Demystifying Estate Sale Commission Rates

While there’s no single, universal price tag for running an estate sale, you’ll find most professional companies charge a commission rate somewhere between 35% and 50%.

It's helpful to think of it as a partnership. The estate sale company fronts all the time, labor, and expertise needed to make your sale a success. Their payment is simply a percentage of the final results, which perfectly aligns their goals with yours.

What's Really Behind the Commission Rate?

Hearing that a company will take a percentage of the gross sales can be a bit of a shock at first. But that commission isn't just a simple fee—it's how the company covers the immense, upfront cost of a project that most families just aren't equipped to handle on their own, especially during an emotional time.

This model is the industry standard for a good reason: it completely removes your upfront financial risk. You aren’t writing checks for the countless hours of sorting, cleaning, researching, pricing, staging, and marketing that happen long before the first customer walks through the door. The company takes on that risk, betting that their professional process will generate enough revenue to pay for their work and, most importantly, leave a significant profit for you.

What That Percentage Actually Pays For

The specific rate a company quotes you will reflect the complexity and scale of your unique situation. A rate on the lower end, around 35%, might be for an estate packed with high-value, easy-to-sell items that don't need a ton of prep work.

On the flip side, a rate closer to 50% is often necessary for a more demanding project. This could involve:

- Extensive clean-out and decluttering of a very full home.

- Deep research needed for niche collectibles or unusual items.

- Tough logistics, like a remote location or poor access to the property.

- A lower overall estimated value, which means the company has to work much harder to create a profitable outcome for everyone.

To help visualize how this works, here’s a look at how rates often scale with the estate's value.

Typical Estate Sale Commission Rate Tiers

This table shows how commission rates can shift based on the estimated total value of the items for sale. Lower-value estates often require a higher commission percentage to make the project viable for the company.

| Estimated Gross Sale Value | Common Commission Rate Range | What This Means for You |

|---|---|---|

| Under $15,000 | 45% - 50% | Sales of this size require nearly the same amount of labor as larger sales, so the company needs a higher cut. |

| $15,000 - $50,000 | 40% - 45% | This is a very common range for many average estates. The rate is balanced against the expected workload and outcome. |

| Over $50,000 | 35% - 40% | For high-value estates, companies are often willing to take a smaller percentage because the total payout is larger. |

Ultimately, a lower percentage doesn't always mean a better deal. A skilled company charging 45% might gross you far more in total sales than a less experienced one charging 35%.

At its core, an estate sale commission is what you pay for expertise, hands-on project management, and total peace of mind. You're hiring a team to take a massive, stressful liquidation off your plate, saving you hundreds of hours of work and emotional strain.

Remember, any good company wants to maximize the sale's total gross revenue. When the sale brings in more money, both you and the company win, creating a true partnership.

To get a clearer picture of how these fees work in the real world, check out our guide on the average estate sale commission and what to expect. Having this baseline knowledge is your best tool for comparing contracts and finding a partner who offers fair, transparent value.

How Different Commission Structures Work

While the industry has a general range for commission, the way that fee is calculated can make a big difference. It’s not a one-size-fits-all situation. Understanding how these models work is the key to picking the right company and getting a realistic idea of your final payout.

The most common and easy-to-grasp approach is the flat-rate commission.

With a flat-rate deal, the company takes a single, agreed-upon percentage of the total gross sales. No surprises, no complicated math. If your contract is for 40% and the sale brings in $30,000, the company’s fee is $12,000. Its simplicity makes it a popular choice.

But a flat rate isn't your only option. Many experienced companies use more dynamic models that are actually designed to get you a better result.

The Sliding Scale Commission

A very common alternative is the sliding scale commission. This model is all about rewarding performance. Think of it like income tax brackets—the rate changes as the total sales grow. This setup gives the company a powerful incentive to work harder and sell more because their success is directly tied to yours.

Here’s a real-world example of how a sliding scale might look:

- 45% commission on the first $15,000 of gross sales.

- 35% commission on all sales above $15,000.

So, if the sale grosses $40,000, you don't just pay 35% on the whole amount. It breaks down like this:

- First Tier: $15,000 x 45% = $6,750

- Second Tier: The remaining $25,000 ($40,000 - $15,000) is charged at the lower rate. $25,000 x 35% = $8,750

- Total Commission: $6,750 + $8,750 = $15,500

This structure allows the company to cover its higher initial costs for setup and marketing on the first chunk of sales, while motivating them to push for every last dollar at the end.

