What Is Estate Liquidation A Practical Guide

So, what exactly is estate liquidation?

At its heart, it’s the organized process of selling off the contents of a home—all the tangible, personal property like furniture, artwork, collectibles, and everyday goods. It’s not just a yard sale; it's a comprehensive clear-out, usually prompted by a significant life event like a death, a major move, or a serious downsizing effort. The main goal is to convert a houseful of items into cash, simply and effectively.

Getting to the Core of Liquidation

Think of a home as a vessel that has collected a lifetime of memories and possessions. Estate liquidation is the methodical process of emptying that vessel by selling its contents. While this often happens after a loved one passes away, it's far from the only reason.

This process is really a practical solution for navigating some of life's toughest transitions. It gives you a structured framework for dealing with a huge volume of personal property that simply can't be kept, moved, or easily divided among family members.

Key Insight: The true purpose of estate liquidation is to achieve a complete and timely clear-out of a property. It’s about turning assets into cash to settle debts, distribute inheritances, or finance the next chapter of life.

This is a much bigger undertaking than a simple garage sale, designed to solve complex financial and logistical puzzles all at once. The need for these services has grown right alongside major demographic shifts. In fact, estate liquidation has blossomed into an industry in the United States worth about $230.3 million. This growth is largely fueled by an aging population navigating the challenges of estate management. If you're curious, you can discover more about the market drivers behind estate liquidation services to see why it's become so common.

When Is Liquidation The Right Move?

Certain life events almost always make liquidating an estate’s contents the most logical path forward. Recognizing these triggers can help you decide if this process is the right fit for your situation.

Here’s a breakdown of the most common scenarios that lead people to a full-scale liquidation.

Common Triggers for Estate Liquidation

| Triggering Event | Primary Reason for Liquidation | Key Considerations |

|---|---|---|

| Death of a Loved One | To settle the estate, pay off debts, and distribute assets to heirs according to a will or trust. | Sticking to legal timelines, dividing proceeds fairly, and managing the emotional attachment to items. |

| Downsizing for Retirement | Moving to a smaller home, condo, or assisted living facility with much less space for belongings. | Deciding what to keep vs. sell. Maximizing the financial return to support retirement funds. |

| Major Relocation | Moving long-distance or internationally where the cost to ship all possessions is just too high. | A cost-benefit analysis of moving items versus selling and buying new things at the destination. |

| Divorce or Separation | The need to fairly divide marital property and convert shared assets into cash for a settlement. | Ensuring a transparent and equitable sale process that both parties can agree on. |

Ultimately, each of these situations creates a clear need: a large number of items must be sold and removed from a property within a specific timeframe. That's precisely the problem that estate liquidation is designed to solve.

When Liquidation Becomes a Necessity

So, we know what estate liquidation is. But the real question is, when does it actually become the best, or only, option? It’s rarely a decision that comes out of the blue. Instead, it’s usually triggered by a handful of major life events that are as emotional as they are practical.

These situations can feel like a perfect storm of logistical headaches and personal stress. Knowing exactly why and when liquidation is the right move can bring some much-needed clarity when life feels chaotic.

Settling Debts and Final Expenses

One of the most common and urgent reasons for liquidation is the need to settle up financially after someone passes away. When a person dies, their estate is on the hook for any debts left behind—mortgages, credit card bills, medical expenses, you name it.

Often, there just isn't enough cash in the bank to cover everything. The executor has a legal duty to pay these bills, and selling the estate's physical assets is the most direct way to raise the money. It's like a mandatory financial reset. The property has to be sold to clear the debts before any remaining value can be passed on to the family. This legal requirement often makes liquidation a necessity, not a choice.

Key Takeaway: Liquidation is often a tool for satisfying legal and financial duties. It ensures that an estate’s debts are paid off completely, providing a clean slate for the beneficiaries.

This isn't a niche problem; it's the driver behind a massive global industry. The liquidation services market is valued at roughly $4.2 billion USD worldwide, with North America being a major hub. This number really highlights how many families and executors rely on liquidation to navigate these complex financial duties. You can learn more about the global liquidation market and its growth to see just how big the demand is.

