A Guide to Vetting Estate Liquidation Companies

What Exactly Do Estate Liquidation Companies Do?

Think of an estate liquidation company as a project manager, but instead of overseeing a construction site, they’re managing the entire process of selling the contents of a home. They’re the specialists you call when a lifetime of belongings needs to be turned into cash, efficiently and without the emotional strain.

These pros step in during major life transitions, solving a huge problem for families dealing with situations like:

- Settling an Inheritance: An executor needs to fairly and transparently liquidate assets for heirs.

- Downsizing: A retiree is moving into a smaller place and can't take everything along.

- Relocation: A cross-country move makes it impractical and expensive to transport all household goods.

Essentially, they handle the heavy lifting—both literally and logistically. This frees up families to focus on the bigger picture instead of getting bogged down for weeks sorting, pricing, and selling every single item.

The Project Managers of Personal Property

At its heart, the job of an estate liquidation company is to bring order to chaos. They walk into a home full of memories and possessions and create a structured, profitable marketplace. Their process usually covers everything from appraising items for fair market value and staging the home to attract buyers, to marketing the sale to their established network.

To see where they fit in, it’s helpful to view their work within the context of broader estate management. They are the hands-on team that executes the liquidation, a crucial step in closing out an estate or getting a house ready to sell. They sweat the details so you don’t have to.

The ultimate goal of a liquidation is to convert assets into cash in an efficient and timely manner. These companies bring the expertise and resources needed to maximize returns while minimizing stress for the client.

A Growing Industry Meeting a Real Need

The demand for these services has exploded, turning what was once a niche service into a major industry. This growth is fueled by aging populations and the fact that modern households often contain a complex mix of assets.

The global liquidation market is a big deal. Forecasts suggest the market could grow from around $35 billion in 2024 to $73 billion by 2034. This isn't just a trend; it shows that more and more families are seeing the immense value in getting professional help. If you want to understand the entire process from start to finish, you can learn more in our deep dive on what is estate liquidation.

Understanding Liquidation Services and Fee Structures

When you hire one of the many estate liquidation companies, you're not just paying someone to run a sale. You're bringing in a team to manage a complex project from top to bottom. Figuring out exactly what they do and how they charge is the key to making a smart decision.

Think of it like hiring a general contractor to renovate your kitchen. You’re paying for the project management, the specialized skills, the logistics, and the final cleanup—not just the new cabinets. An estate liquidator works the same way, turning a house full of possessions into cash.

It’s an impressively thorough process. It all starts with a consultation and contract, but then the real work begins: sorting, organizing, professionally appraising, and staging everything to look its best. From there, they launch a marketing blitz to get the right buyers in the door, whether the sale is in-person or online.

A Breakdown of Core Services

While every company has its own flavor, most pros offer a core set of services. Knowing what these are helps you compare your options fairly.

- Appraisal and Pricing: This is where their expertise really shines. They evaluate everything from fine art to kitchen gadgets to set a fair market price, making sure you don't accidentally give away a treasure or overprice items that won’t move.

- Staging and Organization: The team transforms the home into a shoppable space, much like staging a house for a real estate showing. This means cleaning, arranging furniture, and displaying everything to catch a buyer's eye.

- Marketing and Promotion: Liquidators have built-in networks of collectors, resellers, and loyal shoppers. They’ll use email lists, social media, and industry websites to create buzz and ensure a great turnout.

- Sale Management: On sale days, they run the whole show. This includes managing the crowd, handling all payments, negotiating prices, and keeping everything secure.

- Final Clean-Out: After the sale is over, the company handles all the leftovers. They’ll coordinate donations, arrange for trash hauling, or sell remaining items in bulk to leave the property "broom clean."

Decoding the Fee Structures

The most important part of any agreement is understanding how the company gets paid. While there are a few models out there, commission-based fees are by far the most common.

The commission-based model is simple: the company takes a percentage of the total gross sales. This rate usually falls somewhere between 35% and 50%, depending on the estate's value and how much work is involved. This model is great because it aligns their goals with yours—the more money they make for you, the more they earn.

A key takeaway is that the commission should match the effort. An estate packed with high-value antiques that are easy to sell might get a lower rate than a home filled with thousands of everyday items that require a ton of labor to sort and sell.

