What Is Fair Market Value? A Clear Explanation You Need

When you hear the term Fair Market Value (or FMV), what comes to mind? For many, it sounds like dry, legal jargon. But in reality, it’s one of the most practical and important concepts you’ll encounter when dealing with assets, especially in an estate sale.

Think of FMV as the sweet spot. It’s the price that a knowledgeable buyer and an equally knowledgeable seller can agree on, without either one being backed into a corner. This idea is the foundation for almost every fair transaction, from selling a family member's estate to making a tax-deductible donation.

The Core Principles of Fair Market Value

Let's ditch the textbook definition for a moment and get real. To truly get what fair market value is, you have to understand the human side of a transaction.

Imagine you're selling a beautiful antique mahogany dining table from your parents' home. Its FMV isn't the pie-in-the-sky price you dream of getting, nor is it the lowball offer you might get from a dealer who knows you need it gone by Friday. FMV is the price reached under a specific set of ideal—and fair—conditions.

Key Conditions for FMV

For any price to be considered true fair market value, three simple but non-negotiable conditions have to be in place:

- Knowledgeable Parties: Both you (the seller) and the buyer have a solid understanding of the item. You both know it's a solid wood, early 20th-century piece, not just a "used table." You're aware of its condition, and the buyer knows what similar tables are selling for.

- No Compulsion or Pressure: This is crucial. Neither of you is desperate. You aren't being forced to sell to pay an urgent bill, and the buyer isn't the only person in a 100-mile radius with a truck big enough to move it. The deal happens on a level playing field.

- Willing Participants: Both you and the buyer are there voluntarily. It's what's known as an "arm's-length" transaction—there’s no special relationship (like a sale to your cousin) that could artificially lower or raise the price.

This entire framework isn't just a nice idea; it's so fundamental that it’s baked into our legal system. A key U.S. Supreme Court case established FMV as the price between a willing buyer and seller, both having reasonable knowledge of the facts and neither being under compulsion. This standard is now at the heart of tax law and financial proceedings around the world. You can read more about the legal basis of Fair Market Value to see its official standing.

FMV Is Not a Single Number

Here’s a common mistake people make: thinking an item has one, fixed fair market value. It doesn't. In the real world, FMV is more of a range or a consensus point. It’s the price that a typical, informed buyer and seller would land on, and it can shift based on where you are, the time of year, and what similar items have sold for recently.

To really nail this down, it helps to see how FMV stacks up against other types of valuations you might run into.

Fair Market Value vs Other Valuation Types

Each valuation method has a different job. Mistaking one for another can lead to confusion, whether you're insuring an item, paying taxes, or selling it. This table breaks down the key differences.

| Valuation Type | Key Characteristic | Typical Use Case |

|---|---|---|

| Fair Market Value | A consensus price between informed, unpressured parties. | Estate sales, IRS donations, divorce settlements. |

| Appraised Value | A professional appraiser's opinion, often for a specific purpose. | Securing a mortgage, insurance underwriting. |

| Assessed Value | A value assigned by a government body for taxation. | Calculating annual property taxes. |

| Insurance Value | The cost to replace an item brand new (replacement cost). | Filing an insurance claim after loss or damage. |

As you can see, the "value" of an item really depends on who is asking and why. For the purpose of an estate sale, where the goal is a fair and efficient liquidation, Fair Market Value is the only number that truly matters. Getting these distinctions right is the first step toward valuing your assets correctly and making smart financial decisions.

Why Understanding FMV Is Crucial for Your Finances

Getting a handle on fair market value isn’t just some financial busywork—it's a real-world skill with serious consequences for your wallet. Whether you're filing taxes or navigating a major life change, a solid grasp of FMV is what protects your assets and keeps every transaction on the level. Think of it as the impartial benchmark that everyone, from lawyers to the IRS, uses to make sure they're all working from the same playbook.

Getting a handle on fair market value isn’t just some financial busywork—it's a real-world skill with serious consequences for your wallet. Whether you're filing taxes or navigating a major life change, a solid grasp of FMV is what protects your assets and keeps every transaction on the level. Think of it as the impartial benchmark that everyone, from lawyers to the IRS, uses to make sure they're all working from the same playbook.

This concept stops being theoretical and gets very real the second you have to deal with institutions like the IRS or work through legal matters. A spot-on FMV can be the difference between a smooth, fair process and a costly, dragged-out fight. Let’s break down the specific times when knowing what is fair market value is absolutely vital to your financial well-being.