Navigating Major Life Transitions

But liquidation isn't just about handling an estate after death. It's also an incredibly practical tool for managing other big life changes.

- Downsizing for Retirement: When you’re moving from a sprawling family home to a cozy condo or an assisted living facility, a lifetime of belongings just won't fit. Selling the excess furniture and goods not only clears out the house but can also add a nice financial cushion for your retirement years.

- Relocation: A big move across the country or overseas makes taking everything with you incredibly expensive and impractical. Liquidating non-essential items is almost always more cost-effective than paying for giant shipping containers.

In these moments, a structured liquidation turns an overwhelming mountain of "stuff" into a manageable, organized project.

The Challenge of Fairly Dividing Assets

Here’s another all-too-common trigger: the sheer difficulty of splitting physical property among several heirs. You can easily divide a bank account, but how do you split a grand piano, an antique dining set, or a vintage car three ways?

Trying to figure that out can quickly turn into family drama and resentment. Liquidation offers a clean, straightforward solution by turning physical items into cash—something that's incredibly easy to divide.

It takes the emotion and guesswork out of the equation. By selling the assets and splitting the money, everyone gets their fair share without having to argue over who wanted Mom’s favorite chair the most. It keeps things objective and helps keep the peace during an already tough time.

Choosing Your Liquidation Method

Once you’ve decided that liquidating the estate is the right move, the next big question is how to do it. There's no one-size-fits-all answer here. The best path forward really depends on your specific goals, the kind of items you're dealing with, and how much time and energy you can realistically put in.

Think of it like planning a trip. A flashy sports car is fun and fast, but you can’t pack much. An RV is slower, but it lets you bring everything along for the ride. Each liquidation method has its own pros and cons, and understanding them is the key to making a confident choice for your family.

Let’s break down the three most common ways to handle an estate liquidation.

The Traditional Estate Sale or Tag Sale

This is what most people picture: a company comes into the home, spends days organizing and putting a price tag on every single item, and then opens the doors for a weekend-long public sale. It’s essentially a professionally managed garage sale on a massive scale.

This method can be great for clearing out an entire household of everyday things—furniture, kitchenware, tools, you name it. It creates a one-stop-shop for local buyers who love the thrill of the hunt.

The downside? You’re handing over a lot of control. These companies often charge commissions from 30% to 50% of the total revenue, and you have to trust that they’re pricing everything correctly to get you the best return.

Consigning High-Value Items

What if the estate only has a handful of truly valuable things, like fine art, rare antiques, or designer jewelry? For special items like these, consignment can be a smart move.

Specialty dealers and high-end auction houses have a direct line to serious collectors who are willing to pay top dollar for what they want. This approach is all about maximizing the value of your most precious assets.

But it’s not a quick fix. Consignment can take months to pay off, and it does absolutely nothing to help you clear out the rest of the house.

The Modern Online Auction

Online estate auctions have quickly become a favorite for many families, offering a powerful blend of broad reach and efficiency. Instead of a chaotic weekend sale, your items are listed online for several days, attracting competitive bids from a much larger pool of buyers.

This competitive environment often drives prices higher. Plus, it’s a logistical dream. Everything is sold before a single, scheduled pickup day, which means no streams of strangers walking through the home for days on end. You can dig into a full comparison of these estate sale options to help you decide what makes the most sense for you.

To help you visualize the trade-offs, here’s a straightforward comparison of the methods.

