A Guide to Estate Sales Fees for Sellers

When you start looking into estate sales, one of the first questions is always about the cost. It’s a crucial piece of the puzzle, and thankfully, the industry standard is pretty straightforward.

Most estate sale companies work on a commission-only basis. This means they take a percentage of the total sales, so they only make money when you do. You'll find that fees typically range from 25% to 50%, with the sweet spot for most reputable companies landing somewhere between 35% and 45%.

Decoding the Cost of an Estate Sale

It’s easy to look at that percentage and think of it as just a fee, but it’s more accurate to see it as an investment. You're not just hiring someone to hang price tags on your stuff; you're bringing in a team of professionals to manage a massive, time-consuming project from beginning to end.

Their pay is tied directly to how well they perform. This creates a powerful shared goal: the more money they make for you, the more they earn.

So, what does that commission actually get you? A good company handles all the heavy lifting to ensure your sale is as smooth and profitable as possible. Here’s what’s usually included:

- Sorting and Organizing: Professionals go through every single item, from the attic to the basement, to categorize and prep everything for the sale.

- Pricing and Valuation: They lean on their experience and research to find the right price for each item. This is a critical step, and you can learn more about how to determine fair market value to see just how much goes into it.

- Staging and Merchandising: Your home is transformed into a temporary retail space. Items are beautifully displayed to create a welcoming shopping experience that encourages people to buy.

- Marketing and Advertising: The company gets the word out through their email lists, social media channels, and industry-specific websites to attract a big crowd of serious buyers.

- Sale Management: On sale days, they provide the staff needed to manage the event, handle customer questions, and process all the payments securely.

The commission model works because it aligns everyone's interests. The company fronts all the costs for labor, marketing, and supplies. Their success is literally your success.

Once you understand that the fee covers this whole package of services, the conversation shifts. It’s no longer just about "What does this cost?" but "What value am I getting for my money?" This mindset is key to helping you compare different companies and their fee structures.

To give you a clearer picture, here’s a quick breakdown of the common fee models you'll encounter.

Typical Estate Sale Fee Structures

This table offers a quick look at the most common fee models and the services typically covered by the commission.

| Fee Model | Common Range | What's Usually Included |

|---|---|---|

| Commission-Based | 35% - 45% | All core services: sorting, pricing, staging, marketing, staffing the sale. |

| Sliding Scale | Varies (e.g., 40% on first $10k, 30% after) | Same as standard commission, but the rate changes based on total sales. |

| Commission + Fees | 25% - 35% + extra charges | Lower base commission, but additional fees for advertising, credit card processing, etc. |

Keep in mind that while the commission model is the most popular, it's essential to get a full breakdown of what's included before signing any contract.

How Commission-Based Fees Really Work

The commission model is the absolute standard in the estate sale world, and for a good reason. It puts you and the company on the same team. Think of it as a partnership—their paycheck is a slice of the total sales pie, so they're just as motivated as you are to get the highest prices possible for your items. It’s a classic win-win.

But that doesn't mean every commission rate is the same. The percentage a company quotes is the result of a careful calculation, and understanding what goes into it will help you see why one company might ask for 35% while another needs 45%.

What Influences the Commission Rate

The biggest factor, by far, is the estimated value of what you’re selling. If a home is packed with high-demand antiques, original art, and fine jewelry, the company can usually offer a lower commission rate. That’s because they can hit their revenue goals by selling fewer, more expensive pieces, which often means less physical labor.

On the other hand, an estate filled with more common, everyday household goods will likely get a higher commission quote. This isn't a penalty. It just reflects the sheer amount of work involved—sorting, cleaning, staging, pricing, and selling hundreds of smaller items to reach a total that makes sense for both you and them.

For a great overview of fee structures and industry averages, this guide on typical estate sale commission rates is a fantastic resource.

A few other things can also move the needle on the final rate:

- Labor Intensity: A cluttered home that needs a major clean-out and organization before the sale can even be set up will require a lot more upfront work, which might push the fee higher.

- Geographic Location: Just like real estate, location matters. Rates can vary based on local market conditions, competition, and the general cost of doing business in a particular city or state.

- Specialized Expertise: Does the estate include rare coins, vintage firearms, or a niche collection? If the company needs to bring in a specialist for appraisals or run a targeted marketing campaign, that expertise can influence the final percentage.

