forget to hunt down and eliminate all the small, recurring charges that can bleed your accounts dry over time. You have to be meticulous here:

- Software Subscriptions: Think accounting software, project management tools, or marketing platforms.

- Utility Services: Gas, electricity, internet, and phone lines for your commercial space all need to be formally terminated.

- Business Insurance: Call your broker to cancel every commercial policy, from general liability to workers' compensation.

A common mistake is assuming that once you stop using a service, the billing will stop automatically. It won't. I once advised a retail owner who, six months after closing, discovered he was still paying $200 a month for a point-of-sale software subscription he hadn't touched. That's a $1,200 lesson in the importance of a detailed cancellation list.

Securely Archiving Your Business Records

Your final—and arguably most important—operational step is to preserve your business records. Do not throw anything away. The law requires you to keep most financial and employment documents for a specific period, often for up to seven years.

This archive is your ultimate shield. It's your proof against future audits from the IRS or state tax agencies and your defense against potential claims from former employees or creditors long after you've closed up shop. For a good parallel, look at a comprehensive estate sale checklist; it similarly highlights the critical need for meticulous organization of assets and paperwork.

So, what exactly should you keep?

- Tax Records: All filed federal, state, and local tax returns, plus all supporting documents.

- Financial Statements: Your balance sheets, income statements, and bank statements.

- Legal Documents: This includes formation documents, dissolution paperwork, contracts, and lease agreements.

- Employee Information: All payroll records, including proof of final payments and Form W-2s.

Store these records securely, whether in clearly labeled physical boxes in a safe location or as organized digital files with multiple backups. This final act of organization proves you've done everything by the book, giving you the peace of mind to finally close this chapter and move on to the next one.

Unpacking the "What Ifs" of Closing a Business

Even with the best-laid plans, shutting down a business is a process filled with questions and "what if" moments. It’s natural. As you navigate the formal steps, a few common worries almost always bubble up. Getting straight answers to these tricky points isn't just helpful—it can save you a mountain of stress, time, and money down the road.

Let's dig into some of the most frequent questions I hear from owners during this challenging transition.

What Happens if I Just... Walk Away?

I get it. The temptation to just lock the doors and never look back is real. But skipping the formal dissolution process with the state is one of the most financially dangerous moves an owner can make. If you don't file the right paperwork, your business legally stays alive and kicking in the eyes of the government.

This means you’re still on the hook for annual reports, franchise taxes, and other administrative fees, even if you aren't making a single dollar. These costs can pile up for years, snowballing into serious debt and penalties. Creditors can also keep coming after the business for any money it owes.

Sometimes, the state might eventually force an "administrative dissolution" if you go silent for too long, but that’s not a clean getaway. It can tarnish your professional reputation and might not fully protect you from personal liability for old business debts or tax bills.

The Bottom Line: Simply abandoning your business isn't closing it. The formal dissolution is your legal armor. It officially terminates your company's existence and creates a hard stop for future liabilities, giving you a clear end date to your responsibilities.

Can I Sell Off Business Assets Before Officially Closing?

Absolutely. In fact, selling off your company's assets—a process called liquidation—is a required and expected part of winding things down. The money you make from selling equipment, inventory, intellectual property, or real estate is exactly what you'll use to pay off the company's debts.

But you have to do it by the book. For a corporation, a major asset sale usually needs a green light from the board of directors. For an LLC, your operating agreement will spell out the rules.

The most critical rule here is the order of operations. Any money from liquidation must go to your creditors first. Only after every single business debt is settled can any leftover cash be distributed to the owners or shareholders. Dipping into those funds for personal use before paying off creditors can lead to a court "piercing the corporate veil," which makes you personally responsible for business debts you thought you were protected from.

How Long Do I Need to Keep My Business Records?

This one surprises a lot of people. The safest bet is to keep all your business records securely stored for a minimum of seven years after you’ve officially closed up shop. It sounds like a long time, but there are powerful legal and financial reasons behind it.

The IRS typically has three years to audit a tax return. But that window stretches to six years if they believe you significantly underreported your income (by 25% or more). And if they suspect fraud? There’s no time limit at all.

Your records are your only proof. Make sure you hang onto:

- All federal, state, and local tax returns you filed.

- Final payroll documents, employment records, and W-2s.

- Bank statements and old canceled checks.

- Sales receipts and customer invoices.

- All legal documents, including contracts and the final dissolution papers.

A well-organized digital archive (with backups!) or clearly labeled boxes in a secure spot can be a lifesaver, protecting you from claims or lawsuits that can pop up years after you thought you were done.

What if the Business Has No Money to Pay Its Debts?

This is the million-dollar question, and the answer comes down to two things: your business's legal structure and how you've acted as an owner.

For owners of corporations and LLCs, you generally have a powerful shield called the "corporate veil." This principle creates a legal and financial wall between the business and you personally. If the business runs out of cash, creditors can typically only chase the business's assets, not your personal car or home.

But this shield isn't unbreakable. You can lose that protection and become personally liable if:

- You Signed a Personal Guarantee: If you personally guaranteed a business loan, that contract bypasses the corporate veil. The lender can come directly to you for the money.

- You Mismanaged Funds: If you mixed business and personal money in the same accounts (called co-mingling) or committed fraud, a court could decide to pierce the veil.

- You Didn't Pay Payroll Taxes: The IRS takes this very seriously. They can hold individual owners personally responsible for "trust fund" taxes—the Social Security and Medicare taxes you withheld from your employees' paychecks.

For sole proprietors and general partnerships, the situation is much more stark. There is no legal separation between you and the business. You are the business. This means you are personally on the hook for all business debts, and creditors have every right to pursue your personal assets to get what they're owed. This is a scenario where talking to a lawyer and a CPA is absolutely essential to understand what you're facing.