Comparison of Estate Liquidation Methods

This table offers a side-by-side look to help you match a method to your specific timeline, goals, and the types of assets you're managing.

| Method | Best For | Potential Return | Effort Level | Speed |

|---|---|---|---|---|

| Traditional Estate Sale | Selling an entire household of general goods to a local audience. | Moderate to Good | Low (Company handles most work) | Fast (Usually a single weekend) |

| Consignment | A few high-value items like art, antiques, or jewelry. | Potentially High (for specific items) | Low to Moderate | Slow (Can take months) |

| Online Auction | A mix of general and valuable items, reaching a wider audience. | Good to High (Competitive bidding) | Moderate (Requires cataloging) | Fast (Sale is quick; one pickup day) |

Ultimately, choosing the right method comes down to what you value most. If you need the house cleared fast with minimal effort, a traditional sale might be the answer. If you have a few priceless treasures and time is on your side, consignment is worth exploring.

But for a modern, balanced approach that brings in a wide audience and harnesses the power of competitive bidding, an online auction is often the most effective and profitable solution.

Your Step-By-Step Liquidation Playbook

Tackling an estate liquidation can feel like staring up at a mountain. It looks huge and intimidating. But when you break it down into a series of smaller, logical steps, that mountain becomes a series of manageable hills. This playbook is your map, guiding you through each phase so you never feel lost.