Some companies might offer a flat-fee or a hybrid model. A flat fee is a set price for the whole job, which gives you budget certainty. A hybrid model might mix a smaller commission with a base fee, which is often used for smaller estates where a straight percentage wouldn’t cover the company's costs.

For a deeper dive, check out our guide on understanding estate sale commission rates and what to expect.

How Commission Impacts Your Bottom Line

To see how this plays out in the real world, let's use a hypothetical estate that brings in $20,000 from the sale. That commission rate makes a huge difference in what you actually walk away with.

Comparing Commission Fees and Your Net Profit

This table breaks down how different commission rates affect your payout from a $20,000 sale.

| Commission Rate | Company's Fee | Additional Fees (Estimate) | Your Net Profit |

|---|---|---|---|

| 35% | $7,000 | $500 | $12,500 |

| 40% | $8,000 | $500 | $11,500 |

| 45% | $9,000 | $500 | $10,500 |

| 50% | $10,000 | $500 | $9,500 |

Note: "Additional Fees" can cover things like advertising, extra labor, or special appraisals not included in the commission. Always get this clarified in your contract.

As you can see, the difference between a 35% and a 50% commission is a whopping $3,000. This is why reading the fine print and asking questions is so critical. Once you understand the fee structures, you can confidently compare proposals from estate liquidation companies and find a partner who offers transparent, fair value for their service.

Weighing the Pros and Cons of Hiring a Professional

Deciding to bring in an estate liquidation company is a big step with real trade-offs. This isn't just about selling things; it's about getting through a deeply personal and often stressful time. The right choice really comes down to what you value most—is it time and peace of mind, or is it getting every last dollar and staying in control?

A good analogy is a home renovation. You could absolutely act as your own general contractor, sourcing materials and managing the work to save a chunk of money. Or, you could hire someone to handle it all for a fee, saving yourself the headaches. Neither way is wrong, but they serve completely different needs.

Let's break down the good and the bad to help you figure out which path makes the most sense for you.

The Clear Advantages of Professional Help

For a lot of people, the benefits of hiring a full-service liquidator easily justify the cost. These companies are built from the ground up to solve the exact problems you’re facing, offering a clear path through the chaos.

- Unmatched Convenience: The single biggest pro is simply handing the whole project over. A professional team takes care of every last detail, from sorting through dusty basements to running credit cards and managing the final clean-out. This is a massive weight off your shoulders, especially if you're trying to manage an estate from out of state or while holding down a full-time job.

- Expertise and Efficiency: These people are specialists. They know how to price everything from a vintage painting to a set of fine china and a garage full of old tools with an accuracy that only comes with experience. Their well-oiled process means the whole thing is usually done in weeks, not months.

- Access to Established Buyer Networks: A good liquidator doesn't just put an ad in the paper. They bring a built-in audience of collectors, resellers, and serious shoppers who follow their sales. This marketing muscle almost always leads to a bigger turnout and better prices than you could get on your own.

- Reduced Emotional and Physical Strain: Going through a loved one’s home is emotionally draining. It’s also hard physical work. Giving this responsibility to an impartial third party protects your own well-being and can help sidestep potential family disagreements over who gets what.

Potential Drawbacks to Consider

While the convenience is tempting, you have to look at the other side of the coin. The full-service model isn’t a perfect fit for everyone, and the downsides are important.

The most obvious drawback is the cost. With commission rates typically falling between 35% to 50%, the company's fee takes a significant slice of the final sales total. This financial trade-off is the number one reason people start looking for other ways to do it. For a deeper dive, our guide on hiring for professional estate sales breaks it all down.

The core trade-off is clear: you are exchanging a percentage of your total sales for professional management, speed, and reduced personal effort. For some, this is an invaluable service; for others, the cost is too high.

Another issue can be the loss of control. The company will be making the key decisions on pricing, how items are bundled, and when to negotiate. If you have strong feelings about what certain heirlooms are worth or you just prefer being hands-on, their process can feel impersonal and restrictive.

Finally, while a pro's expertise is a huge plus, it's worth noting where that expertise is concentrated. The liquidation industry is strongest in North America and Europe, with the United States alone projected to make up over 80% of the North American market revenue in 2025. This density gives companies in these areas powerful buyer networks—a key part of what they offer. You can read the full research on the global liquidation service market if you'd like to dig into the data.

Full-Service Company vs. a DIY Approach: Which is Right for You?

