What Is the Average Estate Sale Commission?

When you start looking into estate sales, one of the first questions that comes up is, "How much does it cost?" The most common answer you'll find is a commission fee, which typically lands somewhere between 35% and 45% of the total sales.

This might sound like a big chunk, but it’s a smart model. It means the estate sale company's success is directly tied to yours. The more money they can make for the estate, the more they earn themselves.

Decoding the Standard Estate Sale Commission

When you hire a professional to run an estate sale, you're not just paying someone to slap price tags on old furniture. You're investing in a comprehensive service that takes a complex, emotional, and frankly exhausting process completely off your plate. That commission is how the company gets paid for handling everything from start to finish.

Think of it as a true partnership. The company puts up all the initial time, labor, and money for sorting, researching, pricing, staging, marketing, and staffing the sale. Their paycheck depends entirely on a successful outcome, which is a pretty powerful motivator for them to get the best possible prices for your items. It’s become the industry standard simply because it’s fair for everyone involved.

Why a Percentage Model Works

This commission-based structure keeps the company motivated to push for the highest possible revenue. When the total sale amount goes up, everybody wins. Across the U.S., you’ll see rates ranging from 30% to 50% of the gross sales, but that 35% to 45% national average is the sweet spot. That fee covers the incredible amount of work and expertise it takes to efficiently liquidate the entire contents of a home.

For you, the client, it means you don't have to pay a bunch of money upfront for a service when you don't even know what the final result will be. If you want to dive deeper into how these fees are calculated, our guide to understanding estate sale commissions is a great place to start.

Key Takeaway: The commission isn't just a fee; it's a performance-based payment. The estate sale company only gets paid if they successfully sell your items, directly linking their effort to your financial return.

To give you an even clearer picture, let's break down what you can generally expect at different commission levels.

Typical Estate Sale Commission Rates at a Glance

This table gives you a quick summary of standard commission percentages and what kind of service is usually included at each level.

| Commission Tier | Average Percentage Range | Commonly Included Services |

|---|---|---|

| Standard | 35% - 45% | Full-service management, including sorting, pricing, staging, marketing, sale staffing, and payment processing. |

| High-Value | 25% - 35% | Reserved for estates with significant fine art, antiques, or verified collectibles. Includes specialized marketing. |

| Complex/Small | 45% - 50%+ | For sales requiring extensive cleanup, located in remote areas, or with a lower overall estimated value. |

As you can see, the rate often reflects the amount of work required and the potential value of the items being sold. It’s all about finding the right fit for your specific situation.

What Affects the Commission Rate?

That 35% to 45% commission rate you often hear about is a great starting point, but it's rarely the final number. When you start calling companies for quotes, don't be surprised if the percentages vary quite a bit. This isn't random—it’s a calculated figure based on the unique details of your estate.

Think of it like hiring a contractor to paint your house. The price isn't just about the square footage; it's about the prep work, the number of coats needed, and the complexity of the job. In the same way, an average estate sale commission gets adjusted based on two huge factors: the value of what you’re selling and the amount of work it’ll take to sell it.

The Value of the Estate

By far, the biggest influence on an estate sale company’s rate is the total estimated value of the contents. A home packed with valuable assets—think fine art, sought-after collectibles, or authenticated antiques—is a much bigger opportunity for the company. Their percentage might be smaller, but it’s a piece of a much larger pie. In these cases, you’ll often see rates drop into the 25% to 35% range.

On the flip side, an estate filled with more typical household goods, standard furniture, and everyday items has a lower potential gross. To make the sale worth their time and effort, the company needs to take a larger slice. This is when commissions will push toward the higher end, often 45% or even 50%.

The Value Equation: It's a simple relationship. A higher potential sales total usually means a lower commission percentage for you. The company can hit its profit goals with a smaller piece of a much bigger sale.

The Scope of Work and Logistics

Beyond just the value, the sheer amount of physical labor required plays a massive role in setting the final commission. A few logistical hurdles can easily drive the rate up.

