Estate Sale Managers Near Me: Find, Vet, and Hire Top Pros

When you're facing an estate sale, one of the first and most important decisions you'll make is how you're going to run it. This choice really sets the tone for the whole experience.

Are you going to hire a traditional, full-service company to handle everything for you? Or are you more inclined to use a modern, self-managed platform to keep control and maximize your profit? Each path has its own set of pros and cons, and the right answer depends on your timeline, budget, and how hands-on you want to be.

Your First Decision: Choosing Your Estate Sale Path

Liquidating the contents of a home is a big job, and your initial choice here will directly impact your time commitment, stress levels, and bottom line.

On one side, you have the classic route: hiring a professional estate sale company. This is the turn-key solution many families choose, especially if they're on a tight deadline or trying to manage the process from out of town.

These pros do it all—sorting through decades of memories, pricing every item, marketing the sale, managing the crowds, and even handling the final clean-out. Their expertise can be a lifesaver. But that convenience comes with a hefty price tag, usually a commission between 30% to 50% of the gross sales. If your sale brings in $15,000, that’s up to $7,500 in fees right off the top.

The Modern DIY Alternative

On the other side, there’s a more modern, tech-forward approach. Platforms like DIYAuctions give you the tools to run your own professional-style online auction. This option puts you firmly in the driver's seat, and the benefits can be huge:

- Keep More of Your Money: You handle the legwork, so you keep a much larger slice of the pie—often up to 90% of the proceeds.

- Total Control: You get the final say on what sells, what the starting bids are, and when you want to schedule the pickup day.

- Work at Your Own Pace: Catalog items on your own schedule, without a company’s rigid timeline hanging over your head.

This route is a great fit if you're local, comfortable using a website, and want to personally oversee how sentimental items are handled. It’s a trade-off: you invest a bit of your own time and effort in exchange for saving thousands on commission fees.

This isn't just about money. It's about finding the process that fits your family's needs. Do you need speed and a hands-off experience, or are control and higher profits your top priority?

To help you see the difference more clearly, this table breaks down what you can expect from each path.

Traditional Manager vs. DIY Platform At a Glance

Here’s a direct comparison to help you weigh your options between a full-service estate sale company and a platform like DIYAuctions.

| Feature | Traditional Estate Sale Manager | DIY Online Auction Platform (e.g., DIYAuctions) |

|---|---|---|

| Commission / Fees | High (30% - 50% of gross sales) | Low (10% commission, capped) |

| Your Time Investment | Low (Manager handles most tasks) | Medium (You catalog items and manage pickup) |

| Control Over Pricing | Low (Manager sets prices) | High (You set starting bids and reserves) |

| Scheduling | Rigid (Based on manager's availability) | Flexible (You choose your auction and pickup dates) |

| Process Transparency | Varies by company | High (You see all bids and sales in real-time) |

| Best For | Out-of-town families, tight deadlines, or those wanting a completely hands-off service. | Local families who want to maximize profit, maintain control, and are comfortable with a guided DIY process. |

Ultimately, whether you hire a manager or run the sale yourself, the goal is a smooth, successful liquidation. By understanding the core differences from the start, you can confidently pick the path that aligns with your family’s goals.

How to Find and Vet an Estate Sale Manager You Can Trust

So, you’ve decided professional help is the way to go. Smart move. But finding the right estate sale manager is more than just a quick Google search. You’re handing over the keys to a home filled with memories, and you need to be sure the person in charge is trustworthy, experienced, and effective.

Think of your search as a hiring process. You wouldn't hire an employee without checking references, and the same applies here. A great place to start is by looking at directories from professional groups like the American Society of Estate Liquidators (ASEL). Members are expected to follow a code of ethics, which is a good baseline. You can also ask local real estate agents who work with probate or senior moves—they often have a shortlist of people they trust.

