A Guide to Estate Sale Businesses

Think of an estate sale business as a team of professional project managers for a lifetime’s worth of belongings. They come in during big life transitions when clearing out a house becomes an urgent, and often overwhelming, necessity.

These situations—like downsizing, relocating, or dealing with a loved one's passing—are packed with emotion and logistical headaches. That's where a professional service becomes a lifesaver.

Most people call an estate sale company when they're facing one of these scenarios:

- Handling a loved one's estate after they've passed away.

- Downsizing for retirement or a move into a smaller, more manageable home.

- Big moves for a new job or a fresh start in a different city.

- Divorce or bankruptcy, where assets need to be divided or sold off.

Much More Than a Garage Sale

An estate sale business offers a completely different experience from a weekend yard sale. They provide a structured, professional service designed to get the most value from everything in the house.

It’s not just about selling stuff. These companies manage the entire project with a deep understanding of item values, what’s trending in the market, and how to attract serious buyers.

The ultimate goal of an estate sale company is to empty the entire house. This comprehensive approach means everything—from valuable antiques to everyday kitchen gadgets—is managed and sold, taking a massive weight off the family’s shoulders.

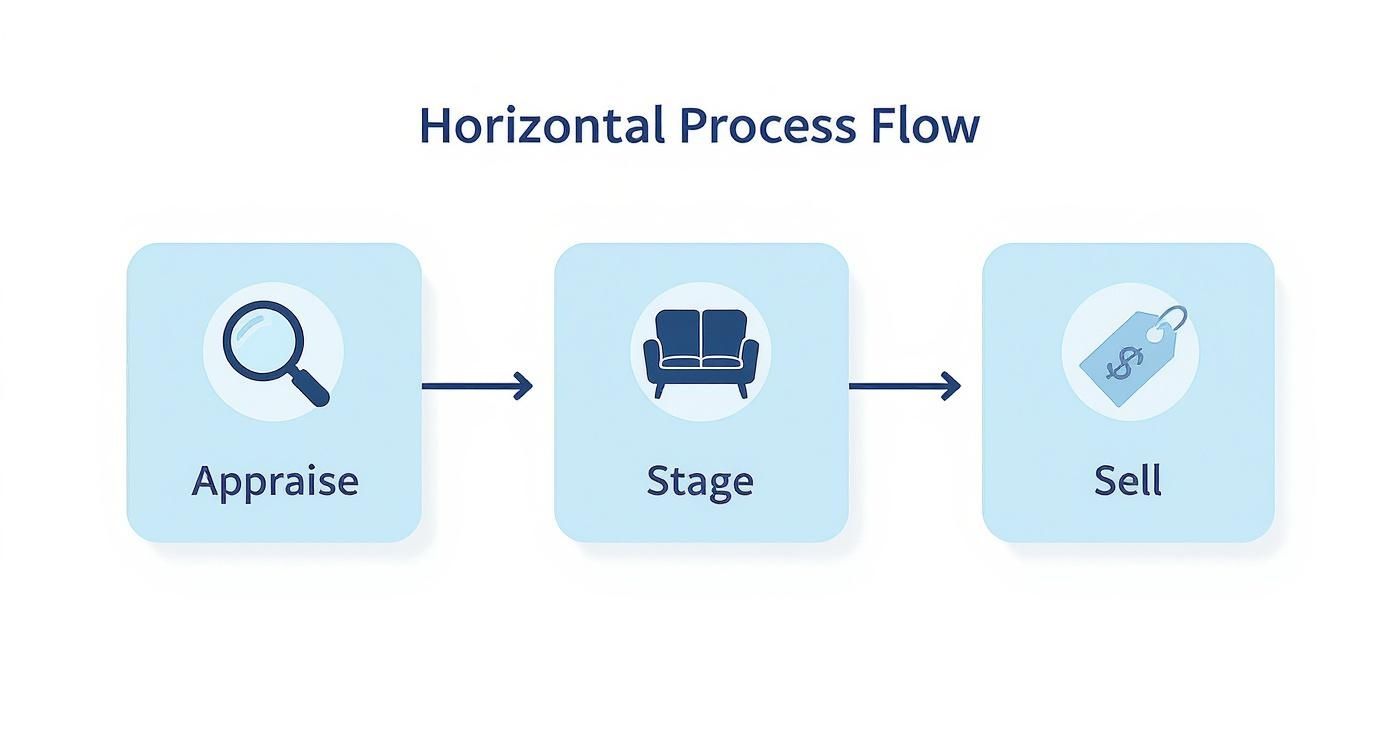

Their process is methodical. First, they go through everything, appraising and inventorying items from the fine china in the cabinet to the tools in the garage. Then, they clean, organize, and stage the home to make it look like a professional retail space.

Finally, they handle all the marketing to their network of collectors and the general public. They run the sale over a few days and manage every single financial transaction.

Deciding what to do with a house and its contents is a huge task, especially when you're grieving. Understanding all your options is the first step. For more context, many people find it helpful to start by reviewing options after inheriting a property. This helps put all the pieces together so you can make a clear-headed decision during a tough time.

How Estate Sale Businesses Structure Their Fees

When you're looking at liquidating an estate, understanding how the money side works is obviously a top priority. Most estate sale companies keep it simple with a performance-based model. Instead of hitting you with a big, flat fee upfront, they work on commission.

This means they take a percentage of the total gross sales from your event. It's a structure that aligns their success directly with yours—the more money they can make for you, the more they earn themselves. It’s the industry standard for a reason.

This commission can swing pretty widely, usually landing somewhere between 25% and 50%. So, what makes the difference between a 25% rate and a 50% one? A few key things come into play.