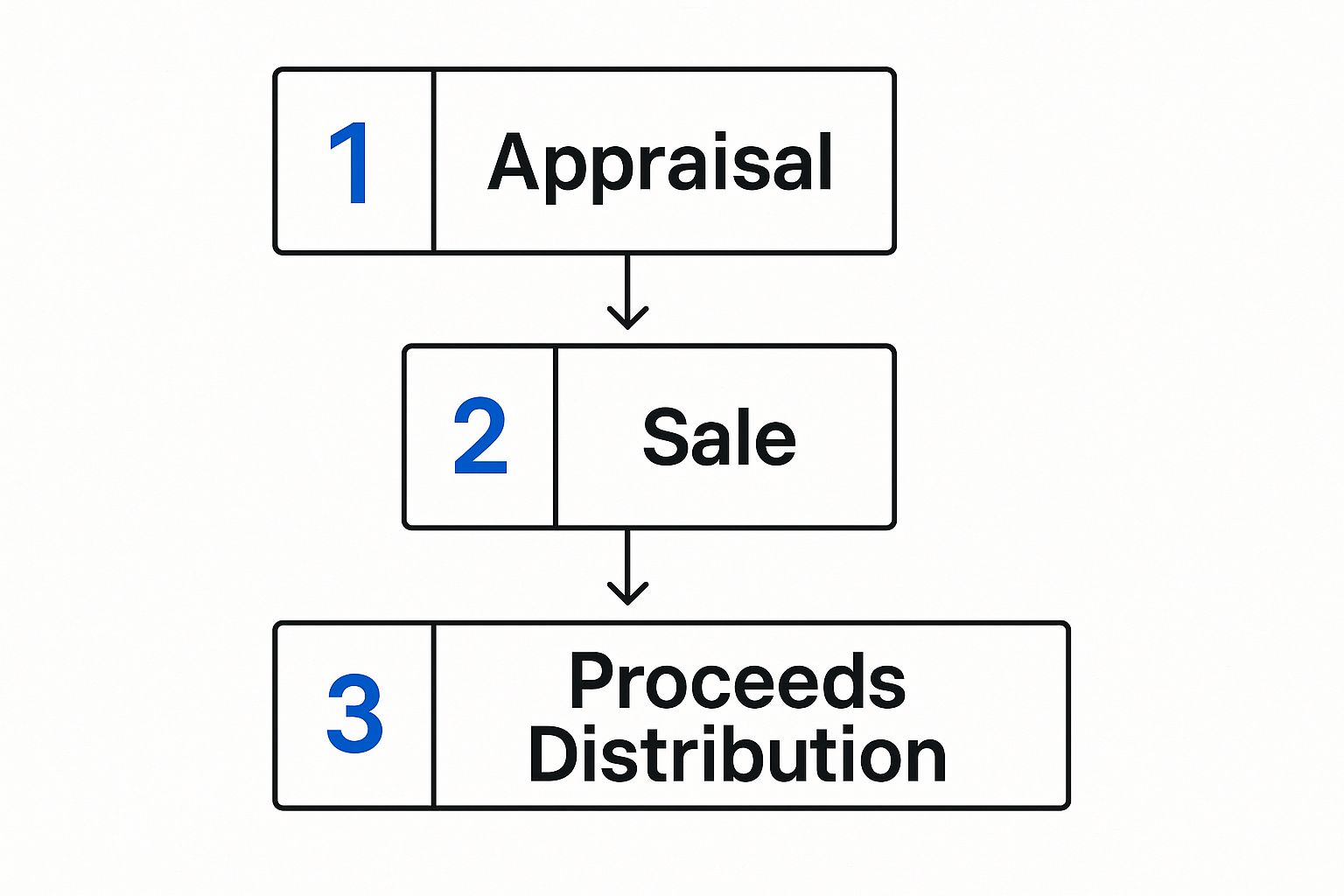

The whole thing follows a pretty natural sequence. This visual lays out the three main stages you'll work through.

As you can see, it flows from figuring out what you have, to turning it into cash, and finally, getting that money to the people who are supposed to have it.

Phase 1: Initial Assessment and Sorting

Before you even think about putting a price tag on anything, the real work begins with taking inventory. This is the foundation for everything that follows. Your primary job is to separate everything into three main piles.

- Personal Keepsakes: First and foremost, pull out anything with sentimental value or items that the will specifically gives to a family member. Think photo albums, personal letters, and cherished heirlooms. Get these items out of the house before any sale begins to prevent heartbreaking mistakes.

- Saleable Assets: This is everything else—furniture, tools, art, kitchen gadgets, and collectibles. These are the items you'll be cataloging to sell.

- Trash and Unsellable Items: You have to be honest about what’s actually worth something. Broken electronics, heavily worn-out furniture, and other items with no real market value just create clutter. Getting rid of them makes the good stuff stand out.

Crucial Tip: Don’t throw anything away until you are absolutely certain it’s worthless. What one person sees as junk—old fishing lures, costume jewelry, a box of vintage postcards—can be a hidden treasure to a collector. If you’re not sure, set it aside.

Phase 2: Professional Appraisal and Valuation

Once the sorting is done, you need to find out what everything is actually worth. Just guessing at prices is one of the biggest and most costly mistakes people make. You could be leaving thousands of dollars on the table without even knowing it.

This is where a professional appraiser is invaluable. They provide an objective, expert eye, and can accurately value everything from everyday furniture to rare collections. A formal appraisal is especially critical for:

- Antiques and fine art

- High-end jewelry and watches

- Collections of coins, stamps, or other rarities

- Vehicles

An accurate valuation doesn't just ensure you get a fair price; it gives you the official documentation needed for legal and tax purposes, which keeps everything transparent for all the heirs involved.

Phase 3: Choosing Your Method and Managing the Sale

With your inventory sorted and valued, you're finally ready to decide how you’re going to sell it all. As we've covered, your main options are hiring a traditional estate sale company, consigning the most valuable pieces, or running the event yourself through an online auction.

If you decide to partner with a service, this is when you'll interview companies, check their references, and sign a contract that clearly spells out their commissions and what they’ll do for you. From there, they take over the heavy lifting of the sale itself. Your job becomes one of oversight—making sure they’re doing what they promised.

Phase 4: Post-Sale Cleanup and Distribution

The sale is over, but you're not quite at the finish line. The final phase is all about handling what’s left and dealing with the money.

- Handling Unsold Items: It's almost unheard of for every single item to sell. Your agreement should be clear on what happens to the leftovers. Usually, this means donating items to charity (and getting a tax receipt), arranging a buyout with a liquidator, or simply calling a junk removal service.

- Final Accounting: Once all the money is collected, your sale partner will provide a detailed settlement statement. This report shows the total sales, their commission and fees, and the final net amount going to the estate.

- Distribution of Funds: This is the last—and most important—step. As the person in charge, you’ll first use the proceeds to pay any of the estate’s debts, taxes, or administrative fees. Whatever is left over is then distributed to the heirs, either according to the will or by state law.

