A Practical Guide to Estate Sale Laws

Starting an estate sale can feel like you've been dropped into a legal maze. It’s a whole different ballgame from a simple garage sale. An estate sale is a formal process, wrapped in rules designed to protect everyone involved—from the heirs right down to the buyers.

The most important thing to get your head around is that estate sale laws aren't set at the federal level. Instead, they're governed state by state, which means the rulebook changes almost every time you cross a state line.

Getting a Handle on the Legal Basics

Before you even think about permits or taxes, you need to understand the fundamental legal landscape. What really sets an estate sale apart is its entire purpose: to liquidate the assets of a person, usually after they've passed away. This direct link to an estate automatically kicks things into a higher gear of legal scrutiny.

More often than not, this process starts in probate court. Think of the probate court as a neutral referee. Its job is to make sure everything is fair and above board. It validates the will, officially appoints the person in charge (the executor), and ensures all debts are paid before any property is sold or passed on to the heirs.

Why State Rules Are King

Since there isn't a single, national law for estate sales, the rules can be wildly different from one state to the next. In most places, the probate court has to sign off on the sale of any estate property. This is to guarantee that the assets are distributed according to the deceased's will—or state law if no will exists—and that the rightful heirs get their share.

This state-level control means you absolutely have to do your local homework. You'll find major differences in key areas like:

- Probate Requirements: Some states have a streamlined, simplified process for smaller estates. Others demand formal court supervision for almost any sale, big or small.

- Licensing for Professionals: The requirements for professional estate liquidators, like bonding and insurance, can vary dramatically.

- Sales Tax Collection: Each state has its own rules on whether you need to collect and remit sales tax from the sale proceeds.

Key Legal Differences: Estate Sale vs. Garage Sale

It’s crucial to understand just how different a casual garage sale is from a formal estate sale, legally speaking. While they both involve selling used items, they exist in completely different legal universes. The distinction often dictates how much red tape you'll face.

Here’s a quick breakdown to highlight the core differences:

| Aspect | Garage Sale | Estate Sale |

|---|---|---|

| Primary Purpose | To clear out personal clutter. | To liquidate the assets of an entire estate, often after a death. |

| Legal Authority | None needed. It's your stuff. | Must be authorized by an executor or court-appointed representative. |

| Court Oversight | None. | Often requires probate court approval and supervision. |

| Fiduciary Duty | None. You're selling for yourself. | Executor has a legal duty to maximize value for heirs and creditors. |

| Tax Implications | Generally no sales tax collected. | Sales tax collection may be required, depending on state law. |

This comparison makes it clear why an estate sale demands a more formal approach. For a deeper look at the operational differences, our guide on the distinctions between an estate sale vs. an auction offers even more context.

A key takeaway is that an estate sale is not just about selling items; it's about the legal and fiduciary duty to liquidate assets properly on behalf of an estate, its heirs, and its creditors.

This legal responsibility is exactly why a casual, "wing-it" attitude can backfire spectacularly. Ignoring probate court orders or local laws can lead to hefty fines, bitter legal battles between heirs, or even personal liability for you as the organizer. Starting with a firm grasp of this legal framework isn't just a good idea—it's the first and most critical step toward a successful, compliant sale.

Navigating the Probate Process for a Sale

When an estate sale happens because of a death, the probate process is often the legal engine driving everything. The word "probate" can sound a little scary, but it’s helpful to think of it as a court-supervised quality control check. It's the official system for making sure the deceased's affairs are wrapped up fairly and by the book.

The probate court essentially acts as a referee. Its main job is to confirm the will is valid, officially appoint the executor (the person named in the will to handle things), and keep an eye on the whole process. This oversight ensures all debts are paid before any assets are sold or passed on to the heirs. Following these estate sale laws isn't a choice—it's a legal must.

The Role of the Executor

The executor has what's called a fiduciary duty. This is a heavy-duty legal term that means they are obligated to act in the absolute best interest of the estate and its beneficiaries. It's not a suggestion; it's a legally binding responsibility.