Protecting Your Interests in Tax Situations

Taxes are, without a doubt, one of the most common arenas where fair market value takes center stage. The IRS and other government agencies lean on FMV as the gold standard for figuring out what property and assets are worth in a few key situations.

A classic example is making a charitable donation. When you donate something other than cash—say, a car, a piece of art, or real estate—your tax deduction is pegged to its FMV on the day you donated it. Get that value wrong, and you could be facing audits and penalties for overstating it, or leaving money on the table by undervaluing it.

Likewise, FMV is the bedrock for calculating gift and estate taxes. When you pass assets down to your heirs, the IRS needs a proper valuation to see if any tax is due. An accurate assessment makes sure the estate is settled correctly and fairly for every beneficiary, which goes a long way in preventing legal battles down the road.

Key Takeaway: The IRS isn't just going to take your word for it. They expect a valuation that reflects the true, objective market price. Getting it right from the start is crucial for staying compliant and making the most of your financial situation.

The financial ripple effect of FMV is massive, reaching far beyond one person's tax return. In the U.S., property tax collections, which are all based on precise FMV assessments, hit about $600 billion in 2023. It’s just as critical in the corporate world, especially during mergers and acquisitions where valuations can swing deal premiums by 12-20% over book value. To see more on this, you can learn more about how FMV shapes major markets.

Ensuring Fairness in Life-Changing Events

Beyond taxes, FMV is the principle that keeps things equitable during some of life's biggest transitions. Its job is to provide an objective yardstick of worth when emotions and personal feelings might otherwise muddy the waters.

Just think about these common situations where a solid FMV is a must-have:

- Divorce Settlements: To divide marital assets, you have to value everything from the family home to retirement accounts. A court-approved FMV for each asset is essential for splitting everything fairly between both people.

- Business Buyouts: If a partner in a small business decides to cash out, their share needs to be bought. Fair market value is used to land on a fair price for their stake, ensuring the person leaving is properly compensated and the remaining partners aren't overpaying.

- Insurance Claims: After a fire, flood, or theft, insurance companies use FMV to calculate the cash value of your lost property, especially for items that have lost value over time.

In every one of these scenarios, locking in a clear and defensible fair market value is the single best way to head off disputes. It swaps out subjective opinions for a transparent, market-based number that everyone involved can see and understand. This foundation of fairness is exactly why professionals in law, finance, and real estate insist on getting the FMV right.

How Professionals Calculate Fair Market Value

Figuring out fair market value isn't just a shot in the dark. Professionals rely on a few established, logical methods to land on a number they can stand behind. While it might sound complicated, the core ideas are actually pretty straightforward.

Think of an appraiser as a detective with a specific toolkit. Each tool is designed for a different type of evidence, and the goal is to find the most objective and supportable value for the item in question. They typically lean on one of three main approaches, each a perfect fit for different kinds of assets.

The Market Approach Using Comparables

The Market Approach is the one most of us are familiar with, even if we don't know its official name. It simply answers the question, "What have similar things sold for recently?" It's the exact same logic a real estate agent uses when they pull "comps" to price a house, looking at what similar homes in the neighborhood have sold for.

This method is the gold standard when there's an active market with plenty of sales data to look at. It's the go-to for assets like:

- Residential homes

- Common stocks and bonds

- Used cars and trucks

- Collectibles with a busy trading scene, like sports cards or stamps

The power of the Market Approach is that it's grounded in reality—it reflects what real people were actually willing to pay for something almost identical. The trick, of course, is finding truly comparable sales. An appraiser has to make smart adjustments for any differences in condition, age, or features to make sure the comparison is fair.

If you're interested in doing your own research, you can learn more about how to determine fair market value yourself.

The Cost Approach Valuing Uniqueness

But what happens when you can't find any comps? This is common with one-of-a-kind, custom-made, or highly specialized items. For these situations, professionals pull out a different tool: the Cost Approach. This method asks a different question: "What would it cost to build this exact thing again from scratch today?"

This approach calculates the current cost to replace an asset and then subtracts value for depreciation—things like age, wear and tear, and just being outdated.