Breaking Down the Costs of Liquidation

Let's talk about the money side of things. Understanding how you'll pay for a professional estate liquidation is absolutely essential. When you bring in an expert company, you're not just hiring someone to run a sale—you're investing in their experience, their network of buyers, and a whole lot of heavy lifting. Getting clear on the costs from the start means no sticker shock later on.

The industry standard is a commission-based fee. Instead of you writing a big check upfront, the company takes a percentage of the total sales. This is a great model because it means your goals and the company's goals are perfectly aligned. The more money they can make for the estate, the more they earn.

But what exactly are you paying for with that commission? It's not just for the hours the doors are open. It’s for the entire end-to-end service that makes a successful sale happen.

What Does the Commission Typically Cover?

Think of the commission as the all-in price for getting the core job done. While the details can vary from one company to the next, a standard commission fee almost always includes:

- Labor and Staffing: This is a big one. It covers the team of people needed to sort through everything, organize it, stage the home to look like a retail space, and price every single item.

- Marketing and Advertising: Getting the word out is key. Professionals use their dedicated email lists, social media channels, and industry-specific websites to draw in a crowd of serious, ready-to-buy shoppers.

- Sale Management: This is the hands-on work of actually running the sale. Whether it's a weekend tag sale or a week-long online auction, they manage all the customer service, questions, and checkout processes.

- Payment Processing: All the logistics of securely accepting payments, including any credit card transaction fees, are usually rolled into the commission.

Commission rates can swing quite a bit, generally landing somewhere between 30% and 50%. The final number really depends on the quality and quantity of the items, how much labor is involved, and what the local market looks like. To get a really detailed look at what drives these numbers, check out our guide on understanding estate sale commission rates.

Key Financial Insight: A lower commission rate isn't automatically a better deal. A more experienced company might charge a higher percentage but bring in so many more buyers that the estate's final payout is significantly larger. It's the net result that counts.

Potential Extra Costs to Watch For

While the commission covers the sale itself, some tasks might fall outside that fee. It’s smart to ask about these potential add-ons before you sign anything so you have a complete financial picture.

These extra charges usually pop up for work needed before or after the main event. Common ones include:

- Excessive Trash Removal: If the property needs a major clean-out or junk hauling that goes beyond a typical sale prep, that will likely be a separate charge.

- Specialized Appraisals: Got a rare piece of art, a high-end watch, or a collection of antique coins? You might need a certified third-party appraiser, and that expert's fee is extra.

- Deep Cleaning Services: Once the sale is over and the house is empty, some companies offer deep cleaning services to get the property ready for the market, which is usually billed separately.

- Moving or Storage Fees: If you decide to keep certain large items and need them moved or stored, those logistical costs are passed on to you.

By asking direct questions about what the commission includes—and more importantly, what it doesn't—you can make sure your contract reflects the true cost of the estate liquidation. This protects you from any last-minute financial surprises.

Finding a Trustworthy Liquidation Company

Choosing the right partner for your estate liquidation is probably the most important decision you'll make in this entire journey. You aren't just hiring a company to sell off some stuff; you're putting a home full of memories—and significant financial value—into someone else's hands.

A great partner brings experience and peace of mind. The wrong one can cause a world of stress and leave money on the table. Think of it like hiring a captain for a ship. You need someone who knows the waters, can navigate any storm, and will get your precious cargo to its destination safely. This is your guide to vetting those captains.

Verifying Credentials and Reputation

Before you even pick up the phone, it’s time to do a little research. Your first move is to confirm that the company is a legitimate, professional operation. Any liquidator worth their salt will be upfront about their credentials and proud of their reputation.

Here’s what to check for:

- Insurance: This is non-negotiable. The company absolutely must carry both general liability and workers' compensation insurance. This protects you from any liability if a shopper trips and falls on the property or if one of their employees gets hurt during the sale.

- Professional Memberships: It’s a good sign if they belong to groups like the National Estate Sales Association (NESA) or the American Society of Estate Liquidators (ASEL). These organizations often have a code of ethics that members are expected to uphold.