- How Much Stuff Is There? A cluttered, three-story home with a packed attic and garage is a ton more work to sort, clean, and stage than a tidy, two-bedroom apartment. More stuff means more hours for the crew.

- What's the Condition of the Home? If the company has to do a major clean-out, haul away trash, or do a lot of organizing just to find and display the items, they'll build that extra labor cost right into their commission.

- Where Is the Sale Located? An estate in a remote or hard-to-reach area can also command a higher commission. The company has to think about how hard it will be to attract buyers and how much time their staff will spend traveling.

At the end of the day, the company is doing a quick risk-reward analysis. They're weighing the potential payoff from the sale against the very real upfront investment of their time, labor, and resources. Every quote you get for an average estate sale commission is a direct reflection of that business decision, customized to your specific situation.

So, What Does That Commission Actually Pay For?

When you hear a commission rate like 35% to 45%, it’s easy to get a little sticker shock. You might wonder, "Where is all that money going?" It's a fair question. The key is to understand that you're not just paying someone to run a weekend yard sale. You're hiring a team of specialists for a full-service, white-glove liquidation project.

Think of it this way: an estate sale company is like a general contractor for your personal property. You hand over the keys, and they take care of absolutely everything else. This frees you from what can be an incredibly emotional, time-consuming, and physically demanding job. The average estate sale commission is an investment in expertise and peace of mind.

The Mountain of Work Before the Sale

Believe it or not, the most labor-intensive part of the process happens long before a single customer sets foot in the home. This is where a company's experience really shines and where they earn a huge chunk of their commission. We're not talking about a quick tidying-up; it's a massive, detailed operation.

Here’s a glimpse of what goes on behind the scenes:

- Sorting and Organizing: Professionals methodically work through every single room, closet, cabinet, and box. Their job is to separate valuable items from personal paperwork and plain old trash—a task that can easily involve sifting through thousands of individual objects.

- Research and Appraisal: This is where the real expertise comes in. For anything that looks special—art, antiques, jewelry, or rare collectibles—the team hits the books. They research current market values to make sure you don't unknowingly sell a family treasure for a few dollars.

- Pricing and Tagging: Every item destined for the sale gets its own price tag. This isn't guesswork. It's a painstaking process that requires a deep understanding of what secondhand goods are actually selling for right now.

By putting in dozens, or sometimes hundreds, of hours on the front end, the company is building the foundation for a successful event. This intensive prep work is the biggest reason a sale succeeds or fails.

Staging, Marketing, and Managing the Event

Once everything is sorted and priced, the real transformation begins. The team doesn't just pile things on tables. They professionally stage the home, creating a clean, inviting, almost boutique-like environment that encourages people to shop longer and spend more.

Then comes the marketing. Your commission funds a targeted advertising campaign to get the right buyers in the door. This isn't just a sign on the corner; it includes professional photos, email blasts to a company’s private list of repeat customers, social media promotions, and strategic local signage.

During the sale itself, the company provides a full crew to manage the crowds, answer questions, handle price negotiations, and process all payments securely. They are also on the hook for the security of your home and everything in it for the entire event. Once the doors close for the last time, their job still isn't done. They manage the final logistics, like arranging for the donation or disposal of any unsold items, and provide you with a complete financial breakdown of the sale.

Unpacking Hidden Fees and Extra Charges

While the average estate sale commission is the biggest slice of the pie, it’s rarely the only cost you’ll see. Think of the commission as the fee for the main event—the company's expertise in pricing, staging, and running the sale itself. But just like with any major service, extra tasks can sometimes mean extra charges on the final invoice, especially if they weren't discussed upfront.

It’s a lot like hiring a moving company. The base quote gets your couch from the old house to the new one, but you'll probably pay more for things like packing supplies, taking apart your bed frame, or moving that antique piano. Estate sale companies operate in a similar way, often charging separate fees for services that fall outside their standard package.

Common Additional Charges to Ask About

Every company is different in how they structure their pricing. Some might roll everything into a higher commission rate, while others prefer to list extra services as separate line items. Your goal is simple: get a crystal-clear, all-in price before you sign anything.

