How to Determine Fair Market Value Like a Pro

Figuring out what something is really worth can feel like a guessing game, but it doesn't have to be. Whether you're dealing with real estate, business equipment, or personal property, the goal is to land on its fair market value.

This process boils down to a few core methods: comparing your item to recent sales of similar ones, looking at its income-generating power, or figuring out what it would cost to replace it from scratch. The right approach—or sometimes a blend of them—really depends on what you're valuing.

What Is Fair Market Value and Why It Matters

Before we get into the nitty-gritty, let's nail down what fair market value (FMV) actually is. The IRS puts it perfectly: it’s “the price at which property would change hands between a willing buyer and a willing seller… both having reasonable knowledge of relevant facts.”

This isn't just bureaucratic jargon; it's a concept that has huge real-world consequences.

Getting the FMV right is absolutely critical for a ton of financial situations. Think about it: filing taxes, settling an estate, selling a business, or even making an insurance claim. A bad valuation can mean you overpay the taxman, leave money on the table in a sale, or get shortchanged by an insurance company. It's a number you want to get right.

The Foundation of an Accurate Valuation

At its heart, FMV is all about objectivity. It pictures a perfect, pressure-free transaction where both the buyer and seller are informed, acting in their own best interests, and not under any duress. That’s why you can’t use a forced foreclosure or a sale to your cousin as a benchmark—those situations don't reflect the true, open market.

Understanding fair market value isn't just about sticking a price tag on something. It’s about finding its true worth in a transparent, competitive marketplace. That's the bedrock of any fair financial deal.

To help you demystify this, we're going to break down the three main methods the pros use. Each one gives you a different angle for sizing up an asset's value. Think of them as different tools in your valuation toolkit.

- Market Approach: This is your go-to for common items where you can easily find comparable sales. It's perfect for things like houses or used cars.

- Income Approach: If the asset makes you money, this is the method for you. It’s ideal for rental properties or an online business.

- Cost Approach: This one is for unique, one-of-a-kind assets where there are no direct comps, like a custom-built workshop or highly specialized machinery.

To give you a clear roadmap, let's quickly summarize these core valuation methods.

Three Core Approaches to Fair Market Value

This table breaks down the three fundamental ways to determine an asset's worth. Understanding when and how to use each one is the key to an accurate valuation.

| Valuation Approach | Primary Use Case | Key Principle |

|---|---|---|

| Market Approach | Residential Real Estate, Vehicles | Value is determined by recent sales of comparable properties. |

| Income Approach | Commercial Real Estate, Businesses | Value is based on the asset's ability to generate future income. |

| Cost Approach | Unique or Special-Use Properties | Value is what it would cost to build or replace the asset today. |

Getting comfortable with these three approaches will give you the confidence to determine a fair, defensible value for almost anything.

The Market Approach Using Comparable Sales

Of all the ways to figure out what something is worth, the market approach is the most straightforward and widely trusted. The logic is simple: an item is worth what someone else recently paid for a similar one. This method, often called the Sales Comparison Approach, is the bedrock for valuing everything from real estate and vehicles to collectibles and business equipment.

The whole process hinges on finding solid "comparables" (or "comps"). These are recently sold items that are as close a match as possible to the one you're trying to value. But here’s the thing—finding the right comps is more of an art than a science. It takes a sharp eye for detail.

Identifying and Qualifying Your Comps

Your first filter should always be time. Markets change quickly, so a sale from a year or two ago just doesn't carry the same weight as one from last month. A good rule of thumb in most markets is to stick to sales from the last 6 to 12 months.

Once you have a list of recent sales, the real work begins. You need to look closely at each potential comp and compare it to your item, paying attention to the key attributes.

- Physical Characteristics: Think size, age, condition, and materials. For a house, that means square footage and the number of bedrooms. For a car, it's all about mileage and overall shape.

- Location: This is a huge deal for real estate. An identical house on a quiet side street is going to have a different value than one on a major road.

- Unique Features: Does your item have something special? A finished basement, a rare artist's signature on a painting, or a fully restored engine can make a big difference.

A perfect "apples-to-apples" comparable is rare. The goal isn't to find an identical twin. It's to find a few very similar items and then intelligently account for the differences. This is where adjustments come in.

Making Apples-to-Apples Adjustments

This is the most critical part of using the market approach correctly. An adjustment is simply a dollar value you add or subtract from a comp’s sale price to make it a more accurate comparison to your item.

Let's imagine you're valuing your three-bedroom house. You find a great comp that sold for $400,000 last month. It's almost identical, but it has a brand-new roof (yours is 15 years old) and an outdated kitchen (yours was just remodeled).

You would need to make some adjustments:

- You'd subtract some value from the comp’s $400,000 price because its new roof is superior to yours.

- Then, you'd add value back to the comp's price to account for your superior, newly remodeled kitchen.