Imagine you need to value a custom piece of factory machinery. No one else has one just like it, so the Market Approach is useless. Instead, an appraiser would calculate the cost of the parts and labor to build a new one (Replacement Cost) and then reduce that value because the existing machine is older and isn't brand new anymore.

The Cost Approach is less about what something could sell for and more about what it would cost to replace. It's critical for valuing items that don't have a secondary market, like specialized industrial equipment.

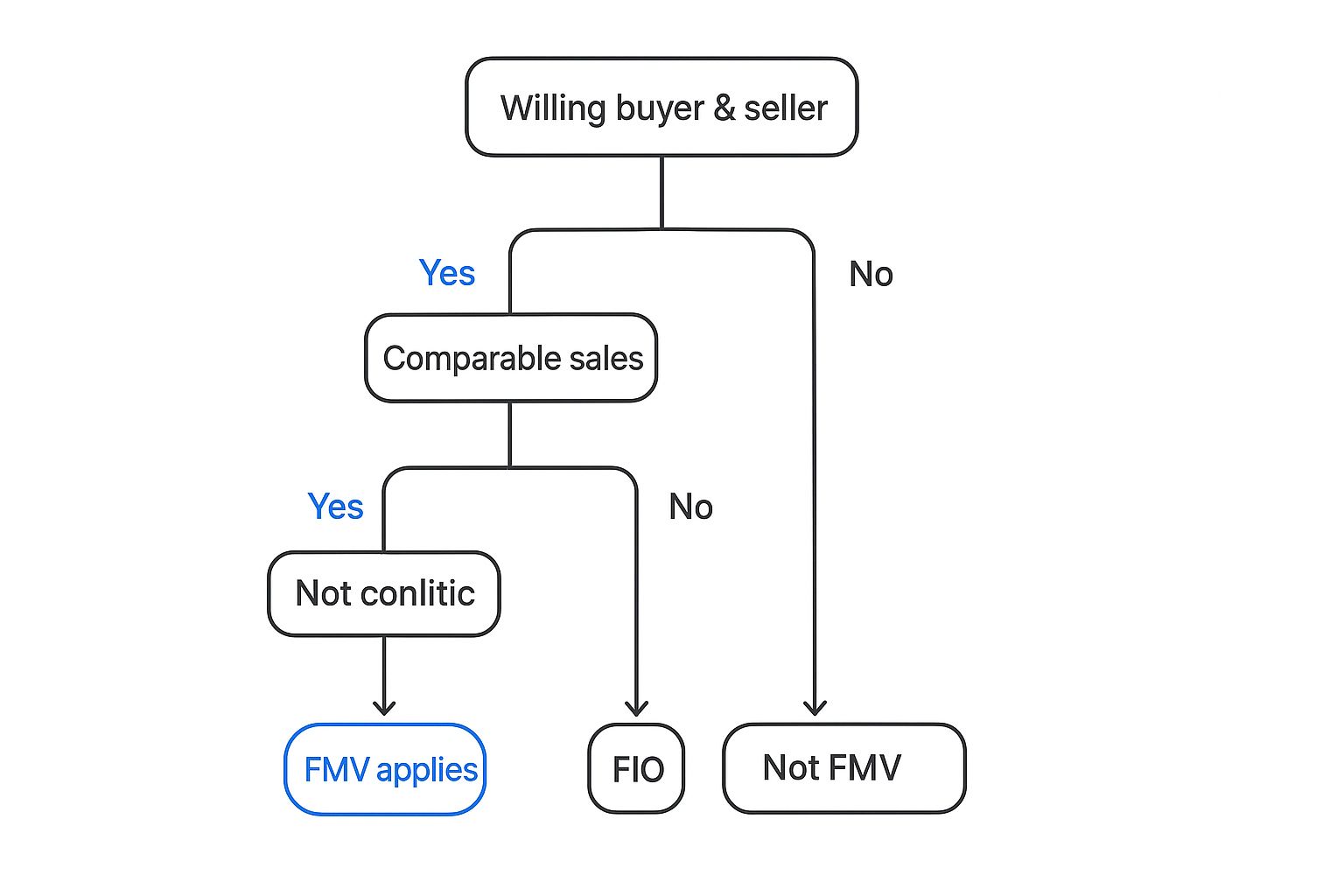

This image breaks down the key ingredients for a transaction to meet the standard of Fair Market Value.

As you can see, true FMV happens at the intersection of informed, willing parties and stable market conditions where good "comps" exist.