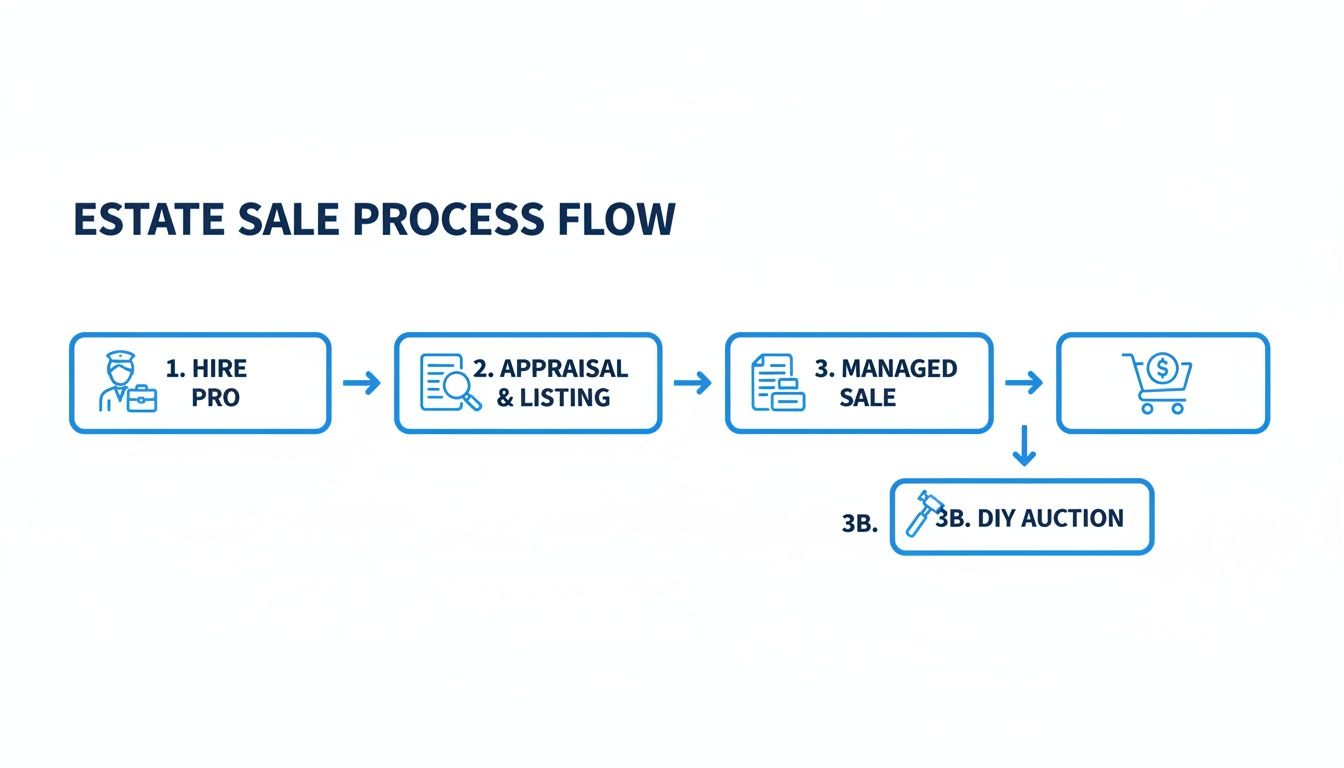

This flowchart breaks down the two main paths for an estate sale. It’s a great visual for understanding how the process works.

As you can see, hiring a pro means handing off most of the work and control. Going the DIY route keeps you in the driver's seat from start to finish.

Your Vetting Checklist

Once you have a list of 3 to 5 potential companies, it’s time to pick up the phone. Don't skip the interview! This is your chance to get a feel for their professionalism and dig into the details.

Here’s what you absolutely need to ask:

- Are you insured and bonded? This is non-negotiable. Ask for proof. Liability insurance protects you if a buyer gets hurt on the property, and bonding protects you from theft.

- Have you handled an estate like this before? A company that specializes in high-end antiques might not be the best choice for a home filled with modern furniture and tools. Find a good match for your specific items.