After making these tweaks, the comp’s adjusted sale price might come out to $392,000. By doing this with three to five solid comps, you can zero in on a tight, defensible value range for your own property. It's a meticulous process, but it's far more accurate than just taking a wild guess or averaging raw sale prices. This technique is especially powerful in estate situations, and our estate sale pricing guide offers more specific tips on valuing common household goods.

Finally, you have to toss out any outliers. Sales between family members, foreclosures, or any other "distressed" transaction don't reflect true market conditions and will throw off your numbers. Fair market value is built on the idea of willing, unpressured buyers and sellers, and your comps need to reflect that reality.

The Income Approach for Valuing Cash-Flow Assets

When an asset is more than just an object—when it's actively making money—its real value is tied directly to how much it can earn. This is the whole idea behind the Income Approach. Instead of hunting for similar items that have sold, this method zeros in on the future cash an asset can generate.

It’s the go-to strategy for valuing things like rental properties, dividend-paying stocks, and, most importantly, entire businesses. The core concept is something we all intuitively understand: a dollar you might get next year is worth less than a dollar in your pocket today.

Forecasting Future Earnings

The first step is figuring out how much cash the asset is likely to produce in the years ahead. This is part science, part educated guess. It’s definitely not about wishful thinking. You need a realistic projection based on hard evidence.

For a small e-commerce business, for instance, you’d dig into past sales figures, profit margins, and what it costs to land a new customer. From there, you'd build a reasonable forecast for the next three to five years, baking in real-world factors like market competition and your marketing plans. The goal is a projection grounded in reality, not just ambition.

Discounting to Find Present Value

Once you have that forecast, the next move is to "discount" those future earnings back to what they're worth right now. This is done with a discount rate, which is just a percentage that reflects the risk of the investment.

The higher the risk, the higher the discount rate, which in turn lowers the asset's present-day value. A stable, well-established business with predictable income might warrant a low discount rate, say 10%. On the other hand, a new startup in a volatile industry could face a rate of 25% or even higher to account for all the uncertainty.

Key Takeaway: The discount rate is the most subjective—and arguably the most important—part of the income approach. It’s a direct reflection of risk. A small change in this rate can have a massive impact on the final valuation.

Let's put it into practice. Imagine your e-commerce store is projected to bring in $50,000 in cash flow next year. If you apply a 15% discount rate, that future money is only worth about $43,478 today. The riskier the venture, the more that future income gets chipped away.

Accounting for Intangible Value

But what about the things you can't see on a spreadsheet? A business's value isn't just its equipment and inventory. Things like brand reputation, a loyal customer base, or a secret recipe are all intangible assets, and they absolutely have value.

The Excess Earnings Method is a clever technique used to put a number on these intangibles. Here’s how it works:

- First, you calculate a fair return on the business's physical, tangible assets (like your warehouse shelves and product stock).

- Then, you subtract that number from the business's total earnings.

- Whatever is left over—the "excess" earnings—is considered the profit generated by your intangible assets.

This method helps you quantify things like goodwill and brand power, giving you a much fuller picture of what a business is truly worth.

It's an essential tool for any owner trying to figure out fair market value beyond the balance sheet. And if you're liquidating assets, whether for a business or a personal estate, knowing how to price individual items is just as crucial. For more on that, you can check out our guide on how to price estate sale items.

The Cost Approach for Unique and Special-Use Assets

So what happens when you need to value something that doesn't really have a sales history and doesn't generate income? This is a common puzzle when dealing with things like a custom-built factory, a public school, or a highly specialized piece of industrial machinery.

For these unique situations, the Cost Approach is often your most reliable tool.

The logic behind it is refreshingly simple: a smart buyer will never pay more for an asset than what it would cost to build or buy a functional equivalent. It’s a method grounded in practicality, answering the fundamental question, "What would it take to replace this from scratch today?"

Replacement Cost vs. Reproduction Cost

When you start digging into the numbers, you'll encounter two key terms: replacement cost and reproduction cost. Getting this distinction right is critical because it directly shapes your final valuation.

-

Replacement Cost: This is the cost to build a substitute asset with similar usefulness, but using modern materials, standards, and design. The focus is on function, not form.

-

Reproduction Cost: This is the cost to create an exact duplicate of the asset. We're talking the same materials, same design, same everything—even if those things are now outdated or wildly expensive.

For almost all valuations you'll ever do, replacement cost is the way to go. A business that needs a new warehouse doesn't care if it's made from the same 1970s-era brick as the old one; they just need a functional, modern space that gets the job done.

Key Insight: The Cost Approach isn't just about the price tag of a new building. Its real power comes from accurately calculating how the existing asset has lost value over time. We call this depreciation.

The Three Flavors of Depreciation

Depreciation is much more than just the wear and tear you can see. To land on an accurate value, you have to subtract every form of value loss, or "obsolescence," from the replacement cost. This is where the real expertise comes in.