The Income Approach Measuring Potential Earnings

The third tool in the kit is the Income Approach, and it’s all about assets that make money. It looks at an asset not as a physical object, but as an income-generating machine. This approach answers the final question: "How much money will this asset produce in the future?"

This is the number one method for valuing commercial real estate like apartment complexes, office buildings, or shopping malls. An investor isn't buying a 50-unit apartment building because they love the brickwork; they're buying it for the rental checks it generates. The property's value is directly tied to its earning power.

To calculate this, an appraiser looks at the property's net operating income (all income minus all operating expenses). They then use a "capitalization rate"—a number that reflects the expected return for that kind of investment—to figure out the asset's current value.

Choosing the Right Valuation Method

Picking the right method is everything. The type of asset you're dealing with will point you toward the most accurate and reliable way to find its fair market value. Professionals will often consider all three but give the most weight to the one that makes the most sense for the situation.

This table can help you understand which tool is right for which job.

| Valuation Method | Best For... | Example Asset |

|---|---|---|

| Market Approach | Common assets with active sales markets. | A 3-bedroom house, a 2021 Ford F-150 |

| Cost Approach | Unique or custom-made assets with no comps. | A custom-built factory machine, a church |

| Income Approach | Assets that generate revenue. | An apartment building, a rental property |

Ultimately, whether it's by looking at comps, replacement cost, or income potential, the goal is always the same: to arrive at a fair, defensible number that reflects an asset's true worth in the open market.

Navigating FMV in Real Estate Deals

For most of us, the idea of fair market value gets real when it comes to real estate. A home is the single biggest thing many people will ever buy or sell, so getting a handle on its value isn’t just a nice-to-know—it’s absolutely critical. This is where what is fair market value stops being a textbook definition and becomes a high-stakes negotiation.

A home’s FMV is a living number, shaped by a whole host of factors. Think of it as the sweet spot where an informed buyer and a motivated seller would logically meet. But things can get confusing fast because FMV is often mistaken for two other numbers: appraised value and assessed value. Knowing how they differ is the key to a much smoother transaction.

Market Value vs. Appraised Value vs. Assessed Value

These three terms sound like they could be interchangeable, but they each have a totally different job. Getting them straight will save you a world of headaches, whether you're buying, selling, or just trying to figure out your property tax bill.

-

Fair Market Value (FMV): This is the street price. It’s what a house will most likely sell for on the open market, driven by current supply, demand, and what similar homes have recently sold for. A sharp real estate agent figures this out with a Comparative Market Analysis (CMA).

-

Appraised Value: This is a formal valuation from a licensed appraiser, almost always ordered by a mortgage lender. The bank needs this professional opinion to make sure the house is worth enough to be good collateral for the loan.

-

Assessed Value: This number comes from your local government and exists for one reason only: to calculate your property taxes. It almost never matches the home’s actual market value.

Let's say your agent suggests listing your home for $450,000, believing that’s its FMV. A buyer offers $445,000, and you accept. But then, the bank’s appraisal comes in at only $435,000. To top it off, your official county tax assessment has the home valued at $380,000. Every single one of these numbers is "correct" for its specific purpose.

The key takeaway is that the final sale price and the appraised value can, and often do, differ. A bank's appraisal is really a risk-management tool for them, not a seal of approval on your price. A low appraisal can often send everyone back to the negotiating table.

How a Home's FMV Is Determined

So, how does an agent or appraiser actually land on a specific number? It’s not guesswork. They perform a detailed analysis based on hard data, using the market approach we touched on earlier.

The single most important piece of the puzzle is comparable sales, or "comps." These are recent sales of very similar homes in the immediate vicinity. A great comp is a home that’s a close match in:

- Location: Same neighborhood, maybe even the same street.

- Size: Similar square footage, bed/bath count.

- Condition: Roughly the same age with a similar level of updates.

- Timing: Sold within the last 3 to 6 months.

An agent or appraiser will find the three to five best comps and then start making adjustments. If a comp sold for $450,000 but had a brand-new kitchen and your home doesn’t, they’ll subtract value from that comp's price to make it a more apples-to-apples comparison. It’s this process of adjusting that hones in on your home's most likely sale price.