Understanding the Minimum Guarantee

Finally, you might see a clause for a minimum guarantee, also called a commission minimum. This isn't an extra fee you pay upfront. It's a safety net for the estate sale company. It ensures their significant investment in labor, advertising, and staff is covered, even if a sale underperforms.

A minimum guarantee protects the company from taking a financial loss on a smaller or particularly labor-intensive estate. For instance, a contract might specify a 45% commission with a $7,000 minimum. If the sale only grosses $12,000, the 45% commission would only be $5,400. In this case, the company would receive the $7,000 minimum instead.

You'll most often see this with estates that have a lower estimated value or need an exceptional amount of cleaning and organization.

By getting a handle on these different models—flat rate, sliding scale, and minimums—you'll be able to read any contract like a pro and choose the financial arrangement that truly fits your family's situation.

The Key Factors That Influence Your Rate

So, why does one estate sale company quote you a 35% commission while another pitches 50% for a different sale? It might seem random, but it's really not. The truth is, there are a few key variables that directly shape the final estate sale commission rates you'll be offered.

It helps to think of it like hiring a contractor for a kitchen remodel. A simple cabinet refresh is going to cost a lot less than a full gut job with custom marble countertops and high-end appliances. In the same way, the complexity of your estate and its potential for profit will determine the company's fee. Once you understand these factors, you'll see exactly why your quote is what it is.

The biggest factor, hands down, is the quality and value of what's in the home. An estate packed with desirable antiques, in-demand collectibles, or fine art is a much more appealing project for a company. Since the potential gross sales are much higher, they can afford to offer you a more competitive, lower commission rate.

On the flip side, an estate filled mostly with standard, everyday household goods presents a different financial reality. The company still has to put in just as much work to sell everything, but the total revenue will be far lower. This means they need a higher commission to make the project worthwhile.

The Scope of Labor and Preparation

The amount of sheer physical work needed to get a home ready for a sale is a massive cost driver. A well-kept, organized home will always get a better rate than one that needs a ton of labor just to get started.

The level of prep work directly impacts estate sale commission rates:

- Decluttering and Cleaning: Does the company need to sift through decades of accumulated belongings or do a major deep clean? A true "hoarder" situation, for example, demands an incredible amount of labor and will naturally lead to a higher commission.

- Research and Pricing: An estate with specialized collections—like rare books, military memorabilia, or fine art—requires serious research time to price things correctly. That expert valuation is a valuable service, and it's built into the rate.

- Staging and Merchandising: A professional company doesn't just throw things on tables. They stage the home like a retail boutique to make everything look as appealing as possible, a process that takes both time and a trained eye.

The less work you leave for the company, the more leverage you may have in negotiating a lower rate. Handling the initial clean-out yourself, for instance, can sometimes reduce the quoted commission.

Location and Company Expertise

Finally, where the sale is held and who you hire both play a huge part. A home in a busy, easy-to-access neighborhood with a strong market for secondhand goods is simply easier to promote. If the home is in a remote or hard-to-reach location, it adds logistical headaches that can bump up the rate.

A company's reputation and track record are also part of the deal. A top-tier firm with a long history of getting great results might charge a higher commission. But think about it—their expertise could easily lead to a much larger net payout for you, making that higher rate a smart investment. It's all about balancing the upfront cost with the proven value they bring to the table.

What Your Commission Fee Actually Pays For

When you see an estate sale company's commission rate, it's easy to get sticker shock and focus only on that number. But that percentage isn't just a fee for pricing a few items and unlocking the front door.

What you're really paying for is a complete, hands-off project management service. You're hiring a team to step in and handle a complex, labor-intensive, and often emotionally draining liquidation from start to finish. Think of it as investing in expertise, efficiency, and most importantly, your own peace of mind.

The Pre-Sale Grind: Labor and Preparation

Long before the first shopper even knows a sale is happening, the real work begins. This is the most demanding phase of the process, and the estate sale company fronts all the time, labor, and initial costs before they’ve earned a dime.