Deciding how to handle an estate liquidation is a lot like planning a move. You can hire a full-service moving company to pack every box and lift every piece of furniture, or you can rent a U-Haul and do it yourself. One route buys you convenience at a premium price; the other saves you a ton of money in exchange for your own time and effort.

There's no single right answer. The best path forward depends entirely on your situation—your goals, your timeline, how much you want to be involved, and your bottom line.

Let's break down when it makes sense to call in the pros, and when a more hands-on approach is the smarter financial move.

When to Hire a Full-Service Company

Hiring a traditional, full-service company is the best choice when your main goal is to offload the stress and save time. These services are built for situations where the emotional and logistical work is simply too much to handle on your own.

You should seriously consider a professional if you're in one of these spots:

- You're Managing the Estate from a Distance: Trying to clear out a house from another city or state is a logistical nightmare. A local company is your team on the ground, handling everything so you don't have to keep traveling.

- You're on a Tight Deadline: If a house has to be emptied fast for a real estate closing, a professional liquidator is worth their weight in gold. Their teams and established processes can clear a home in a few weeks—a job that could take an individual months.

- The Estate is Full of High-Value or Niche Items: Got fine art, rare antiques, or specialized collections? The pros have the network to appraise these items accurately and connect with the right niche buyers, ensuring you get a fair price.

- The Emotional Toll is Just Too High: Sorting through a loved one’s belongings is incredibly draining. Bringing in a neutral third party creates a healthy emotional distance and can help prevent disagreements among family members.

When a DIY or Hybrid Approach Is a Better Fit

While the convenience of a full-service company is a huge plus, their high commissions are a major downside. A Do-It-Yourself or hybrid approach is perfect for anyone who wants to maximize what they earn and keep total control.

This path is your best bet if:

- Keeping the Most Profit is Your #1 Goal: This is the biggest reason people choose the DIY route. By sidestepping commission fees—which often run between 35-50%—you keep a much larger slice of the pie.

- You're Comfortable Using Technology: If you can use a smartphone and browse a website, you have all the skills you need to run a successful online auction with today's platforms.

- You Want Final Say on Pricing and Items: When you run the sale, you decide what everything is worth. You can make sure a special heirloom goes to a good home or stand firm on the price of a valuable piece without being pressured.

- You Have the Time to Invest in the Project: A DIY online auction is much faster than organizing a traditional tag sale, but it does require an upfront time investment to photograph and describe your items.

The Rise of Modern DIY Platforms

Until recently, you had two choices: pay a fortune for full service or do every single thing yourself. Now, modern online platforms are filling that gap. Think of them as a bridge—they give you the professional-grade tools, marketing reach, and payment processing of a big company, but you stay in the driver's seat.

This is part of a bigger trend. The entire estate settlement world is going digital. In fact, one global report projects the estate administration market will grow to $23.79 billion by 2029. As more people get comfortable managing major life events online, DIY platforms are the logical next step. You can read more about this market growth on The Business Research Company.

The Key Takeaway: Modern DIY platforms make professional-level estate sales accessible to everyone. They provide the tools and support you need to run a successful sale without giving up a massive chunk of your profits or losing control.

This screenshot from DIYAuctions shows what it looks like. You get a simple dashboard to manage your own sale from start to finish.

You can see everything you need to catalog items, schedule your auction, and track your earnings. This approach truly offers the best of both worlds, making it a powerful and profitable choice for many families.

A Checklist for Choosing Your Liquidation Strategy

Deciding between hiring an estate liquidation company and taking a more hands-on route can feel like a heavy weight. There’s no single right answer here; the best strategy is deeply personal and hinges entirely on your situation, your resources, and what you’re trying to accomplish.

To cut through the noise, it helps to ask yourself a few direct questions. Think of it as a quick consultation to find your own best path. Your honest answers will point you toward the right solution, whether that’s paying for convenience or taking control for a bigger payout.

What Is Your Primary Goal?

First things first, get crystal clear on what matters most to you. Are you after speed, maximum profit, or just making things as simple as possible?

- Speed or Simplicity? A full-service estate liquidation company is almost certainly your best bet. These pros are built for efficiency. They take the entire logistical and emotional mess off your plate and deliver a broom-clean house on a timeline.

- Maximum Profit? A DIY approach using a modern online auction platform is the hands-down winner. By sidestepping the hefty 35-50% commission fees that traditional companies charge, you keep a much, much larger slice of the pie.