An executor's to-do list is pretty long and requires a lot of care. Key responsibilities include:

- Securing and inventorying all assets, from the house and everything in it to bank accounts and cars.

- Notifying creditors and paying all legitimate debts and final taxes.

- Maintaining the property until it can be sold or handed over to the heirs.

- Distributing what's left exactly as the will instructs.

Trying to hold an estate sale before the court gives its official appointment and approval is a huge mistake. It can leave the person in charge personally on the hook for any debts or legal fights that pop up later.

In short, the probate court gives the executor the legal green light. Without that official stamp of approval, any sale could be ruled invalid, creating a massive legal and financial mess for everyone.

What Happens Without a Will

Things get more complicated if a person dies without a will, a situation known legally as dying intestate. In this case, the court has to appoint an administrator—usually a close relative—to manage the estate. Instead of following a will, the administrator has to follow strict state laws on who gets what.

These laws, called intestacy laws, have a rigid pecking order for inheritance. It typically starts with the spouse and children, then moves on to parents, siblings, and other relatives. Selling property still needs court approval, but where the money goes is decided by state law, not by what the person might have wanted.

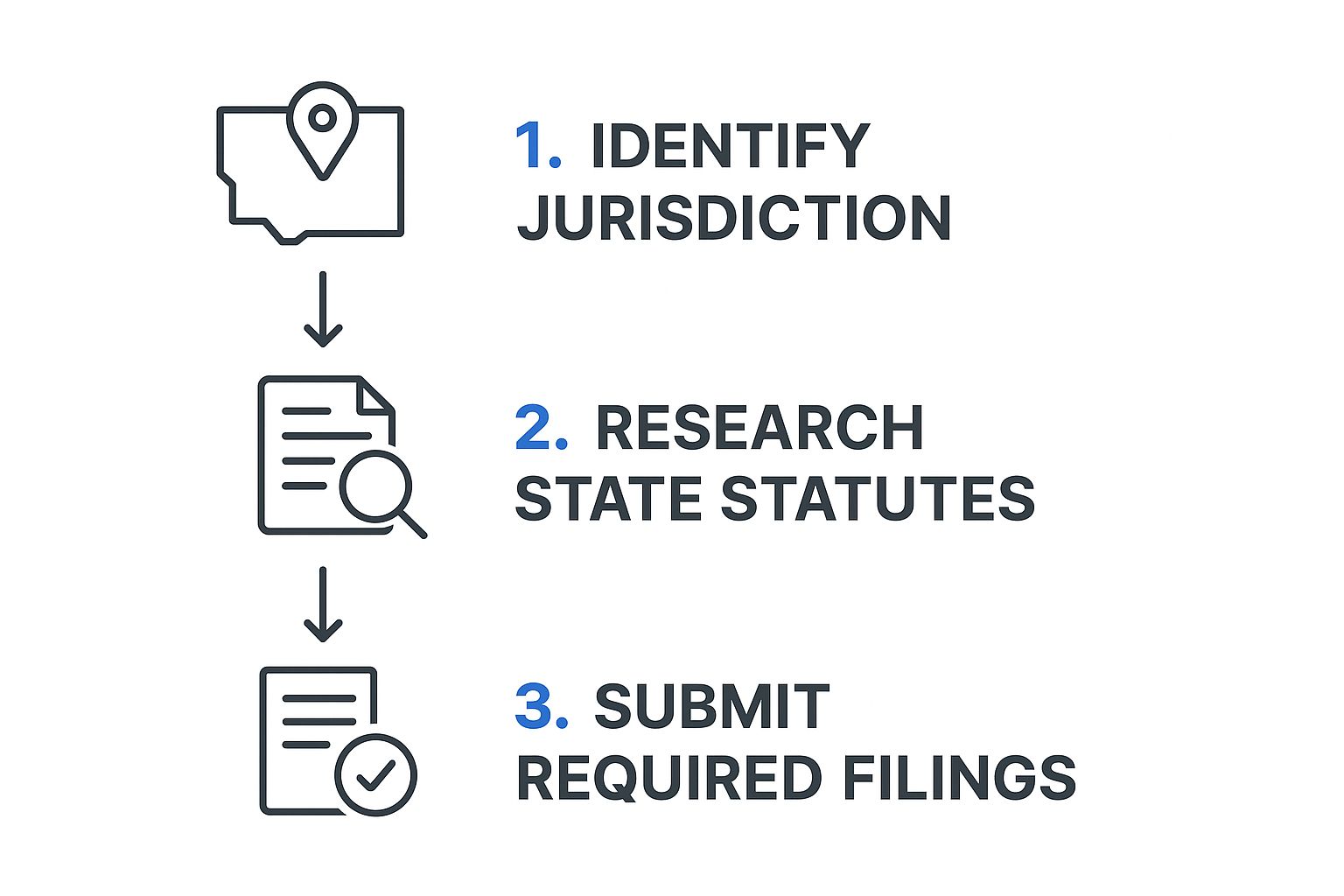

This infographic lays out the general steps for figuring out which rules apply to you.

As you can see, compliance starts with identifying the right jurisdiction. From there, you have to dig into specific state rules before filing any paperwork.

Timelines and Creditor Claims

A huge piece of the probate puzzle is the creditor claim period. As soon as a probate case is opened, the law requires that potential creditors get notified. They are then given a set amount of time—often three to nine months—to come forward and submit claims for any money owed by the deceased.

This waiting period has a direct effect on when you can hold an estate sale. You can't start distributing money or finalizing the sale until this window has closed and every valid debt has been paid. Rushing a sale before dealing with creditors is a recipe for legal trouble, since they have a legal right to be paid before any heirs get their inheritance.

The average probate process in the U.S. can take anywhere from six months to over a year, depending on how complex the estate is and the specific state laws. Building your sale timeline around this reality is the key to a smooth, legally sound process.