Here’s a glimpse of what's happening behind the scenes:

- Initial Consultation and Strategy: It all starts with a walkthrough. This is where a plan is formed based on the home's contents, and realistic goals are set for the sale.

- Sorting and Organizing: This is the heavy lifting—literally. Professionals go through every room, every closet, every attic, and every drawer to sort what can be sold, what should be donated, and what's simply trash.

- Inventory and Research: Key items don't just get a price tag slapped on them. The team catalogs important assets and dives into market research to accurately price everything from antique furniture to everyday kitchenware, ensuring you get top dollar.

- Cleaning and Staging: A pro team doesn't just lay things out on dusty tables. They clean the home and artfully stage the merchandise to create a welcoming, shoppable environment that encourages people to browse longer and buy more.

Sale Management, Marketing, and The Aftermath

Once the house is prepped and staged, the focus shifts to running a smooth, secure, and profitable event. This is where a company's experience really shines, turning what could be chaos into an orderly, successful sale. The commission covers all the professional services needed to maximize your gross revenue.

A professional company's fee covers a full suite of services that a family would otherwise have to coordinate and pay for individually. You are hiring a team to manage logistics, security, marketing, and sales execution, turning a chaotic process into an orderly one.

This phase includes critical operational tasks:

- Strategic Marketing: It’s more than a sign on the lawn. They create targeted ad campaigns on estate sale websites, social media, and through their own dedicated email lists of loyal buyers.

- Professional Staffing: On sale days, they provide enough knowledgeable staff to manage the crowds, answer questions, write up tickets, and help customers.

- Security and Payments: A good company ensures the property is secure and shoppers are safe. They also handle all the transactions, including setting up systems to securely process cash and credit cards.

- Post-Sale Clean-Out: What happens to the leftovers? Your contract will specify how unsold items are handled, which could involve coordinating with donation centers, arranging a final buyout, or hauling away the remaining trash.

When you break it down, it's clear that estate sale commission rates are about so much more than a simple fee. For a deeper dive, you can learn more about standard estate sale fees and what should be included in your agreement. You're paying for a comprehensive solution that saves you an incredible amount of time and stress while generating a far better financial outcome.

Choosing Your Best Liquidation Path

Before you dive deep into estate sale commission rates, it’s worth taking a step back to ask a critical question: Is an estate sale actually the right path for you?

It’s a fantastic tool, but it's not the only tool in the shed. Making the best decision means putting an estate sale head-to-head with the other common ways to liquidate assets, like auctions, consignment, and direct buyouts.

Each method comes with its own way of charging for services and really shines in different situations. Think of it like choosing how to travel. A full-service estate sale is like a reliable minivan—perfect for moving an entire household of different items over a single weekend. An auction is more like a sports car; it's fast and exciting for a few specific high-value items but totally impractical for hauling everyday furniture and kitchenware.

Comparing Your Liquidation Options

The best choice boils down to what you need most: squeezing every last dollar out of the items, getting the process over with quickly, or simply minimizing your own stress and effort.

For example, a consignment shop might be a great fit for your five pieces of designer furniture, but it’s just not built to handle the entire contents of a three-bedroom home. On the flip side, a direct buyout offers incredible speed, but you'll almost always sacrifice a significant amount of the potential cash you could have earned.

The most effective liquidation strategy is the one that aligns with your specific goals. If your priority is to clear a home quickly with the least amount of stress while getting a fair return on a wide variety of items, an estate sale often strikes the perfect balance.