The biggest factor is the total estimated value of the estate. If a home is packed with high-demand antiques, fine art, or sought-after collectibles, you'll likely get a lower commission rate because the total sale is expected to be high. On the flip side, an estate with more standard household goods might come with a higher percentage to make it worth the company’s time and effort.

This infographic gives you a good visual breakdown of the services your commission pays for.

From appraising and pricing every last item to staging the home and running the sale, that percentage covers a full-service project management experience.

Beyond the Commission Percentage

While the commission covers the bulk of the labor, it's not always the full story. You need to be aware of other potential costs that might pop up. It’s really important to get clarity on these before you sign any contract so there are no surprises when you get your final check.

Some common extra fees you might see include:

- Advertising Costs: Fees for placing ads in local newspapers or on specialized online marketplaces.

- Security Services: The cost of hiring security for sales with high-value items or anticipated large crowds.

- Specialized Appraisals: Bringing in a third-party expert for rare items like jewelry, art, or unique collectibles.

- Trash Hauling: Expenses for dumpsters or services to clear out unsold items and trash after the sale.

- Credit Card Processing: A small percentage (usually 2-3%) deducted from credit card sales to cover bank fees.

The estate sale industry has become much more professionalized, now pulling in around $230 million in annual revenue. This has also led some companies to set financial minimums. Today, about 20% of estate sale businesses require a minimum gross sale of $5,000, and 14% set that bar even higher at $10,000.

Typical Estate Sale Fee Structures at a Glance

To make it easier to see how these costs add up, here’s a quick table breaking down the common pricing models you'll encounter.

| Fee Type | Common Range | What It Covers |

|---|---|---|

| Commission | 25% - 50% | The company's core services: sorting, pricing, staging, marketing, and managing the sale event. This is their main source of revenue. |

| Advertising Fees | $50 - $500+ | The cost of promoting the sale through newspapers, online listings, social media ads, or specialized websites to attract more buyers. |

| Clean-Out/Hauling | $300 - $1,000+ | The cost of dumpsters or labor required to remove all unsold items and trash from the property after the sale is over. |

| Specialist Appraisals | Varies by Expert | Fees for hiring a certified appraiser for specific high-value categories like fine art, jewelry, or rare coins to ensure accurate pricing. |

| Credit Card Fees | 2% - 3% | A percentage deducted from credit card transactions to cover the payment processing fees charged by banks. |

Remember, every company is different, so always ask for a detailed breakdown of all potential charges in writing before making a commitment.