Securing the Right Permits and Licenses

While the probate court gives you the green light to liquidate an estate's assets, that's only half the battle. Your local city or county government gets the final say on how you can actually run the sale. Think of it this way: probate court hands you the keys to the car, but the local municipality sets the speed limits and traffic laws.

Ignoring these local estate sale laws is a recipe for disaster. It can lead to hefty fines or, even worse, getting your sale shut down right in the middle of it. These rules aren't just bureaucratic red tape; they exist for good reasons, like preventing a quiet residential street from turning into a parking lot warzone on a Saturday morning.

Identifying Common Local Permits

So, where do you start? Every town is a little different, but most local requirements fall into a few predictable buckets. Knowing what to look for will give you a major head start.

You'll likely run into one or more of these:

- Temporary Event or Sales Permit: This is the big one. It's a general permit for holding a public sale, much like what you'd need for a small community festival.

- Signage Permit: Want to put up signs pointing people to your sale? Most towns have strict rules about the size, number, and placement of signs to avoid clutter and safety issues.

- Business License: If you're a professional company running the sale, a local business license is almost always a non-negotiable requirement.

- Parking or Traffic Control Permit: If you're expecting a massive turnout, the city might require a plan to manage traffic and parking, ensuring neighbors aren't blocked in and emergency vehicles can get through.

Your best first stop is the official website for your city or county. Search for terms like "Clerk's Office," "Permits and Licenses," or "Code Enforcement." Don't be afraid to just pick up the phone—a quick call can often get you a clearer answer than hours of digging online.

Don't make the mistake of thinking an estate sale is just a big garage sale. Local laws often draw a sharp line between the two. Because of their scale and commercial nature, estate sales almost always face tougher regulations.

Family-Run Sale vs Professional Company

The level of oversight you'll face often boils down to one simple question: who is running the sale? A family conducting a one-time event is usually viewed very differently from a professional company that runs sales for a living.