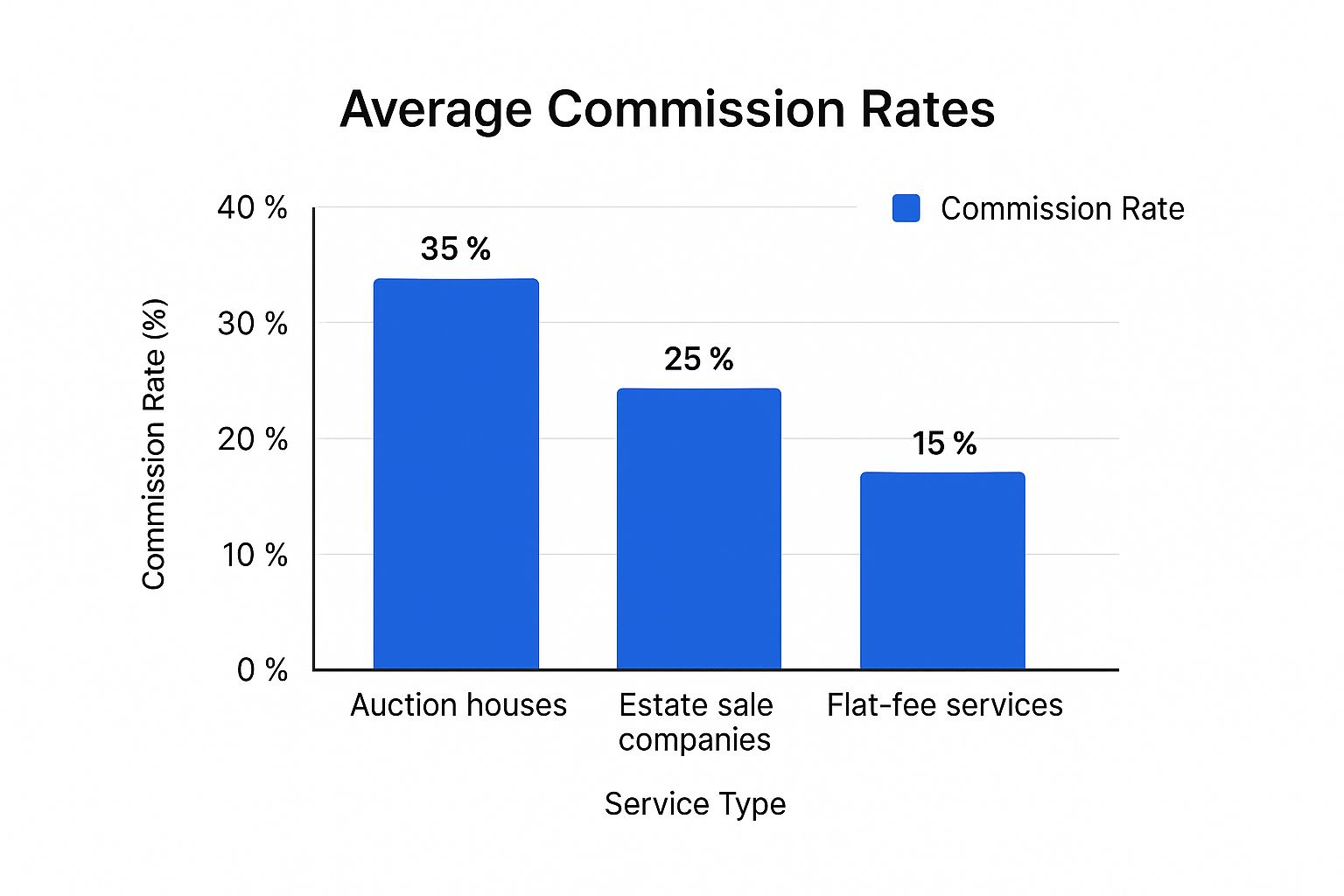

To give you a visual, this chart compares the typical commission rates you can expect from different liquidation services.

As you can see, traditional estate sales, with rates often between 35% and 50%, hit a sweet spot. They offer a comprehensive, hands-off service that’s still very cost-effective. Now, let’s dig into the details of each method so you can see which one truly fits your needs.

Comparing Estate Liquidation Methods

To make it even clearer, here’s a simple side-by-side look at the most common ways to liquidate estate contents. This table highlights the key differences in how they work and what you can expect from each.

| Method | Typical Fee Structure | Best For | Primary Pro | Primary Con |

|---|---|---|---|---|

| Estate Sale | 35% - 50% commission | Liquidating a full household with varied items. | Maximizes value for a wide range of goods. | Can take several weeks from start to finish. |

| Auction | 20% - 50% commission + fees | Selling high-value collectibles, art, or antiques. | Creates competition that can drive up prices. | Everyday household items often sell for very little. |

| Consignment | 40% - 60% commission | A small number of high-end items like furniture or fashion. | Access to a targeted, niche buyer market. | Slow payment process and no guarantee of a sale. |

| Direct Buyout | No commission (lowball offer) | A very fast, as-is liquidation with no effort. | Extremely fast closing, often in a few days. | Significantly lower financial return for your items. |

Ultimately, weighing these pros and cons against your personal situation is the key. Are you in a hurry? Do you have a house full of antiques or just everyday goods? Answering those questions will point you toward the right liquidation partner.