A Practical Financial Example

Let's put this into a real-world scenario to see how the numbers work.

Imagine an estate sale brings in a total of $20,000 in gross sales. The company’s commission is 40%, and you also agreed to a $300 fee for trash hauling after the event.

- Calculate Commission: $20,000 x 0.40 = $8,000

- Subtract Additional Fees: $300 for hauling

- Total Deductions: $8,000 + $300 = $8,300

- Client's Final Payout: $20,000 - $8,300 = $11,700

This simple breakdown shows you exactly how your final payment is calculated. For a more detailed look at what drives these costs, feel free to explore our guide on understanding estate sale fees.

The Pros and Cons of Hiring a Professional Team

Deciding to bring in one of the many estate sale businesses out there is a big step. You're not just hiring help; you're handing over the keys to a home full of memories. It’s a classic trade-off: expertise and convenience versus cost and control.

Getting a clear picture of both sides of that coin is the only way to make the right call for your family and your specific situation.

The Advantages of Professional Management

The most immediate benefit is the sheer relief from stress and back-breaking work. Just try to imagine sorting, cleaning, pricing, and staging an entire household's worth of stuff by yourself. It’s a monumental task. A professional team takes that entire weight off your shoulders, managing every little detail from start to finish.

But it goes deeper than just convenience. Hiring experts brings a few key advantages that are tough to duplicate on your own.

- Expert Pricing and Valuation: These pros know the market value for everything, from that antique armchair to the vintage Pyrex in the kitchen. This ensures you’re not accidentally giving treasures away for pennies or scaring buyers off with unrealistic prices.

- Established Buyer Network: Good companies have built long lists of serious buyers, collectors, and resellers. They market your sale directly to these people, bringing in motivated shoppers ready to spend.

- Professional Staging and Marketing: They know how to turn a home into an attractive, shoppable space. They'll also promote the sale across all the right channels to draw a big crowd on sale days.

- Stress and Labor Reduction: They handle all the heavy lifting, organization, and emotional strain. This frees you up to focus on everything else on your plate.

A good way to think about it is like selling a house. Sure, you can sell it yourself, but a great real estate agent usually gets you a better price and a much smoother closing. Estate sale professionals play that exact same role, just for the contents inside the home.

The Drawbacks and Potential Downsides

Of course, all that convenience and expertise comes with a price tag. The biggest drawback is the commission fee, which takes a direct slice out of your final proceeds.

A 40% commission on a $15,000 sale means $6,000 goes right to the company. That’s a huge chunk of money, so you need to be confident that the service is worth the cost.

Then there’s the loss of control. You’re trusting someone else to make judgment calls on pricing and negotiations. If you’re sentimental about certain items or have strong opinions on what things are worth, this can easily lead to friction.

Finally, the quality of estate sale companies varies wildly. A disorganized or inexperienced crew can leave you with a disappointing total, a house full of unsold items, and a lot of frustration. It’s absolutely vital to vet any company you consider hiring.

You can learn more about what to look for and what to expect in our detailed guide to professional estate sales. Taking the time to weigh these pros and cons will help you choose the path that best fits your financial goals and personal comfort level.

Understanding the Global Liquidation Market

It’s easy to think of a local estate sale as a small, neighborhood event. But in reality, it’s one small gear in a massive economic machine. Every single sale is part of the multi-billion dollar global liquidation market, an industry that hums in response to big economic and demographic shifts.

Think of it this way: an estate sale is like a small stream, but it flows into a much larger river. This river is fed by countless other sources, from corporate downsizing and real estate trends to simple changes in how people shop. Forces like aging populations in Western countries and rapid economic growth in Asia all create a constant, churning need for asset liquidation.