- Online Reviews: See what past clients are saying on Google, Yelp, and even their own company website. You're looking for consistent feedback about their communication, professionalism, and the final results. A single bad review isn’t necessarily a deal-breaker, but a pattern of complaints is a huge red flag.

Questions to Ask During the Interview

Once you have a shortlist of a few companies, it’s time to interview them. This is your chance to get a feel for how they work and see if their style fits your needs. Don't hold back—ask direct questions. How they answer will tell you a lot about their experience and how they do business.

A great way to start is by asking for comprehensive estate sale help and listening to how they explain their entire process. Then, dig deeper with these essentials:

- What is your marketing strategy? You need to know how they plan to get buyers in the door (or to the online sale). Do they have a big email list or an active social media following? A strong marketing plan is what drives turnout and gets you better prices.

- How do you handle high-value items? Do they have appraisers on their team or connections to specialists for things like fine art, jewelry, or rare collectibles? You need to know your most valuable assets will be priced correctly.

- What is your process for unsold items? What happens to everything that doesn't sell? Will it be donated, hauled away, or sold to a buyout company? Make sure you understand exactly how the house will be left completely empty.

- Can you provide a sample contract and settlement statement? Looking at these documents ahead of time helps you understand their fees, terms, and how you’ll get paid. No surprises.

Key Takeaway: A true professional will welcome your questions and give you clear, straightforward answers. If they get defensive or can't produce basic documents, it's a sign to walk away.

Insist on a Detailed Written Contract

Finally, never, ever move forward without a signed, written contract. This document is your single most important piece of protection. It needs to spell out every single detail of your agreement so there’s no room for confusion later on.

The contract must clearly state the commission rate, any other fees, the dates of the sale, and a full list of the services included. It ensures everyone is on the same page and gives you a clear path forward if anything doesn't go as planned.

Answering Your Top Estate Liquidation Questions

Once you get a handle on the basics of estate liquidation, a few practical questions almost always pop up. Getting clear answers to these can make the whole process feel much less daunting. Here are the straight-up answers to the questions we hear most often.

How Long Does an Estate Sale Really Take?

The timeline can definitely vary, but a typical estate liquidation, from the first conversation to the final check, usually takes about four to eight weeks.

This window accounts for everything: sorting through all the items, getting appraisals for unique pieces, marketing the sale, holding the event itself, and then managing the final clear-out. An online auction can sometimes shorten this, since the sale happens online over a few days, leading up to a single, scheduled pickup day.

What can stretch out the timeline?

- The sheer size of the estate and the number of items.

- Needing to bring in specialists for things like rare art, coins, or jewelry.

- The sale method you choose—a traditional in-person sale requires more setup time than an online auction.

What Happens to the Stuff That Doesn't Sell?

It’s completely normal for some items to be left over after a sale—in fact, it’s rare for everything to sell. A professional will have a clear plan for what comes next, which usually involves a few options.

Most often, they’ll coordinate a donation to a local charity and make sure you get a tax-deductible receipt for the estate. Another common route is a "clean out" or buyout, where a company buys all the remaining contents for one flat price. The goal is always the same: to leave the home completely empty and ready for its next step.

Expert Tip: A solid contract will spell out the plan for unsold items. Always talk about this before the sale starts. You don’t want any surprises or unexpected costs when it's time to clear the house.

Is the Money From an Estate Sale Taxable?

For most people, the answer is no, the proceeds from an estate sale are not considered taxable income. This is thanks to a tax rule called the "stepped-up basis."

Here’s how it works: the value of the items you inherit is "stepped up" to their fair market value on the date the original owner passed away. Since you're usually selling those items for right around that same market value, there’s no profit, or capital gain, to be taxed.

The only exception is if you sell an item for significantly more than its appraised value at the time of death. That extra profit could be taxable. When in doubt, it’s always a good idea to chat with a tax professional to be sure about your specific situation.