It’s a common misconception that the commission is the only fee. In reality, about 80% of estate sale companies have additional charges for things like advertising, trash removal, post-sale cleaning, and credit card processing. These aren't just random add-ons; they're services designed to make the sale more successful and your life easier. To get a better handle on what to expect, you can see what other costs might come up on probate.leavethekey.com.

The single most important thing you can do is insist on a detailed contract. A trustworthy company will be completely transparent about every potential cost, leaving no room for surprises when you get your final check.

Before you commit, make sure to ask specifically about these common add-ons:

- Specialized Advertising: If you have fine art, rare coins, or other high-value collectibles, basic ads won't cut it. You may need targeted marketing in niche publications or online forums to reach the right buyers, which can come with an extra cost.

- Trash Hauling & Disposal: Was the house packed to the gills? If there's a significant amount of junk or unsaleable items, expect a fee for renting a dumpster and having it hauled away.

- Deep Cleaning Services: This is more than a quick pass with a broom. It's a full-on, deep clean to get the home ready for its real estate debut. You can also explore our detailed guide on common estate sale fees to see how these services are typically priced.

- Credit Card Processing: When buyers pay with a credit card, the payment processor takes a cut—usually 2-3%. Most estate sale companies pass this transaction fee directly on to the client.

- Extra Security: For sales featuring high-end jewelry, firearms, or other exceptionally valuable assets, hiring security guards is often a smart move to protect everything during the event.

Estate Sale vs Real Estate Commission Rates

When you're settling an estate, it's easy to get confused about the different fees involved. A common question we hear is whether the commission for selling the house is the same as for selling everything inside it.

The short answer is a definite no. The commission structures for an estate sale professional and a real estate agent are worlds apart, and understanding why will help you set the right expectations from the start.

Apples and Oranges: A Labor Comparison

The most glaring difference is the percentage. An average estate sale commission usually falls somewhere between 35% and 45%, which can seem steep at first glance. On the other hand, a real estate agent’s fee is much lower, with a nationwide average of around 5.44% in the United States. If you're looking for more details on property-specific fees, exploring insights on real estate rates can be a big help.

So, why the huge gap? It all comes down to the nature of the work and the sheer volume of labor. A real estate agent is focused on selling one single, high-value asset: the property. Their job involves marketing the home, holding showings, and handling the legal paperwork for that one transaction.

An estate sale company, however, is tasked with liquidating hundreds or even thousands of individual items.

Think of it this way: a real estate agent sells the container, while the estate sale company sells every single thing inside it. This means an incredible amount of hands-on work sorting, researching, appraising, staging, pricing, and selling each unique object.