- What’s your marketing plan? How are they going to get buyers in the door (or online)? A solid strategy should include their own email list, social media posts, and listings on popular sites like EstateSales.net.

When you check online reviews, read between the lines. A perfect 5-star rating is less informative than the actual comments. Look for patterns in what sellers and buyers are saying. Consistent complaints about disorganization or poor communication are a huge red flag.

If the estate has unique valuables, you may need specialists. For instance, knowing how to Find Top Rare Coin Dealers Near Me is crucial if you uncover a significant collection. A good estate sale manager should be able to connect you with these experts.

Red Flags to Watch Out For

Trust your gut. If something feels off during your conversations, it probably is. A true professional will be transparent, patient, and happy to answer all your questions. We cover this in-depth in our complete guide to estate liquidation companies, but here are a few immediate warning signs.

Walk away if you see these red flags:

- No written contract. A handshake deal is asking for trouble. Everything should be in writing.

- They ask for large upfront fees. Reputable companies work on commission. They get paid when you get paid.

- Their answers are vague. If they can’t clearly explain their process for pricing, staging, or security, they’re either inexperienced or hiding something.

- They pressure you to sign immediately. A good partner will give you the time and space you need to make a confident decision.

Decoding Estate Sale Contracts and Commission Fees

The contract is, without a doubt, the most important document you’ll sign. It lays out every single detail of the agreement, from how much you’ll pay the company to what happens when the dust settles after the sale. Skimming over the fine print is a recipe for expensive misunderstandings.

Before you even glance at a contract, you have to get a handle on how these companies are paid. The industry standard is a commission-based fee, which usually falls somewhere between 30% and 50% of the total gross sales. This model works because it gives the manager a powerful incentive to price your items well and market the sale aggressively to bring in the biggest crowd.

But not all commission structures are created equal. You need to get crystal clear on what that percentage actually includes.

What Your Commission Typically Covers

At a minimum, that commission percentage should cover all the core services needed to pull off a successful sale. Always confirm these are part of the base rate and not some hidden extra.

- Sorting and Staging: This is the heavy lifting—all the labor involved in organizing, cleaning, and making everything in the home look appealing to buyers.

- Research and Pricing: The time and expertise it takes to accurately value everything, from a box of kitchen gadgets to a piece of antique furniture.

- Marketing and Advertising: Getting the word out through their email lists, social media channels, and crucial listing sites like EstateSales.net.

- Sale Staffing: The cost of paying the employees who work the floor during the sale, helping customers, and keeping an eye on things.

A professional's compensation should be tied directly to their performance. Your contract needs to state plainly that the commission is the main fee. If a company starts asking for big upfront payments to cover these basic services, that’s a major red flag.

Watch Out for Additional Costs

While the commission should cover the basics, some services almost always carry an extra charge. These should be clearly itemized in your contract as optional add-ons, not nasty surprises deducted from your check later.

Common extras often include:

- Trash Haul-Away: Fees for a dumpster or service to get rid of any items that are truly unsellable.

- Final Clean-Out: The cost for a crew to come in and leave the home “broom-swept,” ready for the realtor to take over.

- Specialized Appraisals: If you suspect you have fine art, rare coins, or high-end collectibles, hiring a certified appraiser will be a separate, and necessary, expense.

It’s also important to have realistic expectations. The estate liquidation industry is a robust $230.3 million market, but the reality for most families is much more modest. Roughly 70.6% of all sales generate less than $20,000 in total revenue. Knowing this helps you do the math on what you might actually net after a 40% commission is taken out.

Key Contract Clauses You Cannot Ignore

Once you’re comfortable with the fee structure, it’s time to really dig into the contract. Pay special attention to the wording around payment timelines and what happens to unsold items. A solid agreement protects both you and the manager.

A good contract will spell out the payout timeline, which should be within 7 to 14 business days after the sale ends. It must also detail what happens to anything left over.