1. Physical Deterioration This is the most obvious kind. It's the rust, rot, cracks, and general decay that happens over time from use and exposure to the elements. Think of a leaky roof on an old building or the worn-out motor on a piece of equipment. It’s the stuff you can physically point to.

2. Functional Obsolescence This type of value loss comes from outdated design or features that just don't meet today's standards. A classic example is a factory with low ceilings and small bay doors that can't accommodate modern semi-trucks. Or an office building with a choppy floor plan that kills any chance of an open, collaborative workspace. The building itself might be solid, but its design is the problem.

3. Economic Obsolescence This one is a little different because it's caused by negative factors happening outside the property itself—things that are completely beyond your control. A new zoning law that restricts your factory's operations, a major employer leaving town and devastating the local economy, or a permanent shift in consumer demand for your product can all crush an asset's value, even if it's in pristine physical condition.

By starting with the modern replacement cost and then carefully subtracting these three types of depreciation, you arrive at a solid, defensible valuation. This approach gives you a clear path to determine fair market value for those one-of-a-kind assets that other methods simply can't handle.

Reconciling The Numbers to Finalize Your Valuation

So, you’ve done the legwork. You’ve dug into the market, income, and cost approaches, and now you probably have three different valuation figures staring back at you. Don’t panic—that’s completely normal. In fact, it’s exactly what should happen.

The final piece of the puzzle isn't about just picking one number or, worse, averaging them out. It’s a process called reconciliation, and it’s where your expertise truly comes into play.

Assigning Weight to Each Approach

Reconciliation is a judgment call where you weigh each approach based on its relevance to the item and the quality of the data you found. The type of asset you're valuing is the biggest factor here.

Think about it like this: if you're valuing a single-family home in a popular suburb, the Market Approach is king. Why? Because you have a goldmine of recent, comparable sales data to work with. It's the most direct reflection of what real buyers are willing to pay right now. The Cost Approach is far less important because a buyer doesn’t really care what it cost to build the house 30 years ago; they care about what similar homes are selling for today.

Now, let's flip the script to a commercial office building. In this scenario, the Income Approach takes center stage. A potential buyer’s number one concern is the property's ability to generate rent and deliver a return on their investment. The Market Approach is still useful for context, but the income potential is the real driver of value.

Reconciliation is where data meets discernment. It’s the process of looking at all your valuation evidence and deciding which story is the most compelling for your specific asset. The final number is a reasoned conclusion, not a mathematical average.

Determining fair market value is always guided by methodologies that prioritize objective evidence. Official accounting guidance often favors the Market Approach because it relies on prices from actual market transactions. Using this kind of observable, real-world data helps ensure your final figure reflects current market expectations, not just theoretical calculations.

Final Adjustments and Documentation

Even after weighing the primary approaches, you might need to make one last adjustment. Maybe you have insider knowledge that a new development is planned nearby that will boost value, something not yet reflected in past sales data. This is where your informed judgment allows you to fine-tune the number and arrive at a single, defensible figure.