Here’s a quick breakdown of how things typically shake out:

| Aspect | One-Time Family-Run Sale | Professional Estate Sale Company |

|---|---|---|

| Licensing | Often just a simple temporary event permit is needed. | A full business license to operate in that city or county is standard. |

| Insurance | General liability insurance is a very good idea, but might not be legally required. | Mandatory proof of liability insurance is a common prerequisite for licensing. |

| Bonding | Almost never required for a family-run sale. | Often must be bonded—a type of insurance that protects the estate from theft or fraud by the company. |

| Frequency Limits | May be limited to one sale per property, per year. | Can hold many sales, but must follow all business rules for each event. |

This is a critical distinction. If you’re hiring a professional company, one of your first questions should be about their local licensing and insurance. Ask to see the paperwork. A reputable firm will have it on hand and will typically handle the entire permitting process for you, making sure your sale is 100% compliant with all local estate sale laws.

A Look at International Estate Sale Laws

While we often get wrapped up in the specifics of U.S. regulations, the fundamental challenge of respectfully and legally liquidating a person’s assets is something every country faces. Taking a quick trip around the globe reveals a fascinating mix of approaches, each molded by unique cultures and legal histories.

It's a bit like looking at the rulebooks for the same game played in different countries. The goal is always to clear the board fairly for everyone involved, but the exact moves and strategies can look quite different. This global perspective really helps put our own system into context.

The United Kingdom and the Grant of Probate

Across the pond in the United Kingdom, the process feels familiar to our own probate system, just with different lingo. Before any items from an estate can be sold, the executor has to secure what's called a "grant of probate." Think of it as the UK’s official green light from the court, authorizing the executor to manage the estate.

If someone passes away without a will, a close relative applies for “letters of administration,” which accomplishes the same thing. This legal key is what allows them to access bank accounts, settle debts, and crucially, sell property. Without it, you’re at a complete standstill—no sales, no transfers.

The scale of this process is huge, with the UK government handling over 300,000 probate applications every year. Creditors get 12 months to make a claim, so it's a structured and deliberate process. If you want to dive deeper into how different countries handle real estate and assets, you can explore more global real estate insights.

Simplified Systems in Australia

Some countries, like Australia, have recognized that not every estate needs to go through a complex, court-heavy process. They’ve built more flexibility into their system.

While they still have a formal probate process for large or complicated estates, many Australian states have created simplified, streamlined procedures for smaller ones. It’s a common-sense solution that saves families from the legal and financial headaches of a full-blown probate when dealing with a modest inheritance. By creating a legal fast-lane, they save people time, money, and stress.

How Inheritance Taxes Shape Sales in Europe

In many parts of Europe, especially in countries like Germany and France, the biggest driver behind an estate sale isn’t a court process—it’s taxes. These nations have hefty inheritance taxes that can completely change how and when an estate liquidation takes place.

The tax bill can dictate the entire strategy. In some situations, heirs are forced to sell valuable assets quickly just to raise enough cash to pay what they owe the government.

This creates a whole different set of pressures. The focus shifts from simply following legal steps to actively managing a financial deadline. Here’s how that can shake things up:

- Timing: A looming tax deadline can force a quick sale, which doesn't always lead to the best price.

- Pricing: Items might be priced for a fast liquidation rather than for their maximum market value, all to meet tax obligations.

- Asset Selection: Heirs might decide to sell off high-value, easy-to-liquidate items like art or jewelry first to cover the tax bill, while holding onto less liquid assets like real estate.

Looking at these different international approaches shows there’s more than one way to tackle the complex job of settling an estate. Whether the process is driven by court oversight, a need for simplicity, or tax laws, each system offers its own unique solution.

Managing Taxes and Financial Duties

Let's be honest, the financial side of an estate sale can feel like you're trying to learn a new language overnight, especially when "taxes" get thrown into the mix. Getting this part right is a huge piece of following estate sale laws, because a simple mistake can lead to some painful and expensive penalties. The job isn't just about selling things; it's about responsibly managing the money that comes in.

But here's the good news: for most estates, the tax situation is a lot more straightforward than you might think. Many of the scariest-sounding taxes only come into play in very specific, high-value situations.