The best companies give you choices: have the items returned, donate them for a tax receipt, or arrange a final buyout. Be wary of any clause that gives the company automatic ownership of anything that doesn't sell.

For a deeper dive into what to expect from fee structures, check out our guide on understanding estate sale commission rates.

The Modern Alternative: Take Control and Boost Your Return

While hiring an estate sale manager offers a hands-off solution, it often comes at a steep price. Those high commissions can take a serious bite out of your final profits.

But what if you could keep more of that money? For families who want more control over the process and a much larger share of the proceeds, there’s a modern alternative that puts you firmly in the driver's seat.

This new approach flips the script on the classic estate sale. Instead of handing over the keys and a huge chunk of your earnings, you can use a powerful online platform to run your own professional-grade auction.

Taking Charge of Your Sale

Platforms like DIYAuctions give you all the tools and the framework to manage the sale yourself—no sales or marketing background needed. You’re in complete control of the timeline and every detail, from beginning to end.

This means you get to decide:

- Item Cataloging: You're the one taking photos and writing descriptions, ensuring sentimental pieces are represented with the care they deserve.

- Pricing Strategy: You set the starting bids and can add reserves for high-value items. The final say on pricing is always yours.

- Scheduling Flexibility: You choose the auction dates and a single, convenient pickup day that actually works for your schedule.

The platform handles all the tricky backend stuff, like marketing your auction to a network of qualified local buyers and securely processing every payment. You get all the benefits of a professional system without the massive cost of a full-service manager.

The biggest win here is the financial return. A traditional manager often takes 30% to 50% in commission. With this model, you can keep up to 90% of the proceeds. On a $15,000 sale, that's the difference between netting $7,500 and walking away with $13,500.

Maximizing Your Profits

This hands-on approach does require some of your time, but it pays off by cutting out the single largest expense of a traditional sale. You're essentially paying yourself for the work you put in, which directly boosts your financial outcome. Knowing the best way to present and price your things is key, and you can get some great tips from this resource on how to sell unwanted items.

By using technology to find buyers, you also expand your reach far beyond the typical weekend estate sale crowd. Online auctions attract a wider, more engaged group of bidders, which often drives up the final prices on your items. You can learn more about the best online auction apps and see just how simple they make the process.

Ultimately, this method isn't just about saving money. It's about taking ownership and making sure you get the full value your family's possessions deserve.

How Market Trends Can Impact Your Estate Sale's Success

You might think an estate sale is all about what’s inside the house, but the economic climate outside plays a surprisingly huge role in your final numbers. Timing is a powerful, often overlooked, factor.

A great estate sale manager will have their finger on the pulse of these trends, but it’s invaluable knowledge for anyone running a sale—especially if you're taking the reins yourself.

The Real Estate Market Connection

Think about it. When the local real estate market is hot, with homes selling fast and for top dollar, a wave of confidence washes over the community. New homeowners need to furnish their spaces, and existing ones feel more financially secure.

This translates directly to your sale. Buyers are more willing to spend on furniture, art, and decor. It can lead to more aggressive bidding at your auction and a quicker, more complete cleanout of the property.

On the flip side, when the market slows down, buyers get more cautious. They might hesitate on big-ticket items or hunt for deep discounts. This doesn't spell disaster, but it does mean you need to be realistic with your financial expectations. A solid strategy involves adjusting pricing to match the current buyer mood.

Tapping Into Economic Confidence

The economy at large creates ripples that eventually reach your sale. When consumer confidence is high, people are more open to buying collectibles, vintage pieces, and other "wants." When it's low, they stick to practical needs.

This isn't just a local phenomenon. For example, global commercial real estate markets have seen a significant recovery recently. Private real estate values have climbed for five straight quarters, with transaction volumes hitting $739 billion in the last year alone—a 19% jump. That kind of investor confidence signals a greater flow of capital, which often means more active buyers for assets like those in an estate sale. Learning about these broader real estate trends and tactics can give you a much clearer picture.