The Scale of the Industry

This isn't some tiny niche. It's a serious global business. The liquidation services market, which includes estate sale businesses, recently hit a value of $3.32 billion. And it's not slowing down—projections show it growing to $4.20 billion soon, a 26% jump that points to strong, ongoing demand.

North America is the current heavyweight, holding 34.7% of the global market share. The United States is the main player, driving over 82% of North America's total revenue. It just goes to show how essential asset liquidation is to the U.S. economy, far more than most people ever realize.

This big-picture view is crucial. It shows that estate sale companies aren't just isolated local businesses. They are on the front lines of major life and economic transitions, turning tangible assets back into liquid cash on a global scale.

Specialized Sectors Within Liquidation

The liquidation market is incredibly diverse and goes way beyond the contents of a home. It covers everything from business inventory and restaurant equipment to highly specialized technology assets.

You can find all sorts of specialists within this huge market. For instance, a sector like What Is IT Asset Disposition (ITAD) Explained For Businesses gives you a peek into how B2B asset management works. The principles they use—maximizing value and ensuring efficient disposal—are often the same ones used in a residential estate sale. This diversity proves just how adaptable and important liquidation services are in every corner of the economy.

How Economic Trends Impact the Estate Sale Industry

The estate sale industry doesn't operate in a vacuum. Far from it. Think of it more like a sensitive barometer, reacting directly to the ups and downs of the wider economy. Estate sale businesses are deeply connected to the real estate market, inflation, and general consumer confidence, which makes them a fascinating reflection of our collective financial health.

When the residential real estate market is hot, for instance, more people decide it's the right time to downsize or move. This activity directly fuels the pipeline for estate liquidators, as families need to clear out homes quickly to get them market-ready. A booming housing market often means more sales—and sometimes higher-value ones—are up for grabs.

On the flip side, a sluggish real estate market can bring things to a crawl. If homes aren't selling, people tend to stay put, and the number of moves that trigger a need for liquidation naturally dries up.

Real Estate's Ripple Effect

The connection doesn't stop with residential homes. The commercial real estate world also plays a huge role in the liquidation business.

While estate sale businesses are a specific niche, their success is often tied to these bigger property trends. For example, the commercial real estate market saw a global investment slump for six straight quarters before showing signs of life. The Americas recently posted a 12% year-over-year jump in property sales. A rebound like this can signal an increase in business liquidations, which share a lot of the same operational DNA as residential estate sales. You can dig deeper into these trends in Deloitte's commercial real estate outlook.

Inflation and Operating Costs

Inflation is the other major economic force shaping the industry. On one hand, it can actually drive up the value of tangible assets like antiques, collectibles, and precious metals, which can lead to higher gross sales. When cash feels less valuable, people often look to hard assets as a hedge, boosting buyer demand.

But that's only half the story. Inflation also hits the business on the operational side. Rising costs for fuel to haul items, advertising to attract bidders, and labor to run the sale all squeeze profit margins for liquidation companies.

An estate sale business must constantly balance the rising value of assets against its own increasing operational expenses. This economic tightrope walk determines profitability and resilience in a fluctuating market.

This dynamic environment forces operators to be both savvy appraisers and sharp business managers. They have to constantly adapt, whether that means adjusting commission rates or finding more efficient ways to manage the logistics of a sale. At the end of the day, the companies that thrive are the ones who understand these economic undercurrents and know how to navigate them.

Modern Alternatives to Traditional Estate Sales

While hiring a full-service estate sale company is a well-worn path, it's not the only one anymore. A new, powerful option has emerged that puts professional-grade tools directly into your hands: the DIY online auction platform. It’s an approach built for today, blending modern technology with your personal control.

While hiring a full-service estate sale company is a well-worn path, it's not the only one anymore. A new, powerful option has emerged that puts professional-grade tools directly into your hands: the DIY online auction platform. It’s an approach built for today, blending modern technology with your personal control.

Think of it like this: you handle the hands-on parts you know best—like sorting and taking pictures of your items—and the platform handles all the tricky backend stuff. This means providing the auction software, marketing your sale to a network of local buyers, and making sure all payments are processed securely.