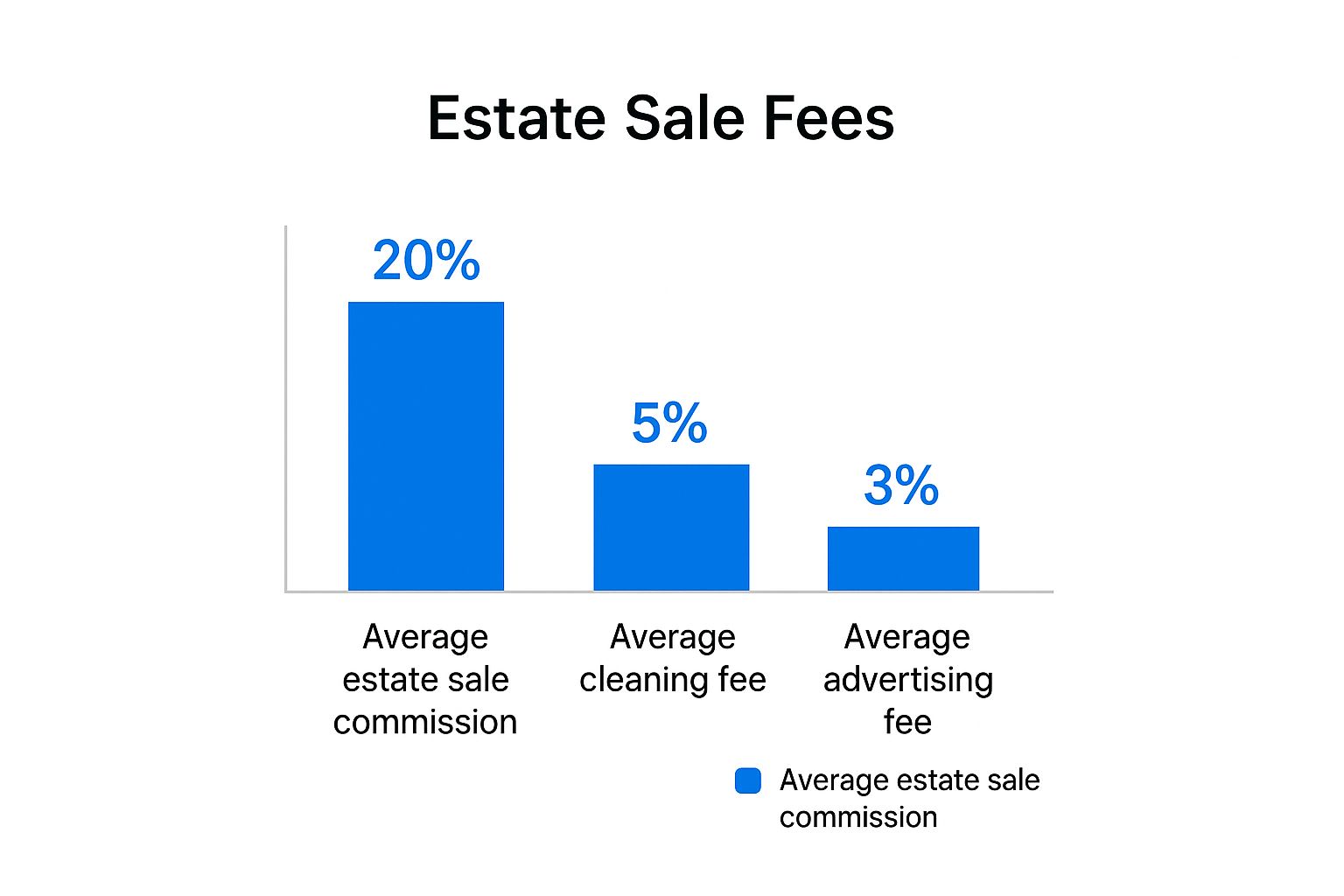

This infographic gives you a clearer picture of where the money goes beyond just the base commission.

As you can see, things like professional cleaning, advertising, and trash removal can be additional costs built into the service. The higher commission rate directly reflects this massive difference in labor, detailed management, and risk.

To help clarify the roles, here’s a simple breakdown of how these two commission-based services compare.

Estate Sale Commission vs. Real Estate Commission

| Feature | Estate Sale Company | Real Estate Agent |

|---|---|---|

| What They Sell | Personal property and contents of a home | The physical house and land (real property) |

| Typical Commission | 35% - 45% of gross sales | 5% - 6% of the home's sale price |

| Primary Labor | Sorting, pricing, staging, and selling many individual items | Marketing one large asset, showings, and contract negotiation |

| Sale Duration | Typically a 1-3 day event, plus weeks of prep | Often takes 30-90+ days from listing to closing |

| Transaction Volume | Hundreds or thousands of small transactions | One single, large transaction |

Ultimately, both services are often critical for settling an estate, but they are fundamentally different jobs that require distinct expertise and pricing. If you're still weighing your options for handling the contents, it's also worth taking a look at an estate sale vs an auction to decide which path is the best fit for your specific situation.

How to Choose the Right Estate Sale Company

Choosing a partner for your sale is hands-down the most important decision you'll make. Now that you have a firm grip on how the average estate sale commission is structured, you can start vetting companies with confidence to find the perfect fit. Remember, the goal isn't to find the cheapest option—it’s about finding the best value.