Of course, things like curb appeal, the current market climate (is it a buyer's or seller's market?), and unique features all play a role, too. Nailing down an accurate FMV is crucial, especially when you're managing an estate liquidation and need to get the best possible price. If you find yourself in that situation, our guide on how to run an estate sale offers practical advice for pricing everything, including the house itself.

Determining FMV for Inherited Property and Estates

When you’re settling an estate, fair market value suddenly becomes much more than just a financial concept. It’s a critical, and often emotional, necessity. The process isn't just about selling things; it's about honoring a legacy while juggling some very strict legal and tax duties. If you’re an executor or a beneficiary, getting a firm handle on what is fair market value is the key to a smooth, fair, and legally sound process.

One of the first rules you'll encounter is that assets in an estate are valued based on the date the original owner passed away. This "date-of-death" valuation establishes a new cost basis for the property, a concept known as a "step-up in basis." This is a big deal. It can have a huge impact on the taxes a beneficiary might owe if they later decide to sell something they've inherited. An accurate FMV ensures every heir gets their rightful share and that all estate taxes are calculated correctly.

A Real-World Inheritance Scenario

Let's make this real. Imagine three siblings—Anna, Ben, and Chloe—inherit their mother's estate. The estate has three very different assets: the family home, a stock portfolio, and a small collection of antique jewelry. Each one needs a unique approach to figure out its fair market value.

As the executor, Anna has the responsibility to value each asset properly so the estate can be divided equally, just as her mother's will instructed. This is where professional help isn't just a good idea—it's essential.

-

The Family Home: Anna brings in a licensed real estate appraiser. Using the Market Approach, the appraiser looks at recent sales of similar homes in the same neighborhood to pin down the house's FMV on the date of death. This gives them an objective, defensible number for the estate's biggest asset.

-

The Stock Portfolio: This part is pretty straightforward. For publicly traded stocks, the FMV is simply the average of the highest and lowest selling prices for each stock on the date of death. All of this information is public and easy to document for the IRS.

-

The Antique Jewelry: Here's where it gets tricky. The jewelry holds a lot of sentimental value, but its actual financial worth is a mystery. Anna knows she can't just guess. She hires a certified gemologist who specializes in estate jewelry. The expert determines its FMV by looking at auction records and sales of comparable pieces.

By getting independent, professional appraisals for the unique items, Anna took all the guesswork—and potential for conflict—out of the equation. It means that when the assets are eventually distributed or sold, the division is based on cold, hard, market-based facts, not someone's opinion or emotional attachment.

The Importance of Qualified Appraisers

For anything unique or high-value like art, antiques, or special collections, hiring a qualified appraiser is simply non-negotiable. An appraiser with credentials from an organization like the International Society of Appraisers (ISA) brings instant expertise and credibility to the valuation. Their formal report is a vital document for the IRS and gives everyone a transparent baseline for dividing the assets.

An appraiser's job is to see past the sentimental value and figure out what an informed buyer in that specific market would actually pay. This expert opinion protects the executor from liability and is the best tool for preventing disagreements among family members who might have very different ideas about an item's worth.

Managing Disagreements and Ensuring Fairness

Even with appraisals in hand, feelings can run high and disagreements can pop up. Ben might truly believe the family home is worth more because of all the memories tied to it, while Chloe's emotional connection to the jewelry might make her think it's priceless. This is where the executor needs to stand firm on the documented FMV.

- Be an open book: The executor should share every single appraisal report with all the beneficiaries. Transparency is your best friend.

- Stick to the facts: Gently guide conversations away from sentimental value and back to the documented fair market value.

- Think about liquidation: Sometimes, the cleanest and fairest way forward is to simply sell the assets at their appraised FMV and divide the cash. You can learn more about this in our guide to what is estate liquidation, which outlines a clear path for converting assets into cash.

Ultimately, navigating the valuation of inherited property takes a mix of diligence, clear communication, and a solid understanding of FMV. It’s the only way to ensure you meet your legal obligations, keep family conflict to a minimum, and truly honor the deceased’s wishes by distributing their assets fairly.

Common Myths About Fair Market Value Debunked

When it comes to settling an estate or just selling off assets, misunderstandings about fair market value can be incredibly costly. These myths often pop up when people mix up FMV with other valuations or, more commonly, when emotion gets in the way of a clear financial picture.

When it comes to settling an estate or just selling off assets, misunderstandings about fair market value can be incredibly costly. These myths often pop up when people mix up FMV with other valuations or, more commonly, when emotion gets in the way of a clear financial picture.