Federal Estate Tax and State Inheritance Tax

First, let's tackle the one that causes the most anxiety: the federal estate tax. This is the big one, but it only applies to truly massive estates. For 2024, the federal estate tax exemption is an incredible $13.61 million per person. That means unless the total estate is worth more than that, you won't owe a single penny in federal estate tax.

Now, a handful of states do have their own estate or inheritance taxes, and their thresholds are much, much lower. It is absolutely critical to check your specific state's laws to see if this affects you, as the rules can vary dramatically from one state line to the next.

The Power of the Step-Up in Basis Rule

This might be one of the most important—and helpful—tax rules for any heir to understand. The "step-up in basis" rule can dramatically slash or even completely wipe out the capital gains tax you might owe on inherited items.

Here’s a simple way to think about it. Imagine your grandfather bought a painting back in 1970 for $1,000. That $1,000 is its original "cost basis." When he passed away, you had the painting professionally appraised, and it's now worth $10,000.

Under the step-up in basis rule, the IRS essentially forgets the original $1,000 cost. The new cost basis for the heirs becomes the fair market value at the time of death—in this case, $10,000.

This is a massive benefit. If you turn around and sell that painting at the estate sale for exactly $10,000, your taxable gain is zero. ($10,000 sale price - $10,000 stepped-up basis = $0). Without this rule, you would have been on the hook for taxes on a $9,000 gain. It's a powerful tool that saves heirs a ton of money.

Who Handles Sales Tax

This is one of the most frequent questions we see, and the answer almost always comes down to who is running the sale. State and local laws are what determine if sales tax needs to be collected on the items you sell.

Here’s a simple breakdown of who is responsible:

- If You Hire a Professional Company: The estate sale company is almost always on the hook for sales tax. As a registered business, they are required to collect the right amount from buyers and send it to the state. This service is part of what their commission covers, and you can get a better sense of how companies price their services by looking at typical estate sale fees.

- If You Run the Sale Yourself: The responsibility might fall on you. Some states will classify a one-time estate sale as an exempt "casual sale," but others will require you to get a temporary sales tax permit. Your best bet is to check directly with your state's Department of Revenue to make sure you're playing by the rules.

Handling these financial duties correctly is all about protecting the estate from problems down the road. By understanding which taxes might apply and who is responsible for what, you can ensure your sale is smooth, legal, and financially successful.

Best Practices for a Legally Compliant Sale

Knowing the rules is one thing, but actually putting that knowledge into practice is what separates a smooth, successful sale from a legal headache. Think of it as your game plan—the step-by-step guide to doing things right and sidestepping the common mistakes that can get you into trouble.

The bedrock of any compliant sale is transparency and fantastic organization. This isn't just about being neat; it's about building an ironclad record that can stand up to questions from heirs, courts, or even the IRS.

Maintain Meticulous Records

When it comes to avoiding future disputes, a detailed paper trail is your absolute best friend. Seriously, don't underestimate the power of good documentation. It's the proof that you acted ethically and responsibly every step of the way.

Your records should be thorough and include:

- A Complete Inventory: This means a comprehensive list of every single item being sold. You’ll want descriptions, photos of more valuable pieces, and notes on any known history or condition issues.

- Detailed Sales Receipts: Keep a clear record of every transaction. Note the item, the price it sold for, and the date. This is absolutely critical for your final accounting and tax reporting.

- A Final Report: After the sale wraps up, put together a final accounting that shows total sales, itemizes all expenses, and clearly states the net proceeds that are going to the estate.

This level of detail is non-negotiable, particularly for an executor who holds a legal duty to the estate. It proves you did your job properly and worked to get the best possible value for the beneficiaries.

The goal is to create a record so clear and complete that anyone—a beneficiary, a judge, or an auditor—can look at it and understand exactly what happened, why it happened, and where every dollar went.

Price Accurately and Advertise Honestly

Want to land in legal trouble fast? Use misleading practices. Your pricing and advertising are two areas where honesty isn't just the best policy—it's a legal requirement.

