Estate Liquidation Services Near Me Your Guide

Tackling an estate liquidation can feel like a mountain of a task, especially since it usually comes at a time of major life transition. The whole process involves sorting, pricing, and selling off personal property and other assets. Kicking off a search for "estate liquidation services near me" is really the first step in turning what feels like a chaotic job into a clear, manageable process.

What Estate Liquidation Actually Involves

At its core, estate liquidation is the process of turning someone's assets into cash. This usually happens after a death, during a move into assisted living, or as part of a major downsizing effort.

Think of it as much more than a glorified garage sale. A full-service liquidation handles everything from everyday household items and furniture to valuable antiques, cars, and even the house itself. The main goal is always the same: clear out a property efficiently while getting the best possible financial return for the family or heirs.

This process is a lifeline in a few common situations:

- Inheritance: When a loved one passes away, the executor of their will is often tasked with selling the contents of a home to distribute the assets among the heirs.

- Downsizing: Many retirees and empty-nesters decide to move into smaller, more manageable homes, which means they have to part with decades of accumulated possessions.

- Relocation: A big move across the country or a transition into a care facility often makes it impossible—or just impractical—to take everything along.

It's More Than Just Selling Stuff

One of the biggest misconceptions is that liquidation is just about selling. In reality, a huge part of the work is meticulous organization, research, and valuation. A good liquidator assesses every single item to figure out its fair market value, whether it's a piece of fine jewelry or the living room sofa.

If you want to get a better handle on the basics, you can learn more about what estate liquidation is and how it all works.

When there's real estate involved, things can get more complicated and often intersect with legal hurdles like probate. For instance, if you're handling an estate in Texas, understanding how probate affects the sale of a property is critical. You can get a good overview from a comprehensive guide to probate and real estate in Texas that breaks down these legal details.

The demand for these services is definitely on the rise. The global liquidation service industry was valued at $3.32 billion in 2021 and is expected to hit $4.20 billion by 2025, with North America leading the market.

This growth just goes to show how many families are turning to professionals to help them through these difficult transitions. By understanding the full picture of what's involved, you can be better prepared for the road ahead and make the best choice for your own situation.

Choosing Your Liquidation Strategy

Picking the right way to liquidate an estate is easily one of the most critical decisions you'll make in this entire process. The path you choose directly impacts your final profit, how much time you'll spend, and frankly, your overall stress level. This isn't a one-size-fits-all deal—the best method really depends on what you're selling and what you hope to achieve.

For instance, a house full of quality, modern furniture is a great candidate for a traditional on-site estate sale. But if you’re dealing with authenticated fine art or a collection of rare stamps, an auction house is where you'll find specialized buyers ready to pay what those items are truly worth.

Understanding Your Options

The world of estate liquidation is broader than most people think, with services ranging from simple appraisals to full-blown online sales events. Most professional liquidators work on a commission based on the total sale, but their methods can vary dramatically.

A traditional sale gets people in the door to browse and buy, while newer models blend online and in-person events to cast a much wider net. The goal is always the same: connect your items with the right buyers.