This model completely flips the script on estate liquidation, putting you firmly in the driver's seat.

The Rise of DIY Auction Platforms

These platforms are perfect for anyone who doesn't mind a little hands-on work in exchange for a much better financial outcome. The whole process is refreshingly straightforward. You create online listings for your items, choose your auction timeline, and manage everything from a simple online dashboard.

Instead of a crew taking over your home for a weekend, you host an online event that leads to a single, organized pickup day. It’s a cleaner, more efficient way to sell, and it’s catching on fast for a few big reasons:

- Far Lower Costs: The fees are a small fraction of what traditional companies charge, so you keep way more of the money you make.

- Total Control: You decide on the starting bids, approve the final prices, and set the schedule. Every key decision is yours to make.

- A Much Bigger Audience: An online auction isn't limited to whoever can show up in person. It opens your sale to interested bidders from all over your region and beyond.

This alternative is a game-changer for smaller estates where a company's high commission minimums just don't pencil out. It’s also ideal for anyone who wants to maximize their profit by investing their own time instead of paying hefty fees.

Comparing Key Differences

When you put the two models side-by-side, the differences are striking. If you really want to dig into the details, you can learn more about how to run successful online estate sales and see what makes this approach so effective.

But to make it simple, let's break down how a traditional company stacks up against a DIY auction platform.

Traditional Estate Sale Company vs DIY Auction Platform

| Feature | Traditional Estate Sale Business | DIY Auction Platform |

|---|---|---|

| Cost Structure | Commission-based, typically 25% - 50% of gross sales. | Lower, flat-rate commission, often around 10%. |

| Control | Limited; the company manages pricing, staging, and negotiation. | Full control; you set all terms, prices, and sale dates. |

| Labor | Fully managed by the professional team; minimal effort from you. | Self-managed; you are responsible for cataloging and photos. |

| Audience Reach | Primarily local buyers who physically attend the in-person sale. | Expansive online audience, reaching bidders from anywhere. |

The choice really comes down to what you value most: paying a premium for a hands-off service or keeping more of your profits by taking on the management yourself.

Your Top Questions About Estate Sales, Answered

If you're new to the world of estate sale businesses, you probably have a few questions. That's completely normal. Getting a handle on how these sales work is the first step toward feeling confident, whether you're hiring a pro or just love to shop.

Let's dive into some of the most common questions we hear.

What Is the Difference Between an Estate Sale and a Tag Sale?

Honestly, not much. For the most part, the terms are used interchangeably, and which one you hear often just comes down to what's common in your region.

Some people feel "tag sale" has a more casual ring to it, but at the end of the day, both refer to the same thing: a professional sale to clear out the contents of a home.

How Can I Find Estate Sales Near Me?

Finding a great sale in your area is simpler than ever. A few tried-and-true methods work best:

- Follow local companies on social media. This is where they'll post sneak peeks, photos, and sale schedules.

- Hop on their email lists. You'll get notifications sent straight to your inbox, so you never miss a sale.

- Check dedicated websites. Platforms like Estatesales.net and Estatesales.org are built for this, letting you search for upcoming sales by zip code.

Do I Need Cash to Shop at an Estate Sale?

It’s always smart to have some cash on you. While most professional estate sale businesses have moved on to accepting credit cards and even apps like Venmo, a privately run sale might still be cash-only.

Plus, having cash in hand can give you a little extra negotiating power, especially when you're shopping on the last day.

Remember, the goal of any estate sale is to sell everything. By the final day, companies are usually very willing to negotiate on remaining items. They’d much rather sell it to you than have to haul it all away themselves.

Are There Items That Are Not Typically for Sale?

Yes, absolutely. Sometimes you'll see items in the house that aren't actually part of the sale. Things like light fixtures, custom window treatments, or major appliances are often considered part of the real estate and stay with the property.

If you're ever not sure if something is up for grabs, just ask a staff member. It never hurts, and you might just spot a fantastic deal that everyone else has overlooked.