Understanding the Sliding Scale Model

Some companies use what’s called a sliding scale commission, and it’s an option I’m always happy to see. It’s a dynamic structure designed to really light a fire under the sales team. With this model, the commission percentage actually changes as the total sales amount goes up.

Here’s a common example: a contract might set a 40% commission on the first $20,000 of gross sales. But for every dollar earned above that $20,000 mark, the rate drops to 30%.

This structure gives the company a powerful incentive to not just hit the initial goal, but to blow past it. After all, once they cross that threshold, both you and the company start making more money on every subsequent sale. It’s a great way to align everyone’s interests toward maximizing the final outcome.

Uncovering Potential Additional Costs

While the commission percentage covers the bulk of an estate sale company's work, it’s best to think of it as the base price. Certain situations and special requests can trigger extra fees that fall outside that standard rate.

A professional company will always be upfront about these possibilities, but knowing what to look for empowers you to ask the right questions from day one.

These aren't "hidden" fees in a sneaky sense. They’re charges for legitimate, often optional, services that go beyond the typical scope of running the sale. Understanding them means you can budget accurately for the entire process, avoiding any sticker shock when you get the final settlement.

Common Extra Services and Their Costs

Think of these as à la carte options. Most estates won’t need all of them, but it’s good to know they exist. Your contract should clearly spell out what's included in the commission and what’s billed separately.

Here are the most common add-ons you might run into:

- Credit Card Processing Fees: Accepting credit cards can seriously boost your total sales—often by 15-20%—but it isn't free. The processing fees, typically 2-3% of each transaction, are almost always passed on to the client. This is standard practice across the industry.

- Specialized Advertising: If you're selling rare art, a niche collection, or high-end antiques, a simple local ad won't cut it. The company might recommend targeted ads in collector magazines or on specialty websites. The cost for that ad spend is usually billed as a separate expense.

- Junk Removal and Haul-Away: After a great sale, there will always be something left over. The labor and disposal fees for clearing out the remaining contents are almost always an additional charge.

- Deep Cleaning Services: Most contracts require the home to be left "broom swept," but if you need a truly deep, professional cleaning after the sale, that will be an extra line item.

Protecting High-Value Collections

Security is another area where costs can pop up, and for good reason. If the estate contains things like fine jewelry, rare coins, or firearms, the standard crew might not be enough to keep everything safe.

In these cases, a company might insist on hiring a professional security guard for the sale days. It’s a necessary expense to protect your most valuable assets from theft. On top of that, having the right insurance coverage is critical. You can learn more about protecting your sale by reading up on estate sale insurance.

Key Takeaway: Always ask for a complete list of potential charges beyond the commission. A reputable company will provide a clear fee schedule right in the contract, leaving no room for confusion. Reading that contract thoroughly is your best defense against unexpected costs.

Comparing Different Fee Models

While a straight percentage-based commission is what you'll see most often, it's not the only game in town. Some estate sale companies use different models, like flat fees or commission minimums, and knowing the difference is key to picking the right partner.

Think of it like choosing a cell phone plan. A pay-as-you-go option is great if you barely use your phone, but an unlimited plan makes more sense for a heavy streamer. The best estate sale fee model really depends on the unique size and value of your estate.

The Flat-Fee Structure

A flat-fee model is just what it sounds like—you pay one single, agreed-upon price for the entire service, no matter what the sale brings in. It's less common, but some people love the predictability.

- Pros: You know your exact cost from day one, which makes budgeting a breeze. If your sale is a massive success, you get to keep every dollar earned above that flat fee.

- Cons: The big one here is the lack of a shared goal. The company gets paid the same whether your sale makes $10,000 or $50,000, which could mean they aren't as motivated to squeeze every last dollar out of your items.

This approach can sometimes make sense for estates with extremely high-value items, where a percentage commission could get outrageously high. Still, it's just one of several estate liquidation options to weigh.