Let's clear the air and bust some of the most common myths we see. Getting a handle on what fair market value truly is will protect you from undervaluing assets, paying more tax than you need to, or sparking unnecessary family arguments. By facing these misconceptions head-on, you can approach your sale with confidence.

Myth 1: The Asking Price Is the Fair Market Value

It’s a common trap to see a price tag and assume that’s what something is worth. In reality, an asking price is just that—what a seller hopes to get. Think of it as the opening bid in a negotiation, not a certified measure of an item's value.

The real fair market value is only proven when a buyer and seller, both acting willingly and without pressure, agree on a price and a transaction happens. A classic car might be listed for $75,000 for months on end. If it finally sells for $60,000, its FMV is much closer to that final sale price, not the seller's initial wishful thinking.

Myth 2: Sentimental Value Increases Financial Worth

This is easily the most emotionally loaded myth, and it’s one we navigate all the time in estate sales. Your grandfather’s rocking chair or your mother’s wedding dress might be priceless to your family, but its fair market value is determined by what a stranger would pay for it.

The market is impersonal. It doesn't factor in memories, personal history, or emotional attachment. An appraiser will value the rocking chair based on its wood, condition, and maker—not on the stories it holds. This distinction is critical for fair distribution in an estate.

Myth 3: Insurance Value and FMV Are the Same

Confusing these two can lead to some seriously expensive mistakes. Insurance value, also known as replacement cost, is the money you'd need to go out and buy a brand new version of an item that was lost or destroyed. Fair market value, on the other hand, is what your used item would sell for today, in its current state.

Let’s look at a 10-year-old sofa:

- Replacement Cost: This could be the $2,500 it costs to buy a similar new sofa from a furniture store.

- Fair Market Value: This is more like the $300 someone would realistically pay for your decade-old sofa at an estate sale or on an online marketplace.

These two numbers serve completely different functions. One is about making you whole after a loss, and the other reflects an item's real cash worth on the open market.

A Few Common Questions About Fair Market Value

Even once you have a good handle on the concept, some practical questions always seem to pop up when it's time to apply fair market value in the real world. Let’s tackle a few of the most common ones we see, especially when it comes to estate sales.

How Often Does Fair Market Value Change?

Think of fair market value as a moving target. It’s not a number that gets set in stone. For assets like publicly traded stocks, the FMV can change by the minute. For things that don't trade as often, like real estate or that antique grandfather clock in the living room, the value might shift over weeks or months.

What causes these shifts? It’s all about market conditions. A booming economy, a sudden spike in demand for a certain style of furniture, or even local events can push an asset's FMV up or down. This is exactly why official valuations, especially for something as critical as an estate settlement, are always tied to a specific date.

Can an Asset Really Have Zero or Negative Value?

Absolutely. It might sound strange, but it’s entirely possible.

An asset has a zero fair market value when no one—not a single person in an open market—is willing to pay for it. Imagine a 20-year-old, hopelessly broken appliance. If fixing it costs more than buying a new one, its FMV is effectively zero. You couldn't even give it away.

An asset can even have a negative fair market value. This happens when you’d have to pay someone to take it off your hands. A classic example is a piece of land with serious environmental contamination—the massive cleanup costs far outweigh the land's potential value, putting it deep in the red.

Who Gets the Final Say on FMV in a Legal Dispute?

When disagreements over value end up in court—say, during an estate settlement or a divorce—the judge or an appointed arbitrator has the final word. Each side will usually show up with their own professional appraisals and expert opinions, but if they can't come to an agreement, the court makes the call.

This is precisely why a detailed, well-documented appraisal from a qualified professional is worth its weight in gold. A credible report gives the court the solid, factual foundation it needs to make a fair and defensible ruling.

What’s the Difference Between "Fair Value" and "Fair Market Value"?

They sound almost identical, but "Fair Value" and "Fair Market Value" are two different terms used in different worlds.

- Fair Market Value (FMV): This is the term the IRS and the legal system care about. It’s all about that hypothetical, arm’s-length transaction between a willing buyer and seller in a public market.

- Fair Value: This is a much broader accounting term. While it can sometimes be the same as FMV, it's mainly used to figure out the value of assets and liabilities on a company's balance sheet, which doesn't always reflect a real-world, open-market sale.