How to Hire the Right Company and Negotiate a Fair Deal

Choosing your estate sale partner is easily the single most important decision you'll make in this entire process. The right company can feel like a godsend, maximizing what you earn while minimizing your stress. The wrong one? It can leave you with a mess and a seriously disappointing bottom line.

This is why you absolutely must vet your potential partners thoroughly. Make it a point to interview at least three different companies. This lets you compare not just their estate sale commission rates, but also their communication style, their proposed services, and the general vibe you get from them. Whatever you do, never sign a contract on the spot. Give yourself time to breathe and review each proposal.

Key Questions to Ask Every Company

When you’re talking to these companies, you need to look past the headline commission rate. A low percentage means nothing if it’s attached to lackluster marketing, a sloppy process, or a bunch of hidden fees that pop up later. Your job is to understand the full picture of what they offer.

Here are the non-negotiables to ask about:

- Insurance and Bonding: The first question should always be, "Are you fully insured and bonded?" Don't just take their word for it—ask to see the paperwork. This protects you from liability if someone gets hurt on your property during the sale.

- Marketing Strategy: Ask them to walk you through how they'll advertise your sale. You want to hear about a real plan that includes online listings, social media promotion, and, most importantly, a solid email list of proven, local buyers.

- Unsold Items: Get crystal clear on what happens to items that don't sell. Does their service include clean-out? Are there extra charges for donation runs or hauling away trash? You need to know this upfront.

- Pricing Strategy: Dig into how they price things. An experienced pro will be able to explain their process, which should be a blend of solid market research and years of hands-on expertise.

A reputable company will welcome your questions and give you clear, transparent answers. If someone gets defensive, seems evasive, or pressures you to make a fast decision, see it for the major red flag it is and walk away.

Negotiating a Fair Agreement

Remember, negotiation isn't about strong-arming someone into the lowest possible rate. It’s about landing on a fair agreement that makes sense for the amount of work involved and the value of the estate.

If you happen to have a home filled with high-value antiques or a significant collection, you likely have some leverage to ask for a lower commission. Why? Because the company still stands to make a healthy profit.

You might also be able to get a better rate by offering to do some of the upfront work yourself. For example, if you handle the initial sorting and decluttering, the company might reduce its fee to reflect the time and labor they’re saving.

Finding the right partner takes a bit of effort, but a great starting point is to see what the best estate sale companies offer. This gives you a benchmark for what top-tier service looks like. The end goal is simple: a transparent, fair partnership where everyone wins.

Common Questions About Estate Sale Commissions

Once you have a handle on how commission rates work, a few more practical questions usually pop up. It’s completely normal. Getting clear answers is the best way to feel confident about hiring an estate sale company and moving forward.

Let’s tackle some of the most common questions we hear.

A professional, reputable estate sale company will never ask for any money upfront. Their entire business is built on performance. They invest their own time, money, and resources to market and run your sale. They only make money when you do, so there should be absolutely zero out-of-pocket costs to get started.

What Happens to Unsold Items?

It’s the million-dollar question: what about the stuff that doesn't sell? Even the most successful sales rarely sell every single item. A good contract will spell out the plan for handling the leftovers so there are no surprises.

You’ll typically see a few options:

- Donation: The company can arrange for a charity to come and pick up the remaining items. You'll get the donation receipt for tax purposes.

- Buyout: Sometimes, the company works with a third-party liquidator who will offer a flat-rate price to buy everything that's left. This amount is then added to your total sale proceeds.

- Trash Haul-Away: For anything that can't be sold or donated, the company will coordinate its disposal.

The costs for these clean-out services are almost always deducted from your final payment, not billed to you separately. Just double-check that your agreement lays this out clearly.

Key Takeaway: You should get paid—and get a full accounting—very quickly after the sale is over. A professional will give you a detailed settlement statement that breaks down the gross sales, their commission, and any other agreed-upon costs like the clean-out fees.

You can generally expect to have a check in your hand and the final paperwork within 7 to 14 business days after the last day of the sale. This gives the company enough time to square up all the payments, reconcile their records, and wrap up those post-sale logistics.