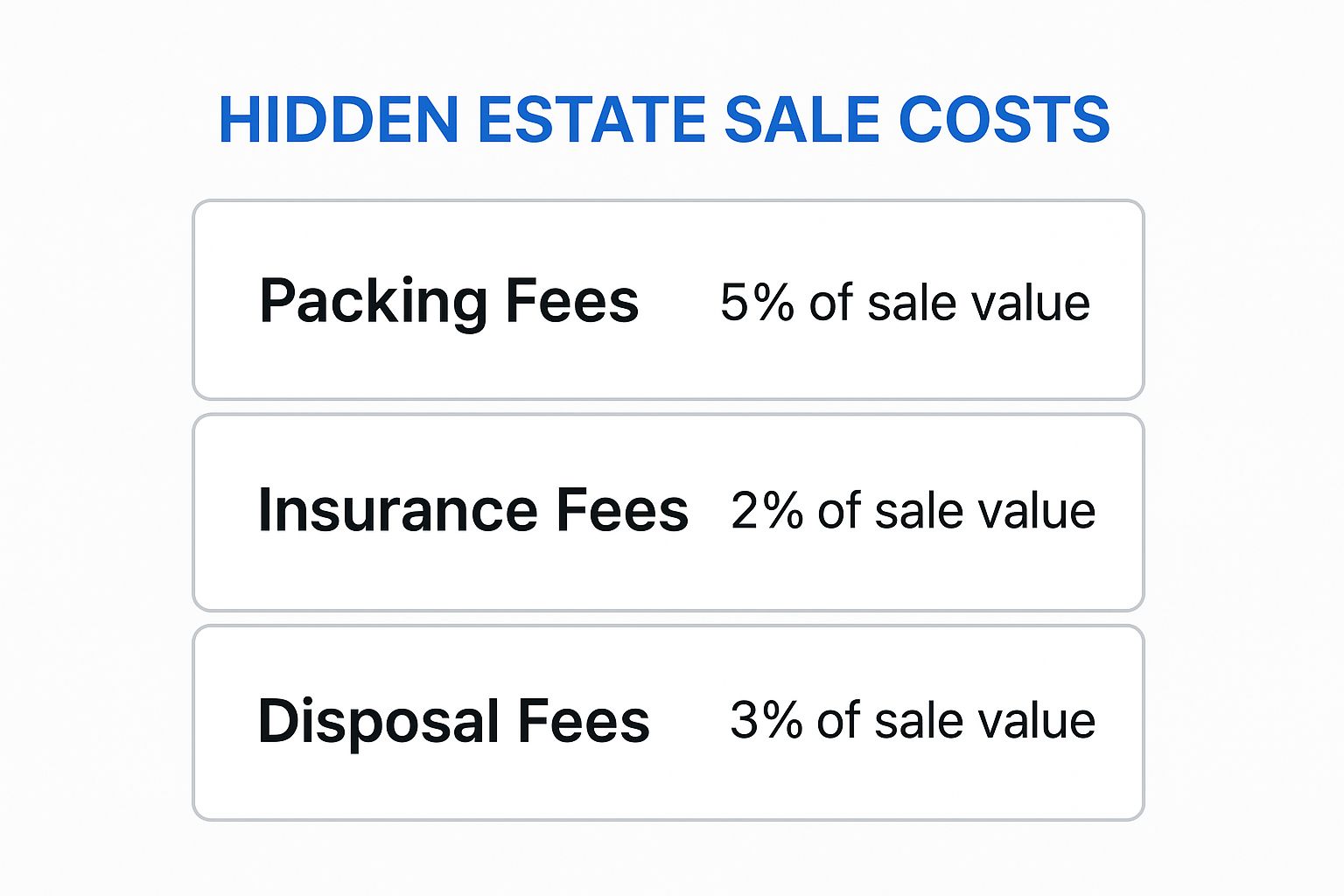

The image below shows how other small costs for services like packing, insurance, or disposal can creep in with any fee model.

It’s a great visual reminder of why you need to read the fine print and understand every single line item in your contract.

Understanding Commission Minimums

More common than a pure flat fee is a commission minimum. This basically acts as a safety net for the estate sale company.

A commission minimum guarantees the company a baseline payment, even if the sale doesn't perform as well as hoped. For example, a contract might state a 40% commission or a $4,000 minimum, whichever is greater.

This protects the company from losing money on smaller sales that still require a ton of work to organize, stage, and run. If the total commission from sales doesn't hit that $4,000 mark, you'll pay the minimum instead.