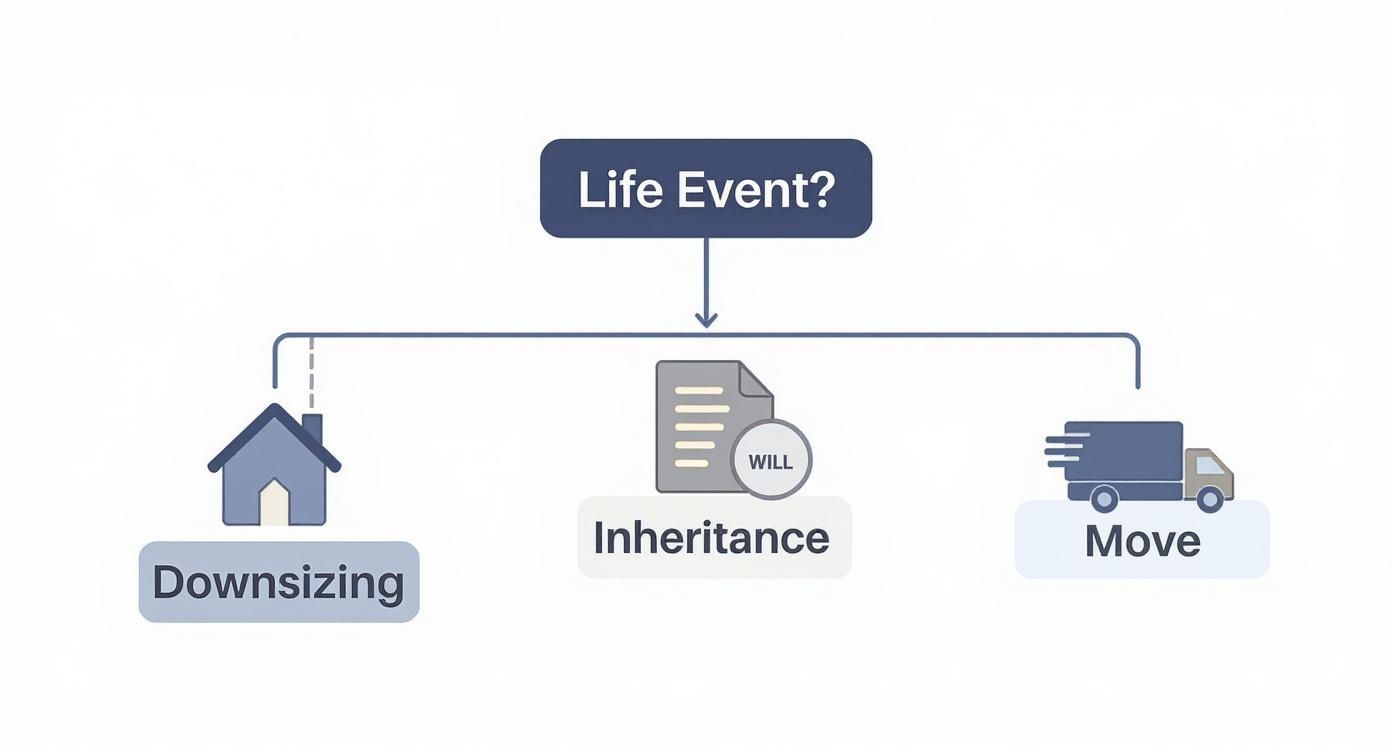

This visual can help you see how different life events often point toward a specific liquidation path.

As you can see, whether you're downsizing, moving, or managing an inheritance, there's a logical starting point. A major part of this for many families is figuring out the best way forward when it comes to selling inherited property, which often makes up a huge chunk of an estate's value.

Comparing Common Liquidation Methods

To make the right call, you have to weigh the pros and cons of each approach. Let’s break down the most common methods side-by-side so you can see how they stack up.

This table gives a quick overview of the main options you'll encounter.

Comparing Estate Liquidation Methods

| Method | Best For | Typical Commission | Speed | Reach |

|---|---|---|---|---|

| On-Site Estate Sale | A large volume of general household goods and furniture. | 30-45% | Fast (1-2 weekends) | Local |

| Auction House | High-value, authenticated items (art, antiques, jewelry). | 20-50% (incl. buyer's premium) | Moderate to Slow | Global / Niche |

| Consignment Shop | A small number of high-quality furniture or designer goods. | 40-60% | Slow (months) | Local |

| Online Auction (DIY) | A mix of unique items, collectibles, and general goods. | ~10% | Fast (1-2 weeks) | Local & Regional |

| Full-Service Liquidation | Complete hands-off management of the entire process. | 35-50% + other fees | Moderate | Varies |

Each of these avenues has its place. Your job is to match your specific situation and timeline with the method that promises the best return for your effort.

Key takeaway: Match the method to the assets. You wouldn't take a valuable coin collection to a general household sale where its true value might be missed by casual shoppers.

If you want to dig a bit deeper, our guide on the different estate liquidation options can help you analyze each path with more clarity. Thinking strategically now will set you up for a much smoother and more profitable experience down the road.

How to Find and Vet Local Estate Liquidators

Picking the right liquidator is easily the most important decision you’ll make in this whole process. A great partner can be the difference between maximizing your returns with minimal stress and turning an already tough situation into an absolute nightmare.

It's tempting to just search for "estate liquidation services near me," but finding a true professional requires digging a little deeper.

The best liquidators rarely come from the top of a search engine list; they come from trusted referrals. Start by asking professionals who deal with estate matters all the time.

- Estate planning attorneys are an incredible resource. They see the good, the bad, and the ugly, and they know who to trust.

- Local antique dealers have a keen eye for who is honest and skilled at pricing unique, valuable items.

- Realtors, especially those who handle inherited properties, often keep a short list of reliable partners for clearing out homes efficiently.

These folks see the aftermath of a liquidator's work firsthand, so their recommendations carry a lot of weight. You can also check national organizations like the American Society of Estate Liquidators (ASEL) for a list of accredited members in your area.

Crucial Questions to Ask Every Potential Liquidator

Once you have a shortlist, it's interview time. Treat this exactly like hiring someone for a critical job—because that's what it is. You need to get a feel for their process, their transparency, and their actual expertise.

Don't just wing it. Go in with a prepared list of questions so you can compare each company apples-to-apples. This goes way beyond just their commission rate; it's about the total value they bring to the table.