How Much Time Can You Realistically Dedicate?

Be brutally honest with yourself about your availability. Clearing out an estate isn't just a weekend project—it requires real, focused effort.

Take a hard look at your work schedule, family life, and your own energy levels. If you have a demanding job or live hours away from the property, finding the time to sort, catalog, and run a sale yourself is next to impossible. In those cases, the fee you pay a professional company is buying you back your most valuable asset: your time.

But if you can carve out several days or a couple of solid weekends, a DIY online auction becomes a totally manageable and profitable option. It's way faster than old-school yard sales, with most of the work loaded into the upfront cataloging phase.

What Is the Nature of the Items?

The kind of stuff you're dealing with plays a huge role in this decision. An estate full of everyday household goods is a completely different ballgame from one with specialized collections.

- High-Value or Niche Collections: If the estate has fine art, rare antiques, coins, or other specialty items, the eye of a professional appraiser and liquidator can be priceless. They have the deep knowledge and buyer networks to get top dollar for those unique assets.

- Standard Household Contents: For most estates—which are a mix of furniture, tools, kitchenware, and general home decor—a DIY platform is more than capable. You can easily research what things are worth online and reach a wide audience of local buyers who are looking for exactly that kind of stuff.

Are You Managing This Locally or From a Distance?

Geography is a massive logistical hurdle. If you live in the same town, you have the flexibility to manage the process yourself. Popping over to sort items, snap photos, and be there for pickup day is no big deal.

But if you live in another city or state, the challenges stack up fast. Travel costs, taking time off work, and the sheer stress of trying to manage everything remotely make hiring a local, full-service company a much more practical choice. They essentially become your trusted team on the ground.