It’s a way for them to ensure the job is worth their time. To help figure out the best path for your situation, it's always a good idea to look at an estate sale vs. auction comparison to see which liquidation method aligns best with your goals.

How to Reduce Your Estate Sale Costs

While professional estate sale fees are a necessary investment, you have more control over the final bill than you might think. A bit of strategic work upfront can directly reduce a company’s labor hours, strengthen your negotiating position, and ultimately keep more money in your pocket.

Think of it as a partnership. When you make the estate sale company’s job easier and more efficient, you give them a good reason to offer a better commission rate and minimize extra charges. It’s a proactive approach that pays off.

Pre-Sale Preparation and Organization

A little tidying before you even call for a quote can make a huge difference. Start by grouping similar items together—put all the kitchen gadgets in the kitchen, gather the linens in one closet, and so on. This simple step saves the company hours of sorting, which is labor you won't have to pay for through a higher fee.

But here’s a crucial tip: do not throw anything away! Seriously. What looks like junk to you could be a niche collectible someone is actively searching for. Let the professionals use their expertise to decide what has value and what doesn’t.

Here’s a smart checklist to tackle before they arrive:

- Gather Important Documents: Find any receipts, appraisals, or certificates of authenticity for big-ticket items like art, jewelry, or antique furniture. This paperwork makes pricing a breeze and proves an item’s value to buyers.

- Set Aside Personal Items: Clearly mark and remove any family heirlooms, photo albums, or personal papers that are not for sale. This prevents any heartbreaking mix-ups and protects your most sentimental belongings.

- Create Clear Pathways: Make sure the home is safe and easy to navigate. Clearing clutter and trip hazards allows the company to do a fast, accurate assessment during their initial walkthrough.

Smart Vetting and Negotiation

Getting multiple quotes is absolutely essential. Plan on interviewing at least three reputable companies to compare their commission rates, what their services include, and their overall plan for your sale. This gives you a solid feel for the local market rate and gives you real negotiating leverage.

When you have a very valuable collection or a few standout pieces, you're in a stronger position to negotiate. Some companies may be willing to offer a lower commission on specific high-ticket items, such as a car or a significant piece of artwork.

Don’t be shy about asking direct questions about every single fee. Ask specifically about extra costs for things like credit card processing, advertising, or post-sale junk removal, and get every detail in writing. A transparent contract is your best friend for a successful, stress-free estate sale.

A Few Lingering Questions on Estate Sale Costs

Even after you've got a handle on the commission models and potential extra fees, a few questions probably still come to mind. It's totally normal. Getting clear answers to these common worries is the final step to feeling confident about hiring a professional and knowing what to expect.

Do I Have to Pay if Nothing Sells?

This is a big one, but you can usually breathe easy. The vast majority of reputable estate sale companies work on a commission-only basis. Their paycheck is a slice of the total sales, which means if nothing sells, they don't get paid. Simple as that.

This model is standard for a reason—it puts you and the company on the same team. Their goal is your goal: sell as much as possible for the best prices. Still, you should always double-check the contract. Some agreements might sneak in a minimum fee to cover their time or have separate charges for things like hauling away unsold items, no matter how the sale goes.

How and When Do I Get Paid After the Sale?

Your contract should spell this out clearly. Typically, you can expect to see your money within 7 to 14 business days after the sale wraps up.

In that window, the company is busy reconciling all the transactions, deducting their commission and any other costs you approved, and putting together a final report for you. A good company will be an open book with their accounting. If you run into a company that's vague about their payout timeline or it seems unusually long, that’s a red flag.

Always ask: "What is your typical payment turnaround time, and will I receive a detailed, itemized settlement statement?" This one question tells you a lot about who you're dealing with.

Should I Throw Away Items Beforehand?

I know it's tempting to start "pre-cleaning," but please, hold off! It’s so important to let the estate sale company see everything—the good, the bad, and the dusty—before you toss a single thing. What looks like trash to you might be a collector's treasure.

These pros have a trained eye for spotting value where most of us wouldn't. I've heard countless stories of people almost throwing out items that ended up being some of the top sellers. Tossing things prematurely is like throwing away potential profit. Once you've hired a team, you can walk through the house together and decide what’s truly unsellable and what the best plan is for donation or disposal.