It's a classic mistake to pick a company just because they offer the lowest commission. That low rate might look tempting, but it can easily backfire. It could mean they’re cutting corners on crucial things like marketing, staging, or even having enough staff on sale day, leading to lower total sales. In the end, that means less money in your pocket.

Think of it like you're the hiring manager for an important job. You need to interview the candidates thoroughly.

Gather and Compare Your Options

Your first move should be to line up at least three in-person consultations with reputable, local companies. Having them walk through the home is non-negotiable. It’s the only way they can accurately see the scope of the project and give you a realistic commission quote and sales estimate.

Pay close attention during these initial walkthroughs. How do they carry themselves? Do they seem to know their stuff when looking at the items? Are they taking notes? A professional and detailed approach right from the start is a great sign of how they’ll handle the entire sale.

Key Takeaway: The interview is a two-way street. You’re evaluating their expertise just as much as they're evaluating the estate. A good company will make you feel confident and informed, not rushed or pressured.

Ask the Right Questions

Once you've met a few companies, it’s time to dig in. You need to understand their entire process, from how they'll advertise the sale to what happens if something gets broken. Walking into these conversations with a list of questions ensures you get the full picture.

Here are a few essential questions you should ask every single company you consider:

- Insurance and Bonding: Are you fully insured and bonded? This is critical. It protects you and the property from any liability during the sale.

- Marketing Plan: Can you show me your marketing plan? Ask about the size of their email list, how they use social media, and what advertising is actually included in their commission.

- Relevant Experience: Have you handled estates like this one before? If you have unique collections like fine art, coins, or military memorabilia, their specific experience is a huge factor.

- Contract Review: May I have a copy of your contract to review? Any trustworthy company will have a clear, easy-to-read agreement that spells out all services, the exact commission rate, and any other potential fees.

By properly vetting each candidate, you can look past the average estate sale commission and find a true partner—one who will work hard to maximize your profit and make the entire process as smooth as possible.

Your Top Questions About Estate Sale Costs, Answered

Even after you get a handle on the average estate sale commission, a handful of practical questions always seem to pop up. And that's completely normal—when you're dealing with a lifetime of possessions, the details really do matter. Let's walk through some of the most common questions people ask when they're looking at proposals from estate sale companies.

Is a Higher Commission Ever Worth It?

It might sound counterintuitive, but sometimes paying a higher commission can put a much bigger check in your pocket at the end of the day.

Think about it this way: a company that charges 45% but has a proven track record with niche items—like rare books, vintage militaria, or designer fashion—might be a far better choice than a generalist company charging 35%. Their deep expertise in research, targeted marketing to collectors, and access to a specific network of buyers can drive prices way up for those key items.

That specialized knowledge often generates a net profit that easily covers the higher commission rate. It’s always smart to weigh a company's unique skills against their fee.

Can I Set Minimum Prices on Items?

Absolutely. This is a common practice known as setting a “reserve” or minimum price. You and the estate sale company can agree on a price floor for specific items, especially those that are highly valuable or hold deep sentimental meaning. The company can't sell those items for less than that number without getting your approval first.

A word of caution, though: use reserves sparingly. If you overprice items, you risk scaring off potential buyers, and the item might not sell at all. A trustworthy company will give you honest advice on realistic market values, helping you set fair reserves that protect your most important assets without killing the sale's momentum.

A great strategy is to place reserves on just a few high-value, "non-negotiable" pieces. This protects what's most important to you while giving the company the flexibility it needs to negotiate on other items and get things moving.

What Happens to Unsold Items?

It’s extremely rare for an estate sale to sell every single item. Once the sale is over, you’ll have a few different options for handling what's left, and your contract should spell these out clearly.

- Charity Donation: This is the most common path. The company will coordinate with a local charity to pick up the remaining goods, and you'll get a donation receipt for your taxes.

- Buyout: Some estate sale companies will offer to buy all the leftover contents for a single lump sum. This gives you a fast and clean end to the whole process.

- Disposal: For items that have no resale or donation value, the company can arrange for a final clean-out service. This usually involves a separate fee for hauling everything away.