Here are the non-negotiables you have to ask:

- What is your complete commission structure? Get specific. Ask about any extra fees for advertising, staff, or final cleanup. A reputable company will be totally upfront about all costs.

- Are you bonded and insured? This is a deal-breaker. It protects you from liability if someone gets hurt on the property. Never, ever work with an uninsured company.

- What is your marketing and advertising strategy? How are they going to get qualified buyers to your sale? You want to hear about a real plan involving professional photos, email lists, and social media.

- How do you handle specialty items? If the estate includes fine art, rare coins, or valuable antiques, ask if they have specialists or certified appraisers on staff. You need expert eyes on those items to get the right price.

- What happens to unsold items after the sale? Do they offer a buyout option, help with donations, or provide a full clean-out service? Make sure you clarify any costs associated with what's left.

A true professional will welcome your questions and give you clear, confident answers. If you feel rushed, dismissed, or get a vague vibe, that’s a massive red flag.

Red Flags and Warning Signs to Watch For

While you're looking for the right fit, it’s just as important to spot the wrong one. Always trust your gut—if a situation feels off, it probably is.

Be very wary of anyone who pressures you to sign a contract on the spot. High-pressure tactics are a sure sign of a company that doesn’t have your best interests at heart. Another major red flag is a vague or confusing contract. The agreement should spell out every service, fee, and timeline in plain English.

If you want to dive even deeper, our guide on choosing an estate liquidation company breaks down the vetting process in even more detail.

At the end of the day, you're entrusting someone with a loved one’s legacy or your own life's collection. Taking the time to properly find and vet a liquidator ensures the process is handled with the professionalism and respect it deserves.

What to Do Before the Liquidators Arrive

Once you've chosen a partner from your "estate liquidation services near me" search, the dynamic shifts. You’re no longer vetting companies—you're preparing the field for a successful sale. A few key steps on your part before the team walks through the door can make a world of difference.

This prep phase is critical. It’s what prevents heartbreaking losses, smooths out the entire process, and ultimately, helps you get a better return. This is where you take back control.

The single most important job you have right now? Clearly identify and remove every single item that is not for sale. This is your final chance to protect irreplaceable heirlooms and personal documents before the doors open to the public.

Secure Personal and Sentimental Items

It's time to do a methodical sweep of the home. Your goal is to locate and set aside specific types of items so your liquidator has a clean slate to work with, free from any personal clutter that could get lost in the shuffle.

Designate a "keep" zone—a locked bedroom, a specific closet, or even an off-site storage unit is perfect. Move these items there:

- Family Heirlooms: Think photo albums, grandpa's military medals, personal letters, wedding dresses, and anything else with deep sentimental value.

- Legal & Financial Documents: This includes wills, trusts, property deeds, tax records, and Social Security cards.

- Personal Identification: Passports, driver's licenses, and birth certificates should all be secured.

- Valuables: Any specific jewelry, art, or collectibles you've already decided to keep or distribute among family members.

Honestly, this step is non-negotiable. The moment a liquidation company starts staging the home for a sale, everything left behind is typically considered part of the inventory. Taking the time to do this right protects your family’s legacy and your financial privacy.

Crucial Tip: The biggest mistake families make is trying to "help" by throwing things away before the professionals arrive. What looks like a pile of junk in the garage to you could contain valuable collectibles. Let the experts decide what has value—don't clean out a thing.

Get Ready for Appraisal and Inventory

Your next move is to help the team hit the ground running with their inventory and appraisal process. While you shouldn't be tossing anything, you can help by gathering any documentation related to important assets. This little bit of effort can seriously impact the final valuation.

For instance, if you know the story behind a particular antique desk, jot it down. If you have the certificate of authenticity for a piece of artwork or the original receipt for a designer watch, find it. This kind of documentation provides provenance and can dramatically increase an item's selling price.

It also helps to create a simple list of the major assets you know are in the estate—things like vehicles, significant furniture pieces, or signed artwork. This isn't about creating your own detailed inventory; it's just a high-level overview to ensure nothing major gets missed during that first walkthrough. This simple prep work ensures your chosen liquidation service can start strong, properly identifying and marketing every key asset for its true worth.

How Modern Liquidators Get You the Most Money

The world of estate sales has changed. A lot. Gone are the days of just sticking a sign in the yard and hoping for the best on a Saturday morning. Today’s sharpest liquidators use a powerful mix of technology, smart marketing, and a real understanding of how people shop now to make sure you get the best possible return.

The biggest shift? Moving the sale online. A local, in-person sale might bring in a few hundred people if you’re lucky. An online auction, on the other hand, can pull in thousands of bidders from across the country—or even the world. This is a game-changer for niche collectibles, art, or designer goods where the most serious collectors probably don't live down the street.

More eyeballs mean more competition, and that competition is what drives prices up. It’s no longer about who can physically show up; it's about connecting your valuables with the perfect buyer, no matter where they are.