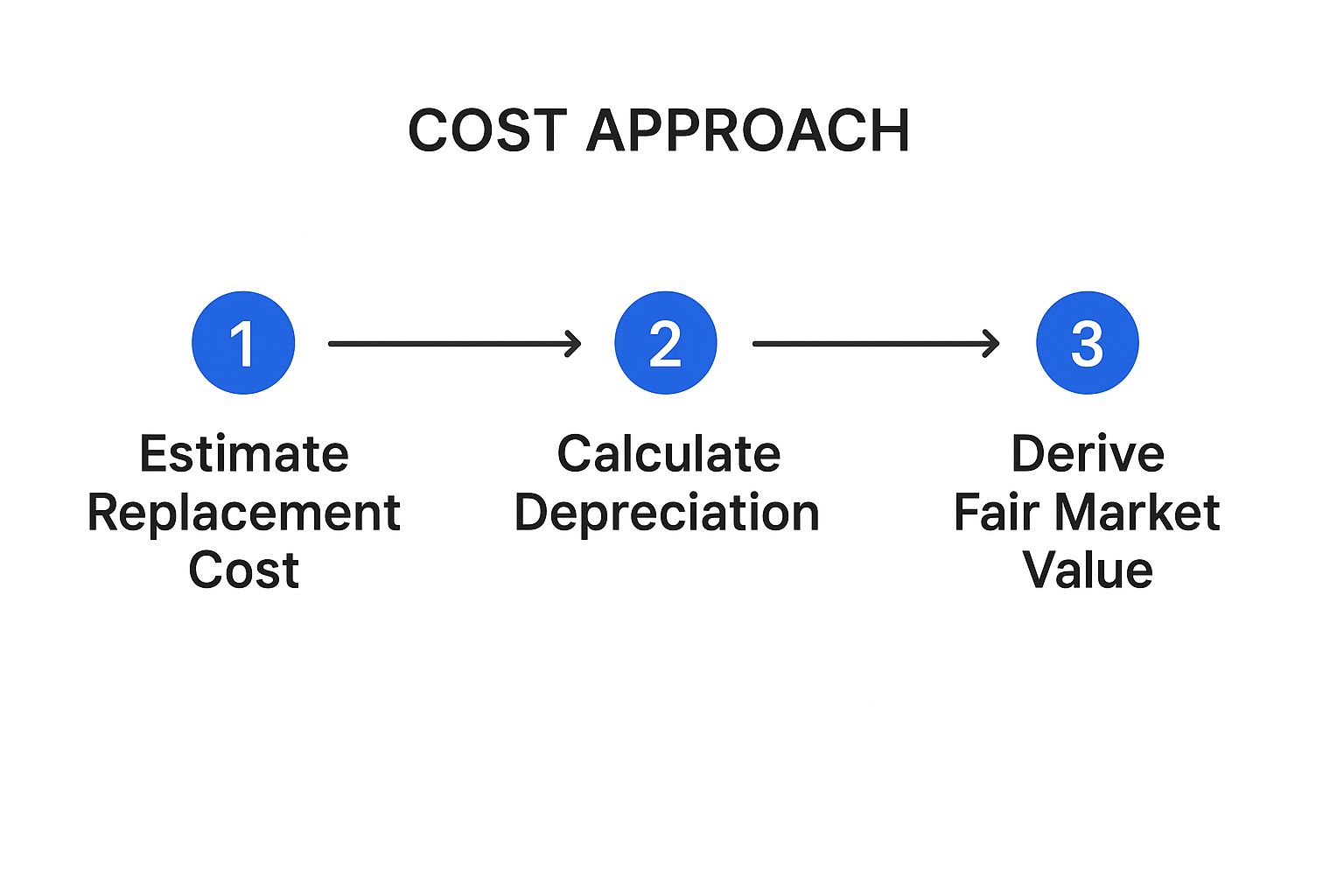

This image breaks down the logic of the Cost Approach, which can be a key piece of the puzzle, especially for unique or new items.

As you can see, the method flows logically from the replacement cost, factoring in all forms of depreciation to land on a final value.

Lastly—and this part is non-negotiable—you must document everything. Your final report should clearly explain which methods you used, why you gave more weight to one over another, and the source of all your data. This documentation is your proof. It’s what you’ll rely on to justify your valuation for tax filings, legal proceedings, or a potential audit. For anyone handling an estate, this level of detail is absolutely critical, a topic we cover in our executor duties checklist.

Common Questions About Fair Market Value

Even after you’ve got a handle on the basics, figuring out fair market value can bring up some tricky questions. It’s totally normal. Let’s clear up a few of the most common points of confusion so you can move forward with confidence.

What Is the Difference Between Fair Market Value and Appraised Value?

This one trips a lot of people up because the terms sound so similar, but they serve different purposes. It's easy to think of it this way: fair market value is the theoretical price an item would fetch if sold today on the open market. It's the number you're working to discover through your research.

An appraised value, on the other hand, is a formal, documented opinion of that fair market value, prepared by a certified professional. Appraisals are done at a specific point in time and are often required for official transactions like securing a mortgage, settling an estate, or making an insurance claim.

Key Difference: FMV is a concept, a target price you research. An appraisal is a formal, legally defensible opinion of that concept. For anything official, you’ll need the appraisal to back you up.

How Often Should I Determine the Fair Market Value of My Assets?

There's no single right answer here—it really depends on the asset and your reason for needing the valuation.

- For investments like a stock portfolio or business equipment, a quarterly or annual check-in is a smart move to keep track of performance.

- For real estate, you really only need a current FMV when you’re planning to sell, refinance, appeal your property taxes, or review your homeowner's insurance.

- For high-value personal items—think fine art, antiques, or jewelry—it’s a good idea to re-evaluate the value every 3-5 years. This ensures your insurance coverage is keeping pace with the market.

Can I Determine Fair Market Value Myself?

Yes, you absolutely can... but with a major caveat.

For informal situations, a do-it-yourself valuation is perfectly fine. If you’re selling a used car to a friend or pricing old furniture for a garage sale, your own research is usually good enough. These are low-stakes transactions where a "good enough" number works.

However, a DIY valuation won't fly for official purposes. A certified appraisal from a qualified professional is almost always mandatory for situations like:

- IRS tax filings, especially for large charitable donations or estate taxes.

- Legal proceedings, such as divorce settlements.

- Securing a loan where the item is being used as collateral.

In these cases, you need an independent, unbiased figure that can withstand official scrutiny. Self-assessing just won't cut it.