Inflating the value of items or creating a false sense of urgency can open the door to claims of deceptive trade practices. Just be truthful. If a grandfather clock has a scratch, it's far better to point it out upfront. Pricing things accurately, often with the help of a professional appraiser for high-value goods, shows you’re committed to getting a fair market price for the estate's assets.

Scrutinize the Estate Sale Company Contract

If you decide to hire a professional company to run your sale, the contract you sign is the single most important document you have to protect your interests. Don't just skim it. Read every line, and don't ever be afraid to ask for clarifications or changes.

A good contract should clearly spell out:

- Commission Structure: Is it a flat fee or a percentage of the total sales? Does the percentage change based on how much is sold? This needs to be crystal clear. You can learn more about the average estate sale commission to see how different models work.

- Included and Excluded Fees: The contract has to specify what that commission actually covers. Are things like advertising, staffing, and credit card processing fees included, or will they be tacked on as extra charges?

- Liability and Insurance: The company absolutely must carry adequate liability insurance. The contract should state that they are responsible for any accidents or damage that happen on the property during the sale.

- Handling of Unsold Items: What's the plan for everything that doesn't sell? The agreement should detail if the company helps with donations, consignment, or a final clean-out, and whether those services come with additional costs.

A vague contract is a major red flag. A reputable, professional company will always provide a detailed agreement that protects both of you and sets clear expectations for a legally sound and successful event.

Got Questions? Let's Talk Estate Sale Laws

Once you get a handle on the big picture of estate sale regulations, the smaller, more specific questions often start bubbling up. It's totally normal. You've got the main rules down, but those nagging "what if" scenarios can keep you up at night. Let's tackle some of the most common ones I hear from folks, so you can move forward with confidence.

These questions aren't just hypotheticals; they reflect major trends. For instance, estate sales have become a surprisingly big slice of the real estate pie. In the U.S., they now make up an estimated 8-10% of all residential property sales each year. That's a significant number. In states with older populations like Florida and New York, we've seen the volume of homes sold this way jump by about 15% in the last decade alone. It’s a direct reflection of changing demographics and economic realities. If you're curious about the broader market, you can discover more about global real estate trends and insights.

Can I Hold an Estate Sale Without Probate?

This is probably the number one question, and the honest answer is: it's complicated. In certain situations, yes, you might be able to skip the formal probate process. This usually happens if the estate is very small or if the deceased person planned ahead and put their assets into a living trust. A living trust is specifically designed for this purpose—to let assets pass to heirs without getting tangled up in court.

But here's the reality check: for most estates, especially any that include a house or other real estate, probate is a legal necessity. The court has to officially grant the executor the authority to sell anything. Trying to get around that is a huge risk and can land the person in charge in serious legal and financial hot water.

Key Takeaway: While you can avoid probate in some very specific cases (like with a living trust), just assuming you can skip it is a dangerous gamble. Always, always verify what's required for your specific situation.

Who’s Responsible for Leftover Items?

After the last customer has left, what happens to everything that didn't sell? The responsibility for dealing with leftovers ultimately falls on the estate itself. Before you ever sign a contract with an estate sale company, you need to have a crystal-clear understanding of how they handle unsold items.

A professional company should spell this out for you. Many offer "clean-out" services for an extra fee, which might include:

- Donating usable items to charities of your choice.

- Consigning valuable pieces that just didn't find the right buyer during the sale.

- Hauling away any remaining trash or unsellable goods.

Make sure you talk this through and get it in writing upfront. The last thing you want are surprise costs or a garage full of stuff to deal with after the sale is over.

What if a Family Member Wants an Item?

This is a classic dilemma and, if you're not careful, a recipe for family drama. The absolute best way to handle this is to have all heirs and family members decide what they want to keep—and physically take it out of the house—before you even start prepping for the sale.

Once an item has been inventoried, photographed, and priced for the public, it needs to stay in the sale. The executor's job is to get the best financial return for the estate as a whole. Allowing family to pull things out at the last minute or buy them at a "special price" can be seen as a conflict of interest and can easily lead to ugly disputes between beneficiaries. Clear, honest communication from the very beginning is the only way to go.