It's All About the Presentation

In a world where we shop with our eyes first, how your items look is just as important as what they are. A modern liquidator gets this. They know that blurry, poorly-lit phone pictures just won't cut it anymore.

Instead, they invest in professional photography and compelling, detailed descriptions that make each item shine. Think of it like selling a house—good staging and great photos bring in way more interest and much higher offers. The same logic applies to everything in an estate, from a dining room set to a vintage watch.

By 2025, estate sales have moved beyond their traditional role as a means to dispose of assets after personal transitions to becoming a significant part of the sustainability and thrift economies. Around this time, estate liquidation practices increasingly align with environmental consciousness, with buyers valuing the extended lifecycle of goods rather than new consumption. You can learn more about how 2025 trends are reshaping estate sales on AcadianaGold.com.

Tapping Into How People Buy Today

Today's buyers are different. The move toward minimalism and a real focus on sustainability has created a massive boom in the secondhand market. People are actively looking for quality, pre-owned goods not just for a good deal, but as a smarter, more environmentally friendly choice.

A savvy liquidator knows exactly how to tap into this mindset. They frame the sale to appeal to these modern trends, highlighting the craftsmanship, history, and sustainable upside of buying secondhand.

Here’s how they do it:

- Smart Digital Marketing: They don't just post and pray. They use social media, email lists, and niche online marketplaces to get in front of the right groups of buyers.

- Telling the Story: They craft narratives around unique pieces to create an emotional connection. That isn't just an old chair; it's a mid-century classic with a story.

- Building a Following: The best liquidators have a loyal base of buyers who trust their eye for quality and eagerly follow their sales.

At the end of the day, a modern approach is so much more than just selling "stuff." It’s strategic marketing, a global reach, and a deep understanding of what makes today's buyers tick. When you're searching for estate liquidation services near me, finding a company that gets this is your surest path to getting the most value out of your estate.

Common Questions About Estate Liquidation

When you first search for "estate liquidation services near me," a flood of questions usually follows. Most people only go through this process once or twice in a lifetime, so it’s completely normal to feel a bit lost in the details.

Getting straight answers to your biggest questions is the best way to move forward with confidence. Let's tackle the ones we hear most often, from how companies get paid to what happens when the sale is over.

How Do Liquidators Get Paid?

The standard in the estate sale world is a commission-based fee. This just means the company takes a percentage of the total gross sales from the event. That percentage can swing pretty widely, usually landing somewhere between 30% and 50%.

So, what determines if you're on the lower or higher end of that range? A few key things:

- The Value of Your Items: An estate packed with fine art, signed first-edition books, and antique furniture will likely get a more favorable commission rate than a home with standard household goods.

- The Amount of Work Involved: Is the home neat and organized, or will the team need to spend days digging through clutter just to see what’s there? More labor often means a higher commission.

- Extra Services: Some companies roll everything into one fee, while others might charge separately for things like advertising, professional appraisals, or hauling away unsold items.

Before you sign anything, make sure you have a crystal-clear, itemized breakdown of all fees in writing. A reputable company will be upfront about their entire cost structure so there are absolutely no surprises when it's time to settle up.

What Does the Timeline Look Like?

From the first handshake to getting your final check, the whole process typically takes about three to six weeks. This can shift based on the size and complexity of the estate, but most sales follow a fairly predictable rhythm.

Expert Insight: The magic happens in the prep work. Those one to three weeks spent sorting, researching, pricing, and marketing are what make or break a sale. A well-staged, professionally advertised event will always bring in more money than a rushed one.

Here’s a rough idea of the schedule:

- Consultation & Contract (1-3 Days): This is the initial meeting where you'll walk through the property, talk about your goals, and sign an agreement.

- Preparation & Staging (1-3 Weeks): The heavy lifting phase. The team will sort, organize, research, price, and stage every single item for the sale.

- The Sale Event (2-3 Days): Usually a weekend event to catch the most foot traffic from buyers.

- Post-Sale & Reconciliation (1-2 Weeks): This final phase involves the clean-out, managing donations, and creating your detailed sales report and payment.

What Happens to Unsold Items?

It's almost unheard of for every single item in an estate to sell. Once the doors close on the last day, you'll have a few choices for what to do with the leftovers. Most professional liquidators will manage this final step for you.

Your contract should spell out exactly what the plan is for anything that doesn't sell. Usually, it involves one of these options:

- Donation: The company can coordinate with a local charity to pick up the remaining items. You'll get a donation receipt for your taxes.

- Buyout: Some liquidators will offer a flat fee to purchase everything that's left. It's a quick way to completely clear the property.

- Clean-Out Service: For an added fee, the company will remove every last thing, leaving the home "broom swept" and ready for whatever comes next.