Practical Steps for Strategic Timing

So, how do you actually use this information? While you probably can't wait indefinitely for the "perfect" market, you can absolutely make smarter decisions.

- Talk to a Real Estate Agent: Get their professional take on local conditions. Are homes flying off the market? Is inventory tight? This is a fantastic barometer for buyer activity.

- Keep an Eye on Other Sales: Pay attention to how other estate sales in your area are doing. Are the crowds big? Are things selling fast? Or are there lots of leftovers?

- Ask Your Manager Directly: If you hire a professional, ask them how current trends are shaping their strategy for your sale. They should have a clear answer.

Your sale doesn’t happen in a vacuum. By understanding the economic tailwinds or headwinds, you can set achievable goals and navigate the process with a clear, realistic perspective.

Answering Your Top Questions About Estate Sales

When you're facing an estate liquidation, a lot of questions come up fast. Whether you’re thinking about hiring a local company or taking a more hands-on approach, getting clear answers is the first step. Let's tackle some of the most common concerns head-on.

How Much Do Estate Sale Managers Typically Charge?

This is usually the first question on everyone's mind, and for good reason. The vast majority of estate sale companies work on a commission basis, which typically ranges from 30% to 50% of the gross sales. The final percentage often depends on where you live and the total estimated value of the contents.

Before you sign any contract, get absolute clarity on a few things:

- What's included in the commission? Make sure it covers the essentials like sorting, pricing, staging the home, marketing the sale, and staffing the event.

- Are there any extra fees? Ask point-blank about potential add-ons. Common ones include charges for trash hauling, final clean-outs, or bringing in a specialist for art or jewelry appraisals.

- Is every single cost in the contract? The commission rate and any potential extra fees must be spelled out in writing. No exceptions.

A reputable company's success is tied directly to yours—they make money by selling your items for the best price, not by nickel-and-diming you with hidden charges. Be wary of anyone who isn’t completely transparent about their fee structure.

What Happens to Items That Don't Sell?

Let's be realistic: not everything is going to sell. A professional will have a clear plan for the leftovers, and you should always have the final say.

Typically, they'll present you with a few options:

- Return to You: The items are yours. They're left neatly for you to handle as you wish.

- Charitable Donation: The company can arrange for a charity to pick everything up, and you'll get the donation receipt for tax purposes.

- Final Buyout/Clean-Out: Some companies offer a clean-out service for an added fee, while others might offer you a lump sum for all the remaining contents.

A huge red flag is any contract that gives the company automatic ownership of unsold items for free. You should always maintain control over your property. When you use a platform like DIYAuctions, for example, you keep full control and can easily decide whether to relist, donate, or keep anything that doesn't sell.

How Long Does the Entire Estate Sale Process Usually Take?

Timing can be a huge deal, especially if you need to get the house on the market. From the first phone call to the final check in your hand, a traditional estate sale company typically takes four to six weeks.

Here’s a general breakdown of that timeline:

- Prep Work (1-2 weeks): This is when the crew gets to work sorting, researching, pricing, and staging everything inside the home.

- Marketing (1 week): The company advertises the sale to their email lists and local buyers.

- The Sale (2-3 days): The main event, usually held over a weekend.

- Post-Sale & Payout (1-2 weeks): This period covers the final clean-out, donation pickups, and settling the finances before you get paid.

Running an online DIY auction can seriously speed things up. You can catalog items on your own schedule, run the auction for about a week, and then manage everything with a single, scheduled pickup day.

Should I Pay Any Upfront Costs to an Estate Sale Company?

The short answer is almost always no. It's a fundamental industry standard that the company's commission covers their operating costs. They get paid when you do—after the sale is over and the money is collected.

If a company demands a large, non-refundable deposit, it's a major warning sign. They might be inexperienced or, worse, dishonest. The only real exception might be a pre-approved expense for something specific, like hiring a certified appraiser for a high-value coin collection, and even that should be discussed and agreed upon in writing beforehand. With modern alternatives, upfront costs are a non-issue; a small commission is simply deducted from the final proceeds.