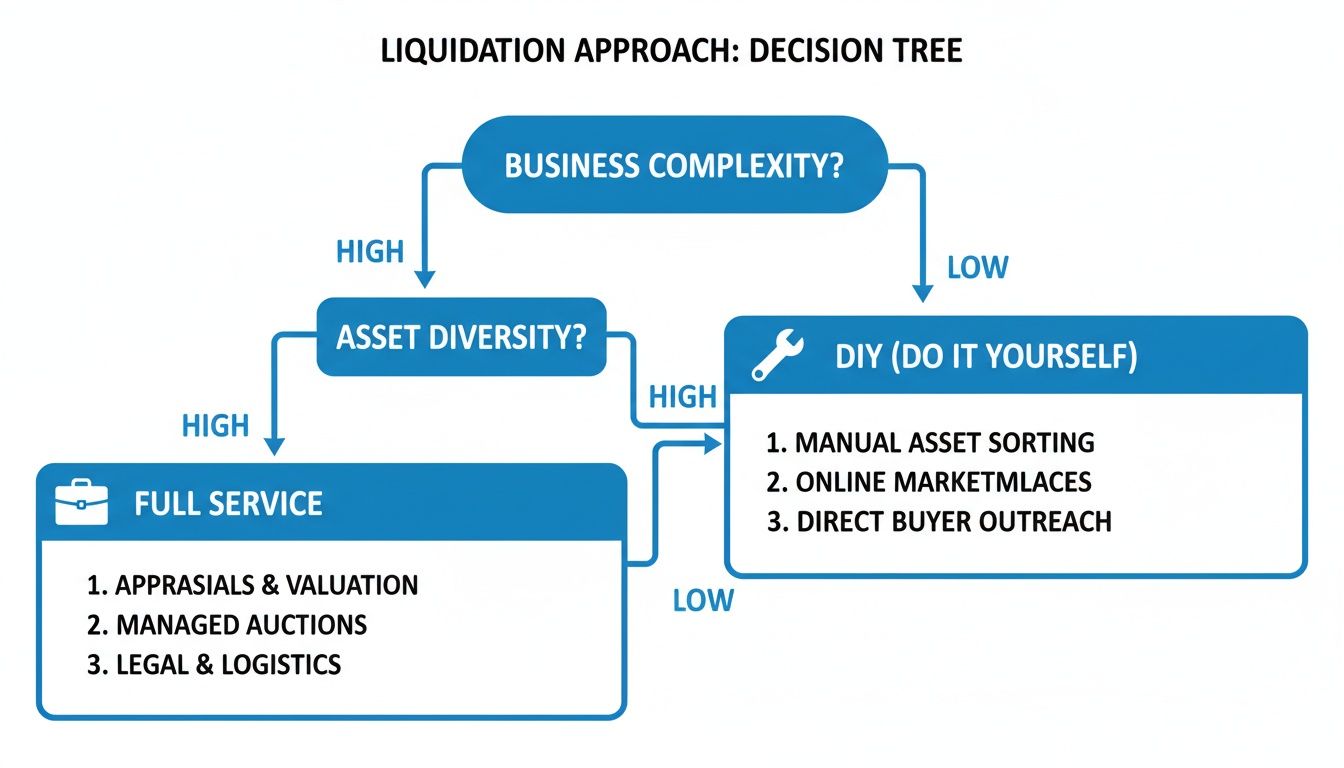

This decision tree gives you a simple visual way to compare the two main approaches.

As you can see, your choice really boils down to whether you value hands-off service or hands-on control and profit.

How Comfortable Are You With Technology?

Modern DIY platforms are designed to be really easy to use, but you do need a basic comfort level with a smartphone or computer. If you can take photos, write a simple description, and find your way around a website, you have all the tech skills you need to run a successful online auction.

If the idea of managing an online process feels intimidating, then a traditional company that handles everything offline might feel safer. But if you’re good with digital tools, the control and financial upside of a DIY platform are massive.

The need to liquidate an estate often comes after a death, which is a difficult time. To help navigate those first steps, you might find a comprehensive checklist for when someone dies to be a huge help. By thinking through these questions, you can move forward with confidence, knowing you’ve picked the liquidation strategy that’s truly right for you.

Common Questions About Estate Liquidation

Even with a good grasp of the pros and cons, practical questions always pop up. The choice between hiring a full-service estate liquidation company and taking a more hands-on approach comes down to real-world details—timelines, costs, and what happens to all the stuff that doesn't sell.

Getting clear answers to these questions is the last step before you can make a decision you feel good about. Let's tackle those specific sticking points right now.

How Long Does the Entire Liquidation Process Take?

The timeline can swing wildly depending on the path you choose, and for many families, this is a huge deal—especially if a house needs to get on the market fast.

A traditional estate sale company usually needs a good bit of lead time. From the first phone call to the final check and clean-out, you're typically looking at anywhere from three to six weeks. This buffer accounts for their own packed schedule, the days their crew needs to sort and price everything, and the time for the sale itself.

On the other hand, a DIY online auction can be dramatically faster. You're the one in control of the schedule. Most people find they can get everything photographed and cataloged over a weekend, run the online auction for a week, and wrap the whole thing up—pickup day included—in just one to two weeks.

Are There Hidden Fees I Should Watch Out For?

Transparency is key, but unfortunately, it’s not always a given. While most reputable companies are upfront about their commission, you have to dig a little deeper to understand the total cost.

It's absolutely essential to ask about extra charges that might be tacked on. Some common ones include:

- Advertising Fees: Extra costs for marketing the sale.

- Heavy Lifting or Sorting: Additional labor charges for very cluttered estates.

- Credit Card Processing Fees: A percentage passed on from buyer transactions.

- Clean-Out Services: The cost to haul away unsold items and trash.

Always get a detailed contract that spells out every single potential charge. It’s the only way to avoid surprises and make a true apples-to-apples comparison between different estate liquidation companies.

Modern platforms often build everything into one number. For example, some operate on a single, clear commission. That means all the marketing, payment processing, and platform tools are already included, so the price you see is the price you pay.

What Happens to Items That Do Not Sell?

This is one of the most important questions you can ask. The answer directly affects how the property is left and whether you can get any tax deductions for donations.

With a traditional company, their contract will spell out what happens to the leftovers. Usually, they'll handle it in one of three ways: donate it to charity for you (and give you the receipt), sell the rest in bulk to a reseller, or arrange for it all to be hauled away. You need to know their policy upfront to make sure it works for you.

When you use a DIY platform, you keep total control over every item. You decide what happens to anything that doesn't find a new home. This gives you the flexibility to:

- Relist Items: Easily run another online auction for any remaining pieces.

- Donate to Your Preferred Charity: You get to choose the organization that means the most to you.

- Give Items to Family: Make sure special things end up with loved ones.

- Arrange Your Own Clean-Out: Hire a service that fits your schedule and budget.

This level of control means nothing happens without you saying so, which gives you complete peace of mind as you wrap up the process.